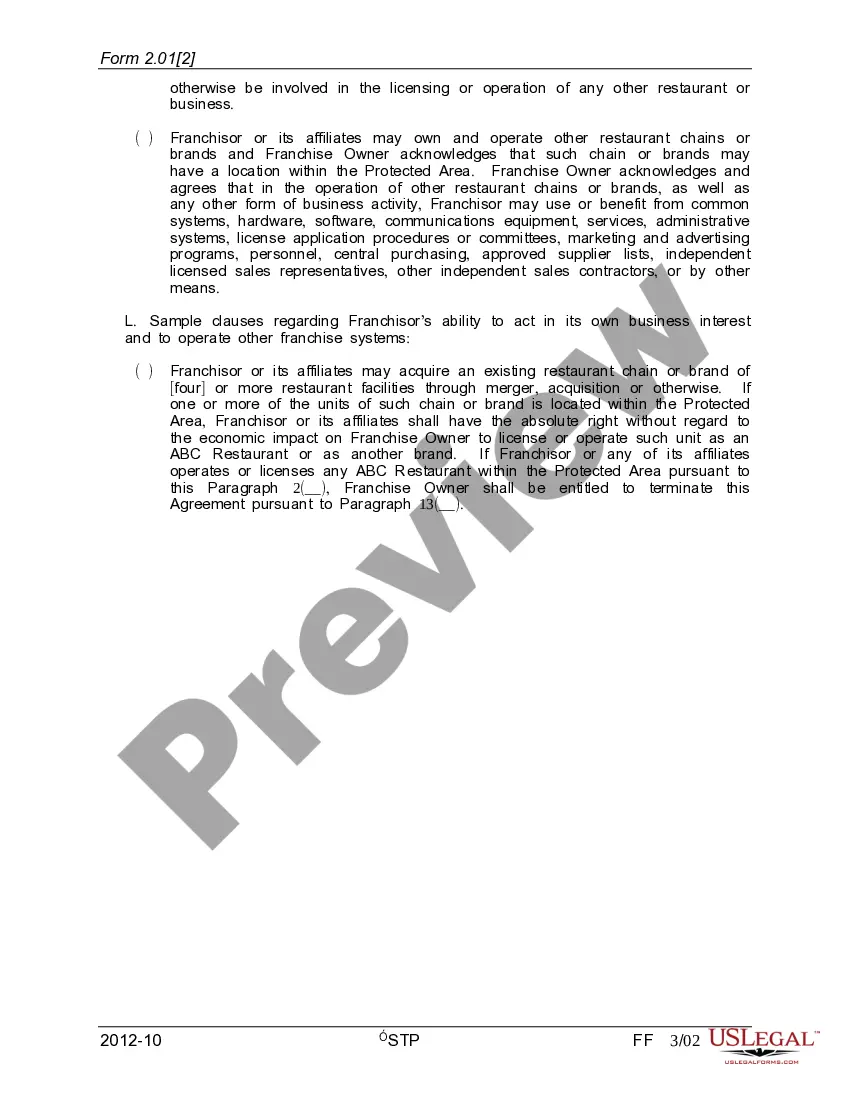

Maricopa, Arizona is a vibrant city located in the southern part of the state. As one of the fastest-growing cities in the United States, Maricopa offers a range of opportunities for both residents and businesses alike. In relation to the Unit Franchise Agreement, Maricopa Arizona has a few essential annotations that need to be considered: 1. Jurisdictional Annotations: When entering into a Unit Franchise Agreement in Maricopa, it is crucial to be aware of specific jurisdictional annotations that apply. These annotations refer to the rules and regulations set forth by the city and state governing bodies regarding franchise agreements. 2. Zoning Annotations: Maricopa, like any other city, has specific zoning regulations related to businesses and franchises. These annotations highlight the designated areas where a franchise unit can be established, considering factors such as land use, building codes, and neighborhood compatibility. 3. Licensing and Permits Annotations: Franchise agreements typically require various licenses and permits operating legally within Maricopa. Annotations outlining the necessary licenses, such as business permits, health permits, liquor licenses (if applicable), etc., keep the franchisee informed about the requirements and processes involved. 4. Insurance Annotations: Maricopa Arizona Annotations for Unit Franchise Agreement may include provisions related to insurance coverage. These annotations outline the types and minimum coverage amounts required for the franchise unit, ensuring compliance with local regulations and protecting both the franchisee and franchisor. 5. Tax Annotations: Understanding the tax obligations is essential for franchisees in Maricopa, Arizona. Annotations relating to taxes encompass various aspects such as sales tax, income tax, property tax, and any special tax assessments imposed by the city or county. 6. Employment Regulations Annotations: Maricopa follows specific employment laws, including minimum wage, overtime, and discrimination regulations. Annotations addressing these employment regulations within the Unit Franchise Agreement help franchisees navigate labor-related matters in compliance with local laws. It is important to note that the exact annotations within the Maricopa Arizona Unit Franchise Agreement may vary depending on the specific franchise and its industry. Franchisees and franchisors should consult legal professionals to ensure all relevant annotations are included in the agreement based on Maricopa's regulations.

Maricopa Arizona Annotations for Unit Franchise Agreement

Description

How to fill out Maricopa Arizona Annotations For Unit Franchise Agreement?

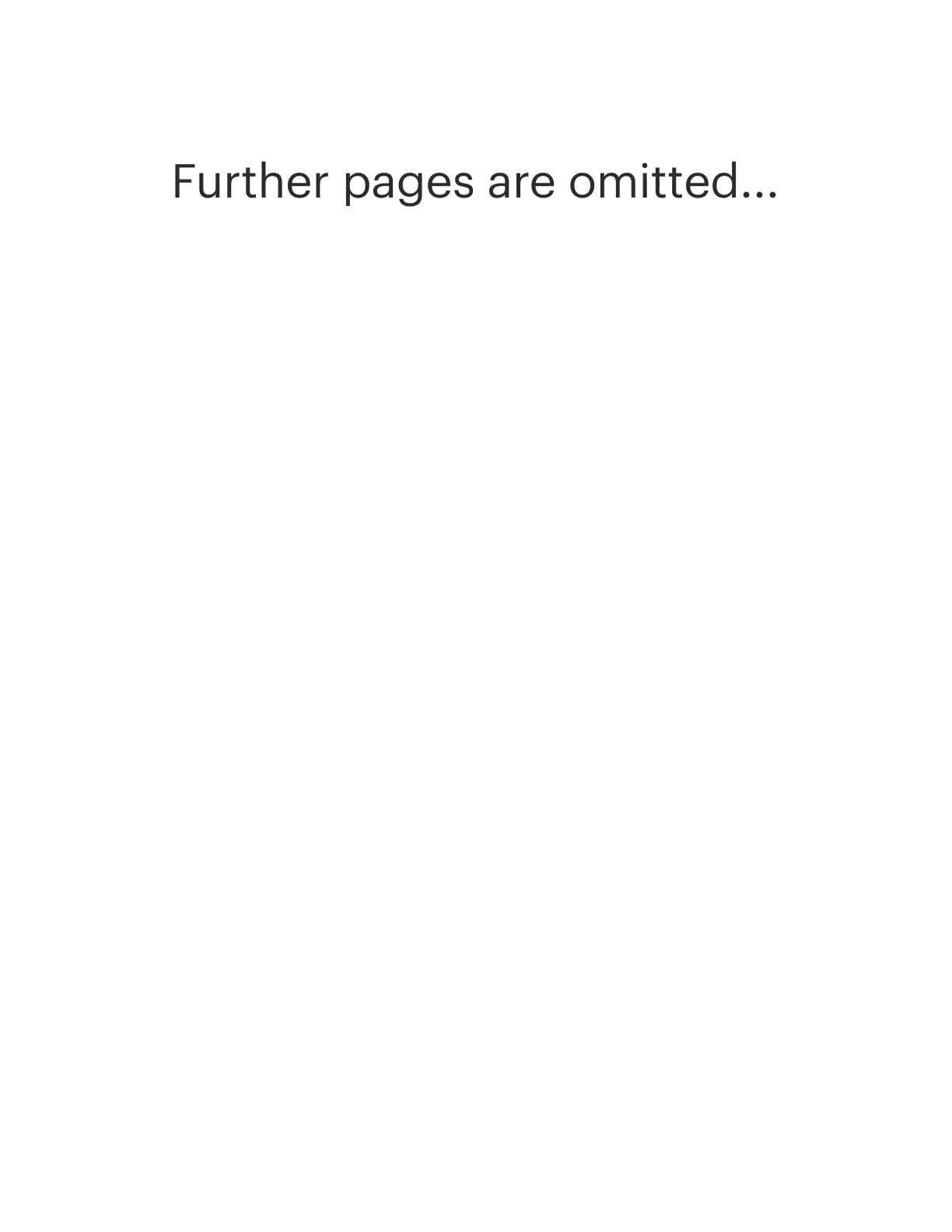

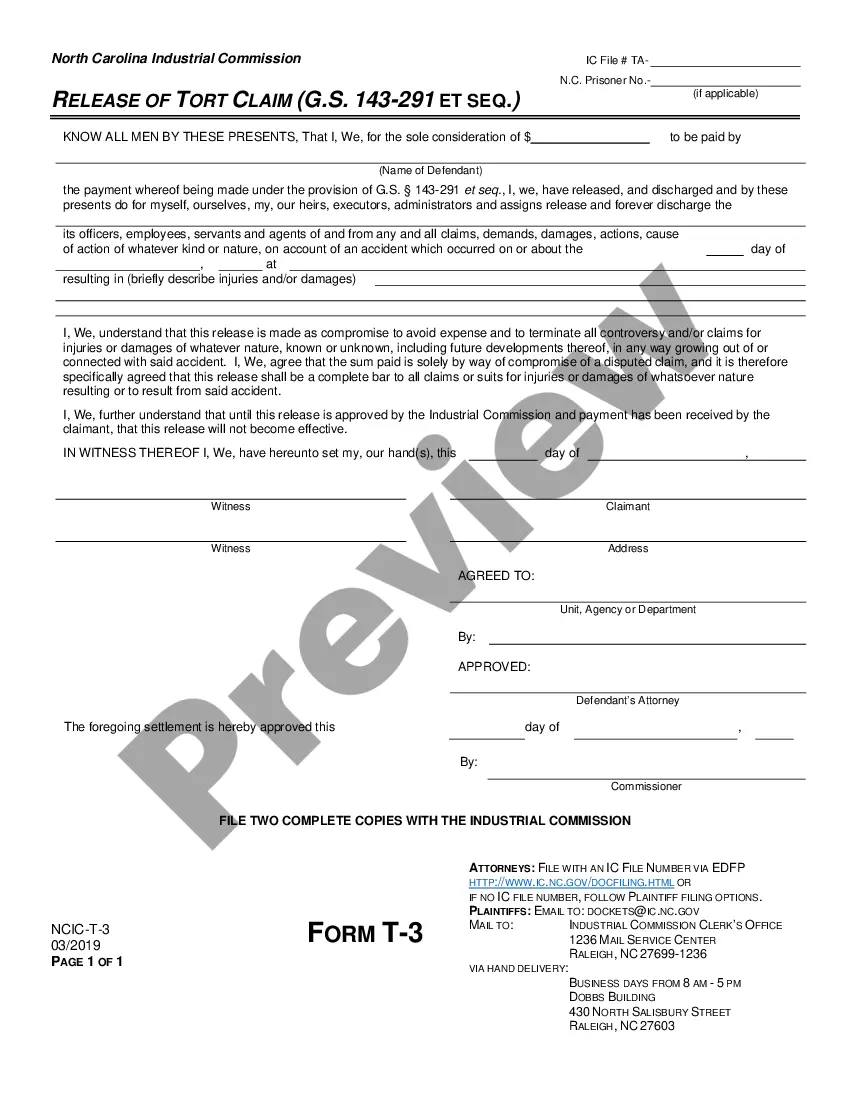

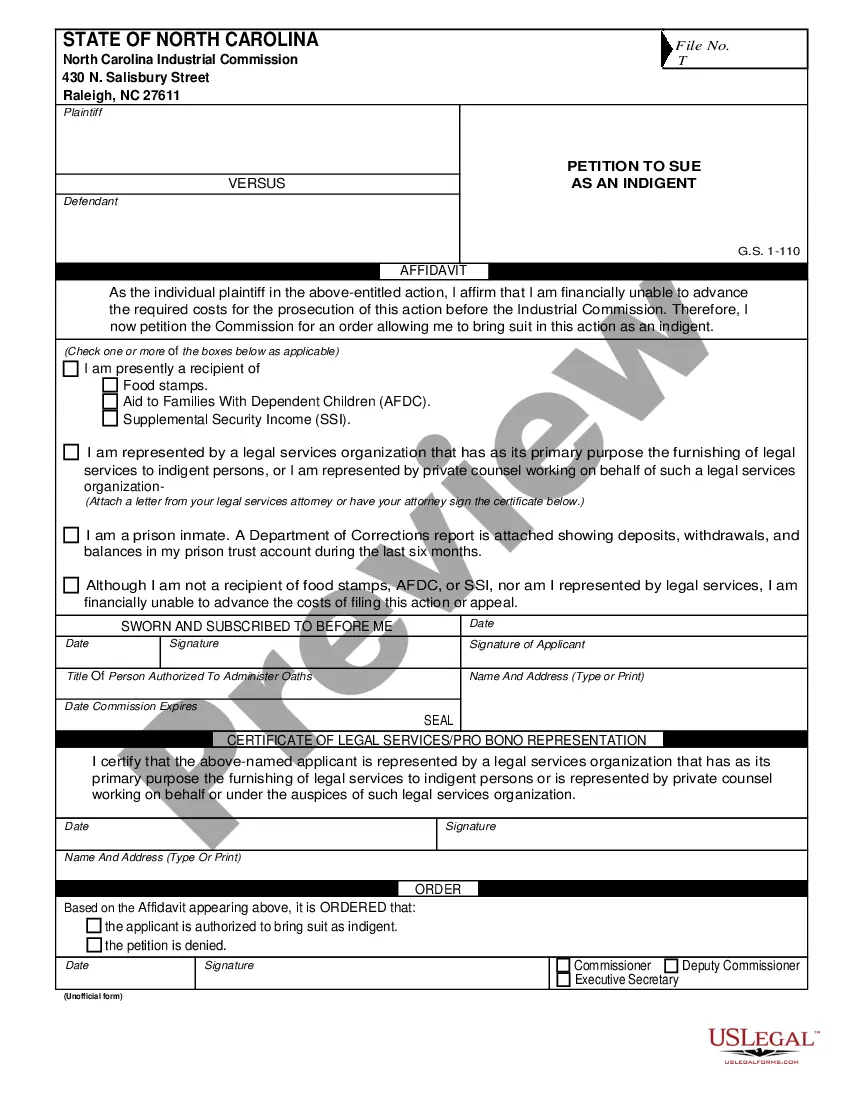

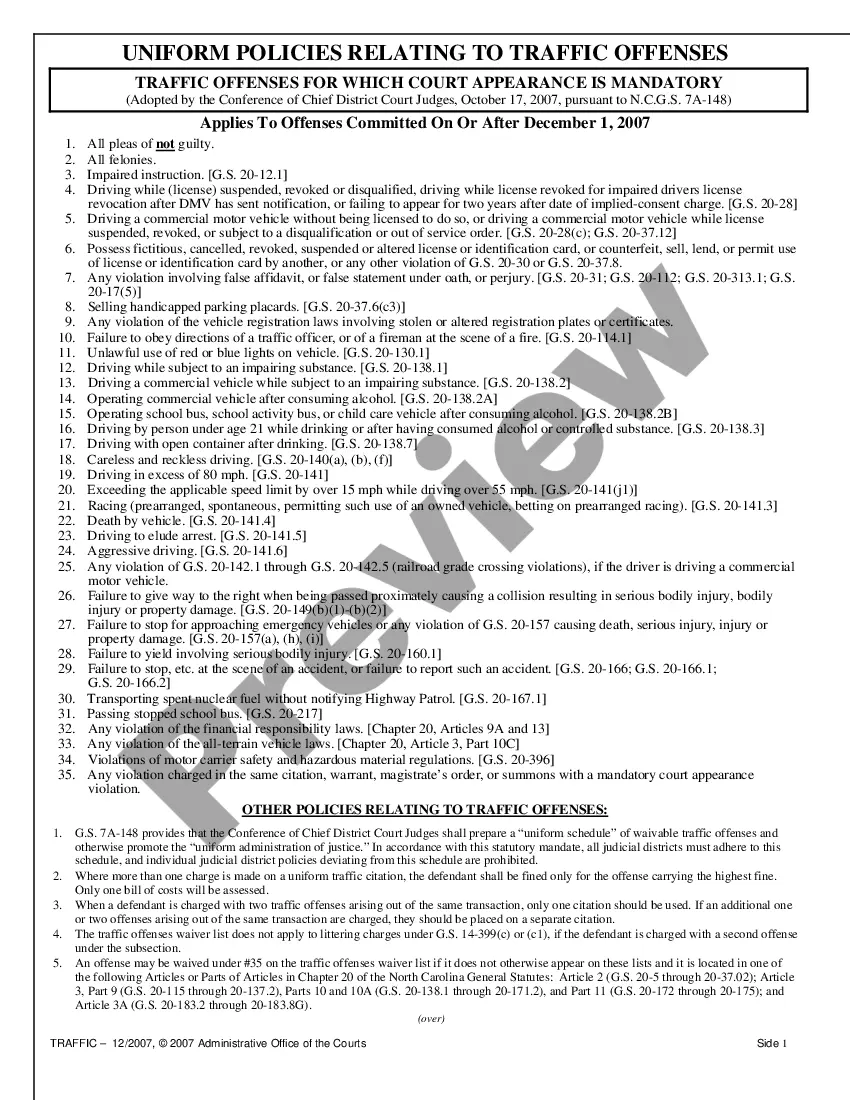

Whether you plan to open your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business case. All files are collected by state and area of use, so opting for a copy like Maricopa Annotations for Unit Franchise Agreement is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Maricopa Annotations for Unit Franchise Agreement. Adhere to the instructions below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the file once you find the right one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Annotations for Unit Franchise Agreement in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!