Keywords: Franklin Ohio, Payroll Deduction Authorization Form, types, detail Description: The Franklin Ohio Payroll Deduction Authorization Form is a document used by employees in Franklin, Ohio, to request deductions from their wages or salaries for various purposes. This form allows employees to authorize their employers to deduct a specific amount or percentage from their paychecks before taxes and other deductions are made. This authorization form is essential for employees who want to contribute to certain benefit programs, such as health insurance, retirement savings, or voluntary employee benefit plans. It ensures that the requested deductions are accurately processed and reflected in the employee's payroll records. There are several types of Franklin Ohio Payroll Deduction Authorization Forms, each intended for different purposes. These include: 1. Health Insurance Deduction Authorization Form: This form allows employees to authorize deductions from their paychecks to cover health insurance premiums. By completing this form, employees can ensure that their health insurance premiums are paid regularly and on time. 2. Retirement Savings Deduction Authorization Form: This form enables employees to authorize deductions for contributions to their retirement savings accounts. By utilizing this form, employees can save for their future and take advantage of any employer matching contributions if available. 3. Voluntary Benefit Deduction Authorization Form: This form is used to authorize deductions for various voluntary employee benefits, such as flexible spending accounts, life insurance, disability insurance, or other supplemental insurance plans. Employees can elect to contribute a specific amount or percentage towards these benefits through this form. 4. Charitable Giving Deduction Authorization Form: This form is designed for employees who wish to contribute a portion of their wages to charitable organizations. By completing this form, employees can donate to their chosen charities conveniently and regularly through automated deductions. Regardless of the type, the Franklin Ohio Payroll Deduction Authorization Form serves as an agreement between the employee and the employer. It outlines the specific deduction amount or percentage and the duration of the authorization. Employees should carefully review and complete the form accurately to ensure the desired deductions are correctly processed. Please note that the specific types and names of the Franklin Ohio Payroll Deduction Authorization Forms may vary depending on the policies and practices of individual employers or organizations in Franklin, Ohio.

Franklin Ohio Payroll Deduction Authorization Form

Description

How to fill out Franklin Ohio Payroll Deduction Authorization Form?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Franklin Payroll Deduction Authorization Form, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Franklin Payroll Deduction Authorization Form from the My Forms tab.

For new users, it's necessary to make some more steps to get the Franklin Payroll Deduction Authorization Form:

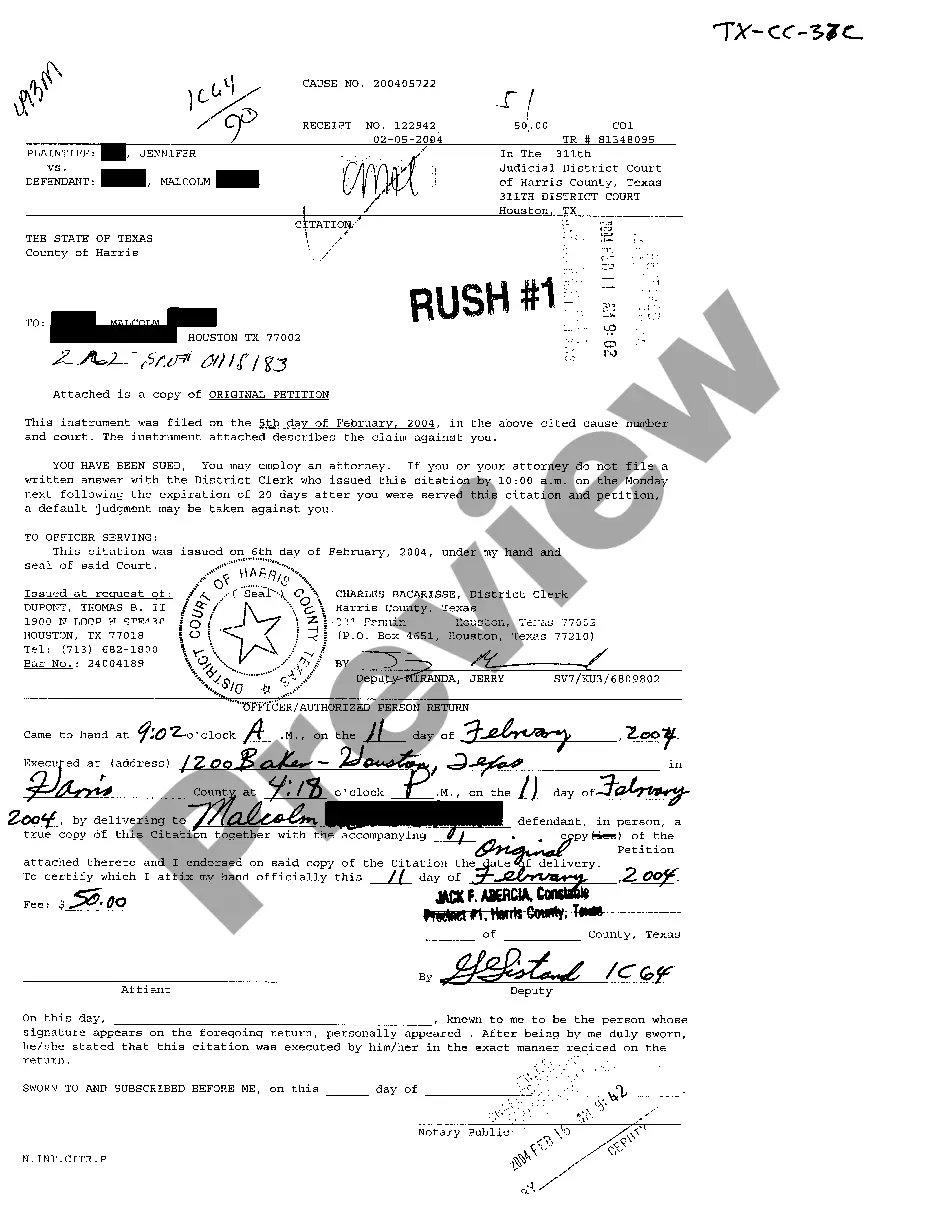

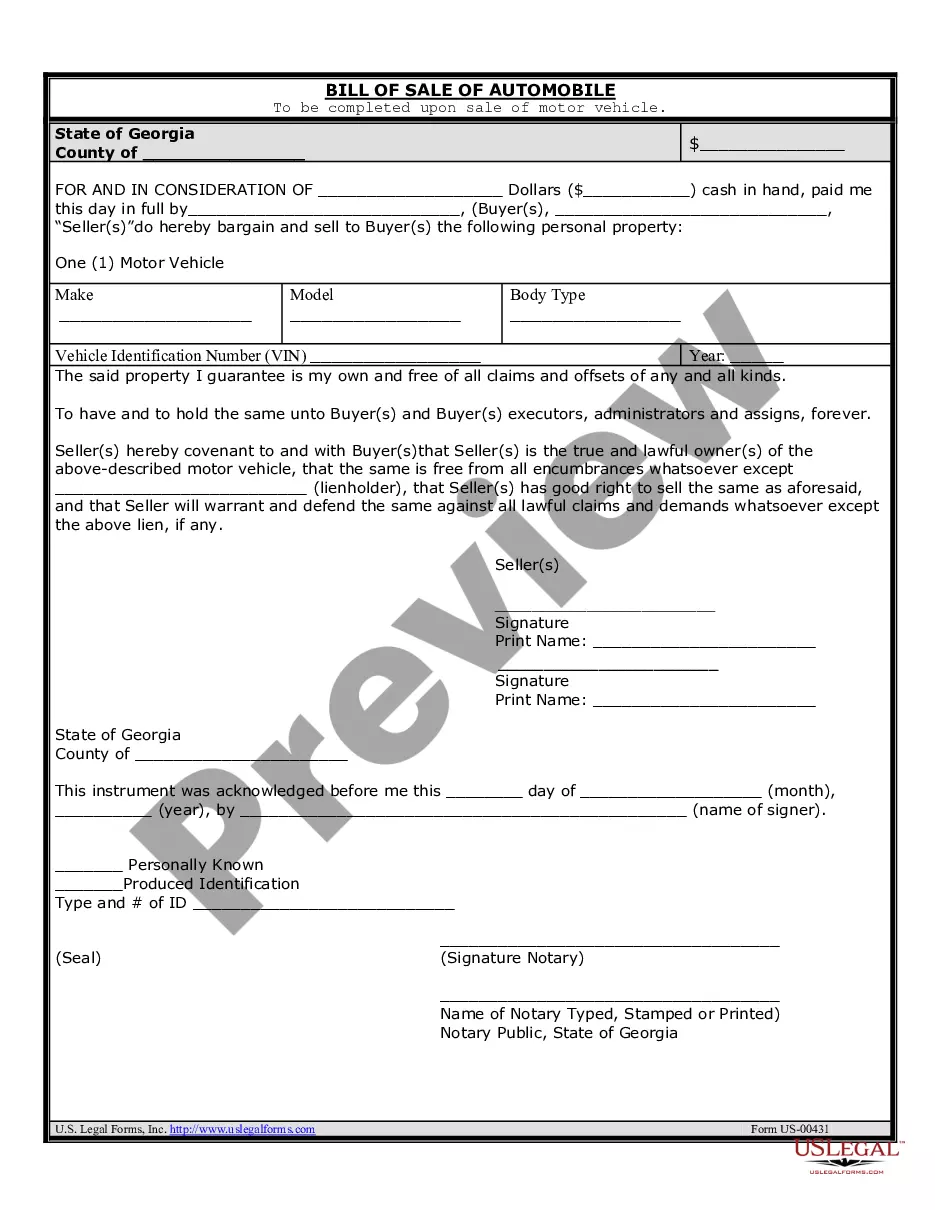

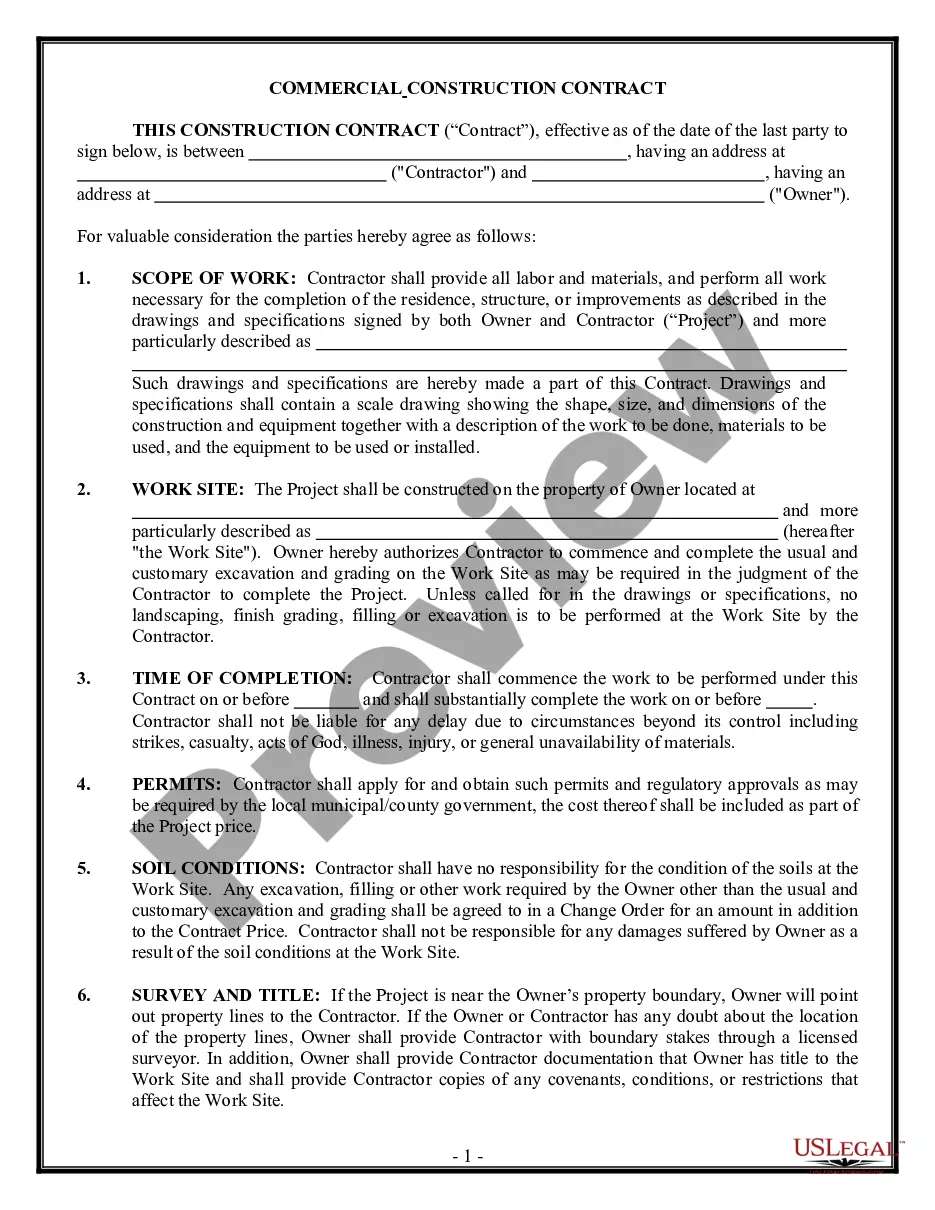

- Examine the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!