Hennepin County, Minnesota is a vibrant region located in the central part of the state. It is the most populous county in Minnesota and is home to the city of Minneapolis, the largest city in the state. Hennepin County offers a diverse landscape with a mix of urban and suburban areas, including a thriving business district, numerous parks, lakes, and recreational opportunities. One significant aspect related to business operations in Hennepin County is the Unit Franchise Agreement. A Unit Franchise Agreement is a legal contract between a franchisor and a franchisee that outlines the terms and conditions under which the franchisee can operate a specific unit or location of a larger franchise system. In the context of Hennepin County, there may be specific annotations or provisions that are unique to the region or comply with local regulations. These annotations serve to provide additional clarity or requirements specific to Hennepin County. Some potential types of Hennepin Minnesota Annotations for Unit Franchise Agreements could include: 1. Zoning Regulations: Hennepin County may have specific zoning regulations that a franchisee must adhere to when establishing a unit within the county. These regulations may govern things like the types of businesses allowed in certain areas, signage restrictions, or operating hours. 2. Licensing and Permits: Hennepin County may have specific licensing or permit requirements that a franchisee must fulfill before operating a unit within the county. These could include health permits, liquor licenses, or other industry-specific permits. 3. Employment Laws: Hennepin County may have additional employment-related regulations or laws that a franchisee must observe. These could include minimum wage requirements, employee benefits, or regulations related to working conditions. 4. Environmental Regulations: Hennepin County may have environmental regulations that impact certain industries or businesses. Franchisees may need to comply with waste management practices, energy efficiency standards, or other environmentally conscious guidelines. 5. Taxation Requirements: Hennepin County may have specific taxation requirements or rates that franchisees need to be aware of. This could include sales tax, property tax, or other applicable taxes. It is important for both franchisors and franchisees operating in Hennepin County to thoroughly review and understand the Hennepin Minnesota Annotations for Unit Franchise Agreements. These annotations can ensure compliance with local laws, protect the interests of both parties, and foster a successful business venture within the county.

Hennepin Minnesota Annotations for Unit Franchise Agreement

Description

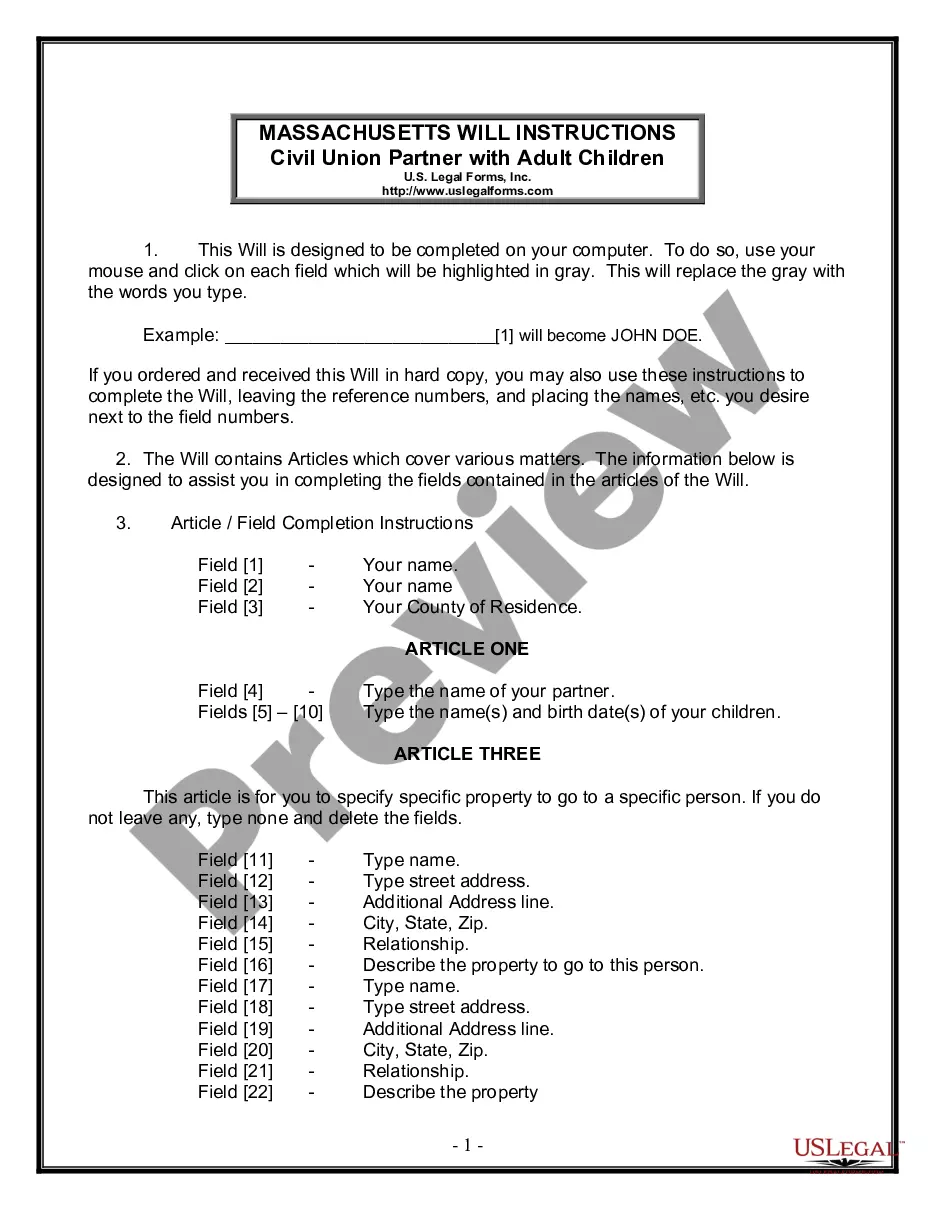

How to fill out Hennepin Minnesota Annotations For Unit Franchise Agreement?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a lawyer to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Hennepin Annotations for Unit Franchise Agreement, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario collected all in one place. Therefore, if you need the latest version of the Hennepin Annotations for Unit Franchise Agreement, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Hennepin Annotations for Unit Franchise Agreement:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Hennepin Annotations for Unit Franchise Agreement and download it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

The typical duration of a franchise agreement is usually 10 or 20 years. This part of the contract will also spell out the conditions under which the franchise can be sold to someone else, which can be stringent to make sure that any future franchisee is qualified to be an owner.

unit franchise is an agreement that allows a franchisee to open and operate just a single location. Singleunit franchises are typically managed and run by the franchisee rather than by hired staff.

What are the Most Important Sections in the Franchise Agreement? Use of Trademarks. Location of the Franchise. Term of the Franchise. Franchisee's Fees and Other Payments. Obligations and Duties of the Franchisor. Restriction on Goods and Services Offered. Renewal, Termination and Transfer of Franchise Agreement.

A franchise agreement incorporates the rights and obligations of the franchisor and franchisee to license and sell a company's intellectual property and licensing rights. Examples of businesses that use franchise agreements include: Convenience stores. Fast food and chain restaurants.

The three types of franchise agreements include: Master Franchise Agreement. Area Representative. Area Development Agreement.

Here are 10 fundamental provisions outlined in some form or fashion in every franchise agreement: Location/territory.Operations.Training and ongoing support.Duration.Franchise fee/investment.Royalties/ongoing fees.Trademark/patent/signage.Advertising/marketing.

Overview of the relationship: This includes the parties to the contract, the ownership of IP, and the overall obligations of the franchisee to operate its business to brand standards.

Below are four types of agreements franchised businesses commonly form. Single-Unit Franchise Agreement. In a single-unit agreement, the arrangement grants the franchisee the right to open and operate a single franchise unit.Multi-Unit Franchise Agreement.Area Development Franchise Agreement.Master Franchise Agreement.

The franchise agreement outlines the costs of franchising ownership. All franchises charge fees. These include the initial franchise fee, as well as ongoing fees such as the monthly royalty fee, advertising or marketing fee, and any other fee. Agreements can include late fees and interest.