Los Angeles California Memorandum to Stop Direct Deposit is a legal document used by employees in Los Angeles, California, to inform their employers about their decision to stop receiving wages through direct deposit. This memorandum is crucial for those individuals who no longer wish to have their salary electronically deposited into their bank accounts. By submitting this document, employees formally communicate to their employers the request to discontinue the direct deposit method and opt for an alternative method of receiving their wages. The Los Angeles California Memorandum to Stop Direct Deposit typically includes the following information: 1. Employee's Full Name: The employee must provide their full legal name, ensuring accurate identification. 2. Employee's Address: The employee's current residential address is stated in the memorandum. 3. Employee's Contact Information: Contact information such as phone number and email address are included for better communication. 4. Employer's Name and Address: The full name and address of the employer or the employing organization are mentioned. 5. Employee ID/Account Number: The employee's unique identification number or account number is an essential part of the memorandum. 6. Effective Date: The specific date on which the employee wants the direct deposit to cease is indicated in this section. 7. Alternative Payment Method: Employees can specify their preferred payment method, such as physical checks or cash. 8. Signature and Date: The memorandum requires the employee's signature and the date of submission. Different variations of Los Angeles California Memorandum to Stop Direct Deposit may exist based on the specific requirements or policies of an employer or organizational regulations. Some possible types or versions may include: 1. Los Angeles California Memorandum to Stop Direct Deposit — Company A: Customized for employees belonging to Company A in Los Angeles. 2. Los Angeles California Memorandum to Stop Direct Deposit — Non-Profit Organization: Tailored for employees working in non-profit organizations in Los Angeles. 3. Los Angeles California Memorandum to Stop Direct Deposit — Government Employees: Specifically designed for government employees residing in Los Angeles. It's important to note that these variations may differ in certain sections or include additional fields based on the employer's preferences or any specific legal requirements. Employees should ensure they utilize the appropriate memorandum according to their employer and job position.

Los Angeles California Memorandum to Stop Direct Deposit

Description

How to fill out Los Angeles California Memorandum To Stop Direct Deposit?

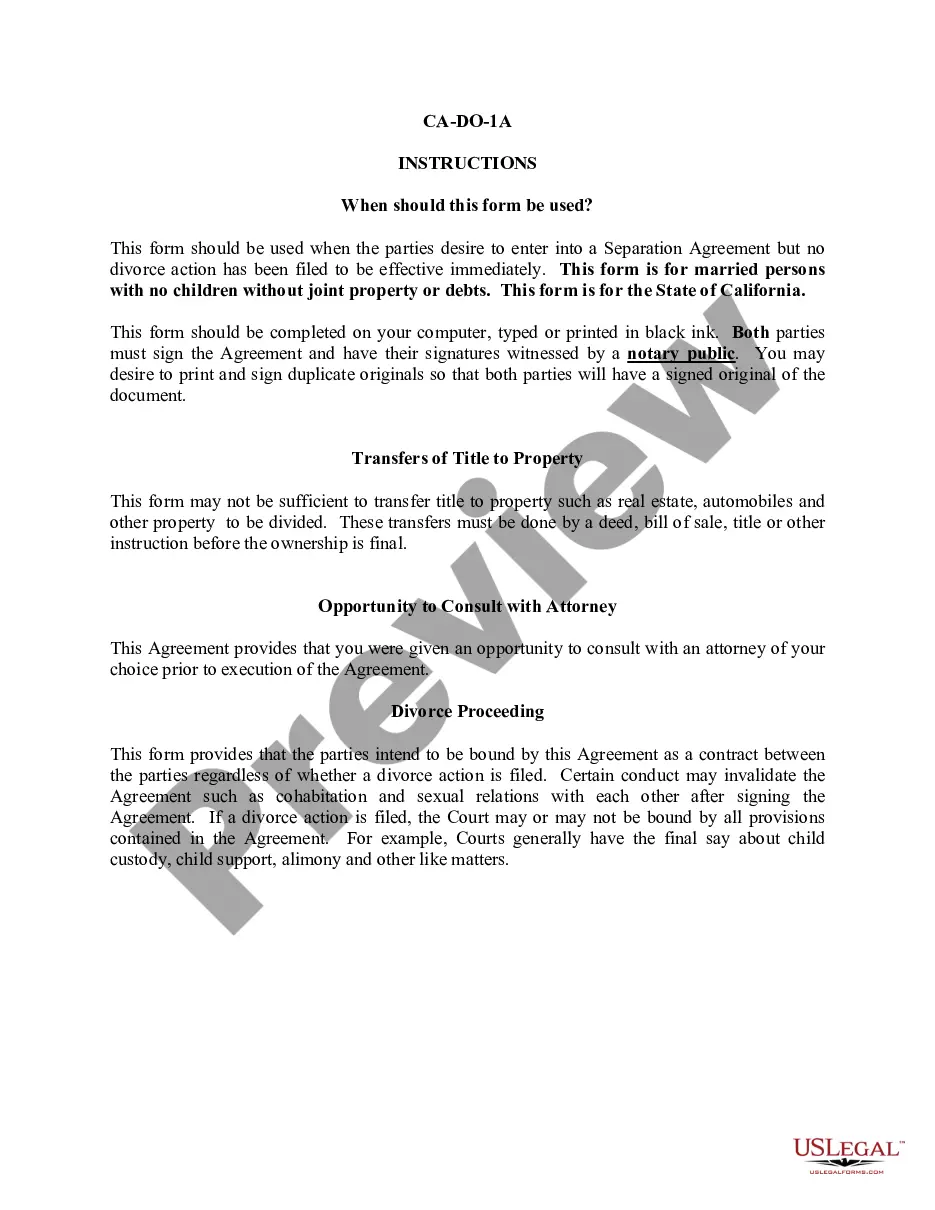

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Los Angeles Memorandum to Stop Direct Deposit, it may cost you a fortune. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Consequently, if you need the recent version of the Los Angeles Memorandum to Stop Direct Deposit, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Los Angeles Memorandum to Stop Direct Deposit:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Los Angeles Memorandum to Stop Direct Deposit and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Cancellation by the employee: You may stop participating in direct deposit at any time by notifying your payroll office and completing a new Direct Deposit Enrollment Form. On a new form, check the Cancel Box, fill in your name, Social Security number then sign and date the form.

Direct deposit allows the government to make the refund immediately available to the citizen. The same applies to government benefits like Social Security.

Even if you have not revoked your authorization with the company, you can stop an automatic payment from being charged to your account by giving your bank a stop payment order. This instructs your bank to stop allowing the company to take payments from your account.

To stop the next scheduled payment, give your bank the stop payment order at least three business days before the payment is scheduled. You can give the order in person, over the phone or in writing. To stop future payments, you might have to send your bank the stop payment order in writing.

Early direct deposit is a recent feature that several banks and credit unions are now offering so that their customers have faster access to a paycheck and can also earn interest on their money sooner. Consumers have access to their funds two days sooner, which can be beneficial if your payday falls on a weekend.

Employee Requests Direct Deposit be Stopped Depending on the situation, they may instruct the employee to reopen their account or contact the bank for assistance. If they determine the payment should be stopped, the payroll office can complete the stop pending form.

It means that they have decided to release that money to you on credit, with the expectation that the check writer's bank will make those funds available shortly and the check will clear.

Yes. The National Automated Clearinghouse Association (NACHA) guidelines say that an employer is permitted to reverse a direct deposit within five business days.

One of the biggest benefits of direct deposit is that it happens very quickly, usually one to three days but sometimes up to five business days. This varies depending on who is actually sending the funds and may even get faster in the future. (Learn more about transferring money from one bank to another.)

In short, you can expect a direct deposit to arrive in your bank account between 12 a.m. and 6 a.m. on the day your employer sends them out.