The Oakland Michigan Lost Receipt Form is an essential document designed to assist individuals in reporting lost or missing receipts for various purposes. This form is specifically used within the administrative functions of Oakland County, located in the state of Michigan. It enables individuals to adequately document their lost receipts, ensuring accuracy and transparency in financial records. With this form, individuals can provide detailed information about the missing receipt, including the date of the transaction, the name and location of the business or vendor, the amount spent, and the purpose of the expense. By collecting this information, the Oakland Michigan Lost Receipt Form allows for the proper tracking and verification of transactions. Keywords: Oakland Michigan, lost receipt form, Oakland County, Michigan, administrative functions, missing receipts, financial records, document, accuracy, transparency, detailed information, date of transaction, name of business, location of business, vendor, amount spent, purpose of expense, tracking, verification, transactions. Different types of Oakland Michigan Lost Receipt Forms may include: 1. Personal Lost Receipt Form: This form is primarily used by individuals who have lost a personal receipt for their own expenses. It could involve various types of expenses such as retail purchases, service fees, or restaurant bills. 2. Business Lost Receipt Form: Specifically designed for business-related expenses, this form allows employees or contractors to report and document any missing receipts incurred during travel, entertainment, or other work-related activities. 3. Government Lost Receipt Form: This type of form is utilized by government employees or officials who need to report lost receipts for expenses associated with official duties, conferences, training, or other government-related activities. 4. Tax Deduction Lost Receipt Form: For tax purposes, individuals or businesses may need to provide evidence of expenses as part of the deduction process. This form allows taxpayers to report and document lost receipts that may be required for potential tax deductions. 5. Grant Lost Receipt Form: When individuals or organizations receive grants or funding for specific programs, it is often necessary to provide evidence of expenses. This form aids in reporting lost receipts associated with grant-related spending. These various types of Oakland Michigan Lost Receipt Forms ensure that the proper documentation of lost receipts is maintained, providing individuals and organizations with a systematic approach to managing their financial records.

Oakland Michigan Lost Receipt Form

Description

How to fill out Oakland Michigan Lost Receipt Form?

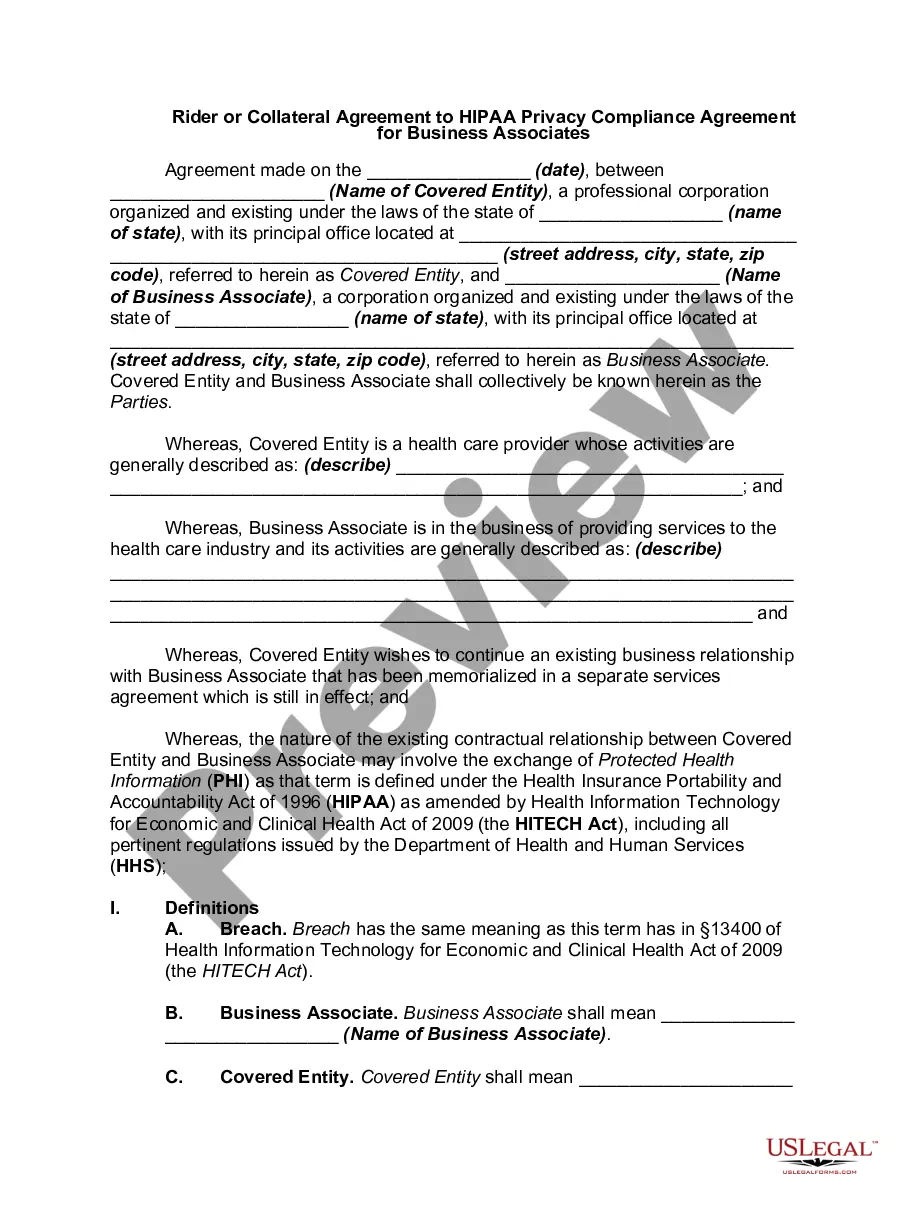

Preparing legal paperwork can be difficult. Besides, if you decide to ask an attorney to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Oakland Lost Receipt Form, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Consequently, if you need the latest version of the Oakland Lost Receipt Form, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Oakland Lost Receipt Form:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Oakland Lost Receipt Form and save it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!