The Nassau New York Payroll Deduction Authorization Form is a legal document that allows employees in Nassau County, New York, to authorize their employers to deduct voluntary deductions from their paychecks. These deductions can include various expenses, such as retirement contributions, health or life insurance premiums, union dues, and charitable donations. By completing this form, employees give their consent for these voluntary deductions to be automatically deducted from their wages before they receive their net pay. The Nassau New York Payroll Deduction Authorization Form ensures that the deduction process is transparent and lawful, as it requires employees to provide their explicit consent and specify the dollar amount or percentage of their wages they wish to contribute or allocate towards each deduction category. This form is typically used by employers to accurately calculate and manage employees' voluntary deductions in compliance with state and federal laws. Different types of Nassau New York Payroll Deduction Authorization Forms may exist based on the specific deductions being authorized. For instance, there might be separate forms for retirement plan deductions, health insurance premium deductions, charitable giving deductions, and union dues deductions. Utilizing separate forms for different deduction categories allows for easy tracking and record-keeping by both employers and employees. It is important to note that the Nassau New York Payroll Deduction Authorization Form is specific to Nassau County in New York State. Other counties or states may have their own versions of payroll deduction authorization forms, tailored to their respective jurisdiction's laws and regulations. In summary, the Nassau New York Payroll Deduction Authorization Form is a crucial document that enables employees in Nassau County, New York, to grant their consent for specific voluntary deductions to be automatically deducted from their paychecks. Different types of this form may exist, depending on the various categories of deductions being authorized, ensuring accuracy, compliance, and transparency in payroll management.

Nassau New York Payroll Deduction Authorization Form

Description

How to fill out Nassau New York Payroll Deduction Authorization Form?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including Nassau Payroll Deduction Authorization Form, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various categories ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find information resources and tutorials on the website to make any activities associated with paperwork execution straightforward.

Here's how you can purchase and download Nassau Payroll Deduction Authorization Form.

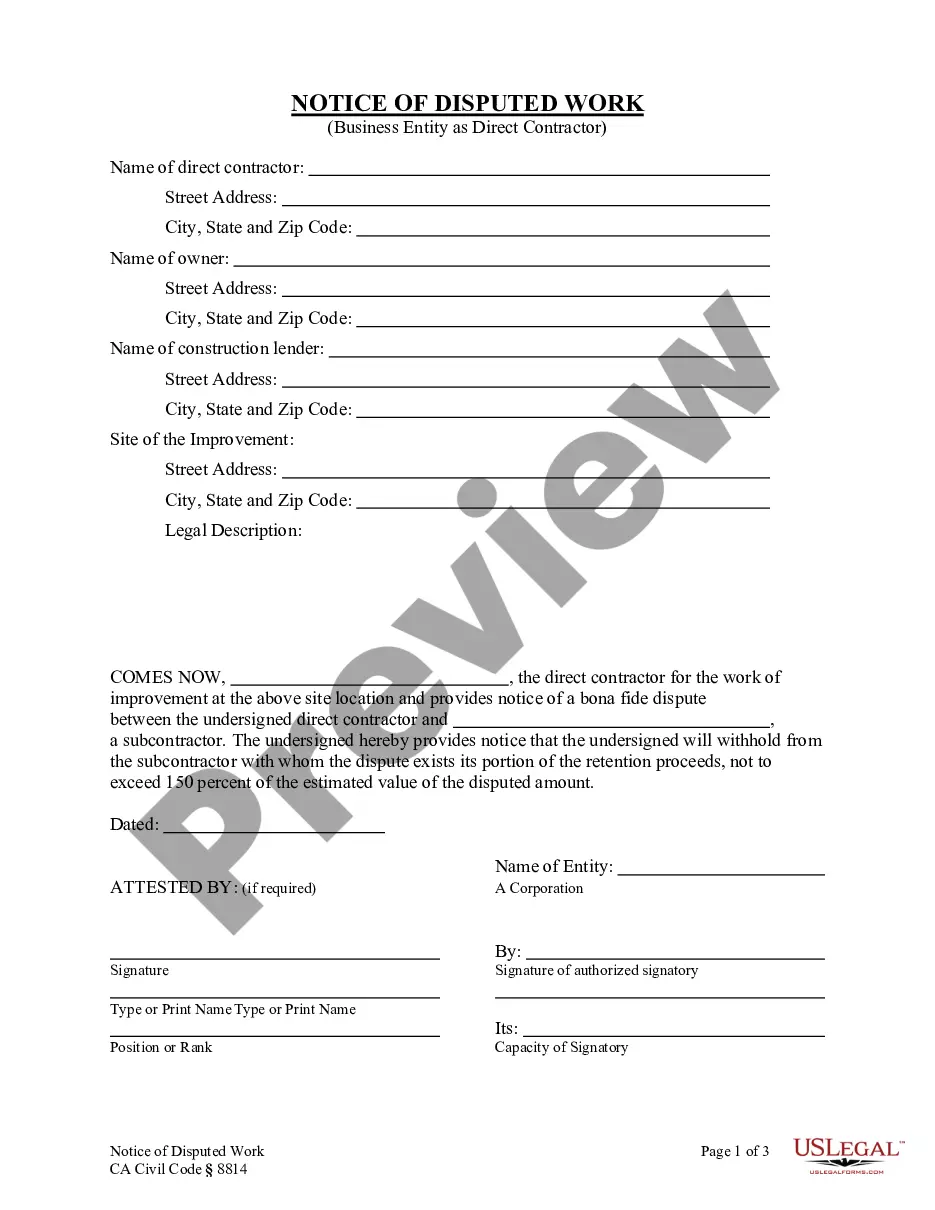

- Take a look at the document's preview and description (if available) to get a basic information on what you’ll get after getting the form.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can affect the validity of some documents.

- Check the similar forms or start the search over to find the correct document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and buy Nassau Payroll Deduction Authorization Form.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Nassau Payroll Deduction Authorization Form, log in to your account, and download it. Needless to say, our platform can’t take the place of a legal professional entirely. If you have to cope with an extremely challenging case, we recommend using the services of an attorney to examine your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and purchase your state-specific documents with ease!