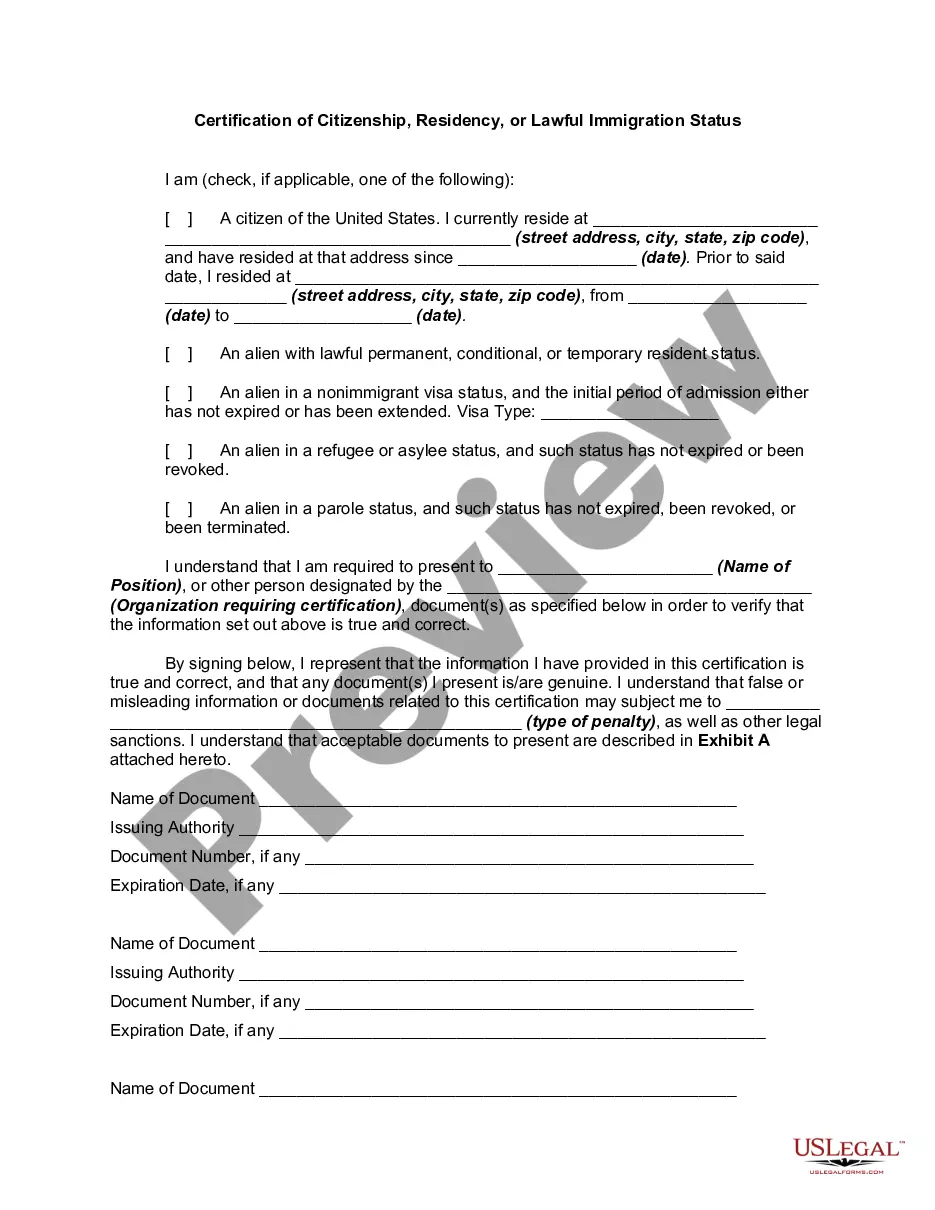

Broward Florida Payroll Deduction Authorization Form is a document that allows employees in Broward County, Florida to authorize specific deductions from their paychecks. This form is typically used to give consent for deductions related to employee benefits, such as health insurance premiums, retirement plans, and other voluntary contributions. It is an essential tool for both employers and employees to ensure accurate payroll management and maintain transparency in financial transactions. The Broward Florida Payroll Deduction Authorization Form is designed to capture relevant information of the employee, including their name, employee identification number, address, and contact details. It will also require the employer's name, address, and contact information. Furthermore, this form provides a section where the employee can select the type of deduction they wish to authorize. Common types of deductions mentioned in Broward Florida Payroll Deduction Authorization Forms may include: 1. Health Insurance Premium: This deduction is typically used to facilitate the employee's contribution towards their health insurance coverage. It allows employees to have their insurance premiums deducted directly from their paycheck. 2. Retirement Plan Contributions: This deduction enables employees to authorize contributions towards their retirement plans, such as 401(k) or pension plans. The form may include options to specify the percentage or fixed amount of the contribution. 3. Charitable Contributions: Some Broward County employers offer a payroll deduction option for employees who wish to donate a portion of their salary to a registered charity. The form may include a section for employees to specify the charity and the donation amount. 4. Flexible Spending Account (FSA) Contributions: This deduction pertains to employees who opt for FSA's to cover medical expenses not included in their health insurance plan. The form may include an option for employees to authorize a set amount or a percentage of their paycheck to be deducted for FSA contributions. 5. Union Dues: In cases where employees are members of labor unions, the payroll deduction form may have provisions for authorizing the deduction of union dues. It is important for employees to carefully review and understand the Broward Florida Payroll Deduction Authorization Form before providing their consent. Once completed, this form serves as a formal agreement between the employer and employee and allows the employer to make the authorized deductions from the employee's paycheck in accordance with applicable laws and regulations.

Broward Florida Payroll Deduction Authorization Form

Description

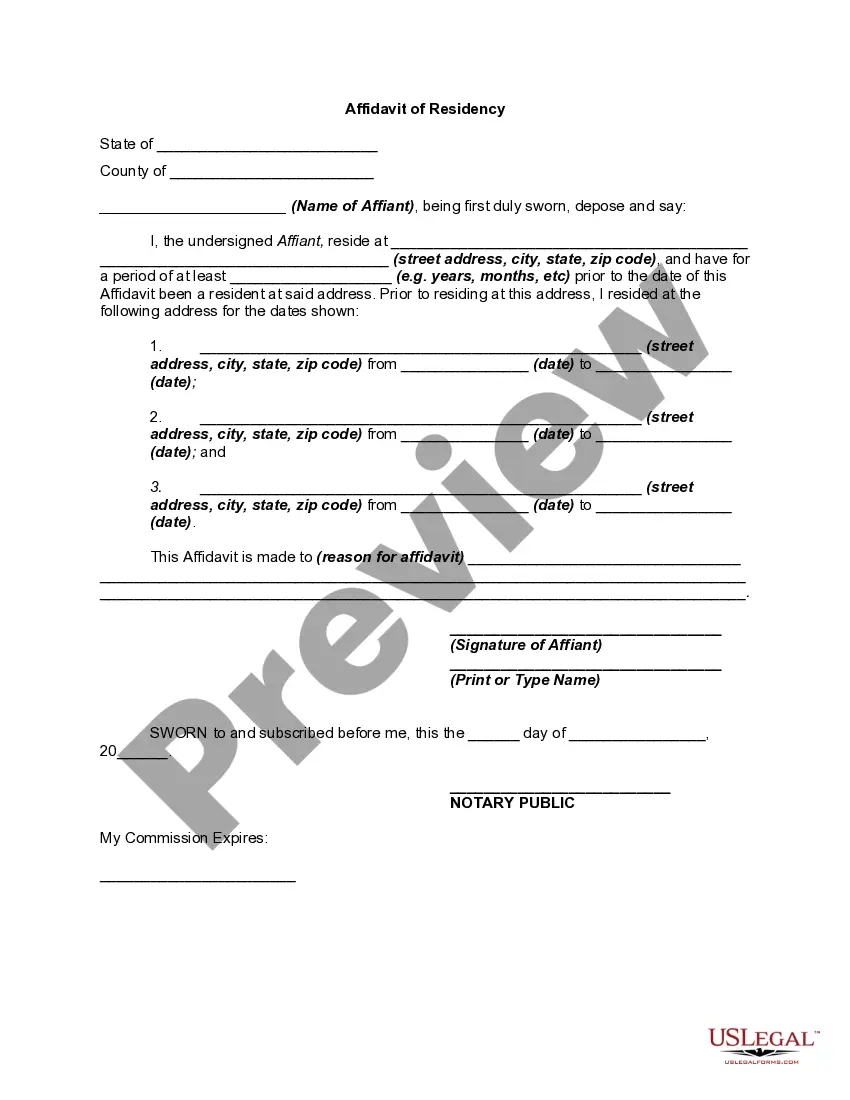

How to fill out Broward Florida Payroll Deduction Authorization Form?

Whether you intend to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occasion. All files are collected by state and area of use, so picking a copy like Broward Payroll Deduction Authorization Form is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Broward Payroll Deduction Authorization Form. Adhere to the guide below:

- Make sure the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the file once you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Broward Payroll Deduction Authorization Form in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!