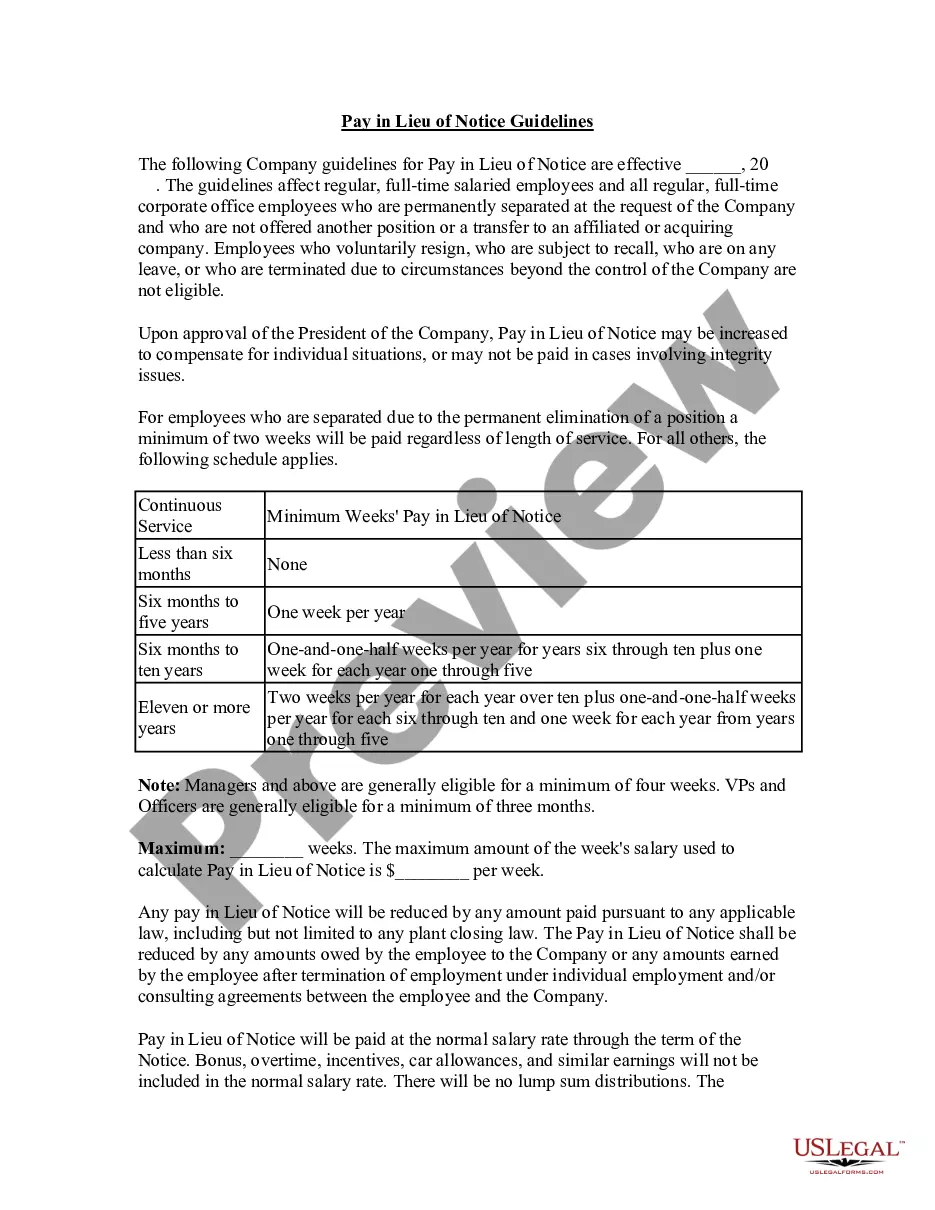

Oakland Michigan Pay in Lieu of Notice Guidelines are the regulations and provisions established by the county of Oakland, Michigan, regarding the compensation an employer is required to provide an employee who is terminated without receiving proper advanced notice. Pay in Lieu of Notice (PILOT) refers to the monetary amount an employee is entitled to receive instead of serving out their notice period. These guidelines are designed to protect the rights and financial well-being of employees who are faced with sudden termination or layoff. By enacting these guidelines, Oakland County ensures that employees are fairly compensated during the transition period and are not left financially stranded. Key provisions included in Oakland Michigan Pay in Lieu of Notice Guidelines may cover the following aspects: 1. Eligibility: The guidelines establish the eligibility criteria for employees to qualify for pay in lieu of notice. Factors such as length of employment, type of contract, and reason for termination are considered to determine entitlement. 2. Notice Period: The guidelines set out specific notice periods that an employer should provide to employees before termination. If proper notice is not given, the employer must provide pay in lieu of notice as compensation. 3. Calculation of Payment: The guidelines define the method of calculating the pay in lieu of notice. Typically, it is calculated based on the employee's regular wages, including any applicable benefits, bonuses, or allowances. 4. Exemptions: Certain categories of employees may be exempted from receiving pay in lieu of notice, such as those engaged in temporary or seasonal work, or individuals dismissed for gross misconduct. 5. Reporting Procedures: The guidelines stipulate the reporting procedures and timelines for both employers and employees to ensure transparent and efficient processing of pay in lieu of notice claims. It is essential to note that there may be variations or different types of Oakland Michigan Pay in Lieu of Notice Guidelines, depending on the specific sector or industry. For example, there might be separate guidelines for public sector employees, unionized workers, or employees covered under specific collective bargaining agreements. Understanding and adhering to Oakland Michigan Pay in Lieu of Notice Guidelines not only protects the rights of employees but also promotes fair and ethical employment practices within the county. Employers must familiarize themselves with these guidelines to avoid non-compliance and potential legal consequences.

Oakland Michigan Pay in Lieu of Notice Guidelines are the regulations and provisions established by the county of Oakland, Michigan, regarding the compensation an employer is required to provide an employee who is terminated without receiving proper advanced notice. Pay in Lieu of Notice (PILOT) refers to the monetary amount an employee is entitled to receive instead of serving out their notice period. These guidelines are designed to protect the rights and financial well-being of employees who are faced with sudden termination or layoff. By enacting these guidelines, Oakland County ensures that employees are fairly compensated during the transition period and are not left financially stranded. Key provisions included in Oakland Michigan Pay in Lieu of Notice Guidelines may cover the following aspects: 1. Eligibility: The guidelines establish the eligibility criteria for employees to qualify for pay in lieu of notice. Factors such as length of employment, type of contract, and reason for termination are considered to determine entitlement. 2. Notice Period: The guidelines set out specific notice periods that an employer should provide to employees before termination. If proper notice is not given, the employer must provide pay in lieu of notice as compensation. 3. Calculation of Payment: The guidelines define the method of calculating the pay in lieu of notice. Typically, it is calculated based on the employee's regular wages, including any applicable benefits, bonuses, or allowances. 4. Exemptions: Certain categories of employees may be exempted from receiving pay in lieu of notice, such as those engaged in temporary or seasonal work, or individuals dismissed for gross misconduct. 5. Reporting Procedures: The guidelines stipulate the reporting procedures and timelines for both employers and employees to ensure transparent and efficient processing of pay in lieu of notice claims. It is essential to note that there may be variations or different types of Oakland Michigan Pay in Lieu of Notice Guidelines, depending on the specific sector or industry. For example, there might be separate guidelines for public sector employees, unionized workers, or employees covered under specific collective bargaining agreements. Understanding and adhering to Oakland Michigan Pay in Lieu of Notice Guidelines not only protects the rights of employees but also promotes fair and ethical employment practices within the county. Employers must familiarize themselves with these guidelines to avoid non-compliance and potential legal consequences.