San Diego California Payroll Deduction Authorization Form is a legal document designed to authorize employers in San Diego, California to deduct specific amounts from an employee's salary or wages. This deduction allows for the allocation of funds towards various purposes, such as healthcare benefits, retirement savings, union dues, insurance premiums, or other authorized deductions. The San Diego California Payroll Deduction Authorization Form serves as a written agreement between the employer and the employee, outlining the terms and conditions of the payroll deduction. It guarantees that the employer deducts the agreed-upon amount from the employee's wages and channels it to the appropriate recipient or account. This authorization form is crucial to ensure transparency and compliance with legal requirements. It provides clear documentation that both parties have agreed to the specified deductions, eliminating any potential misunderstandings or disputes. In San Diego, California, there may be different types of Payroll Deduction Authorization Forms based on the purpose of the deduction. Some common types include: 1. Health Insurance Deduction Authorization Form: This form authorizes the employer to deduct a specific amount from the employee's wages to cover health insurance premiums, ensuring the employee's health coverage. 2. Retirement Plan Deduction Authorization Form: This form allows the employer to deduct a predetermined portion from the employee's wages for contributions towards a retirement plan such as a 401(k) or pension. 3. Union Dues Deduction Authorization Form: If the employee is a union member, this form authorizes the employer to deduct union dues from the employee's wages, supporting the employee's affiliation with the union. 4. Flexible Spending Account (FSA) Deduction Authorization Form: This form permits the employer to deduct a certain amount from the employee's wages to be deposited into their FSA, enabling the employee to pay for eligible healthcare or dependent care expenses with pre-tax dollars. 5. Charitable Contribution Deduction Authorization Form: In some cases, employers may offer employees the option to participate in charitable giving programs through payroll deductions. This form confirms the employee's agreement to have the designated amount deducted and donated to a chosen charitable organization. It is essential for both employers and employees to complete the San Diego California Payroll Deduction Authorization Form accurately and in accordance with the applicable laws and regulations. It is recommended to consult with a legal professional or human resources specialist to ensure proper usage of these forms in compliance with local and federal laws.

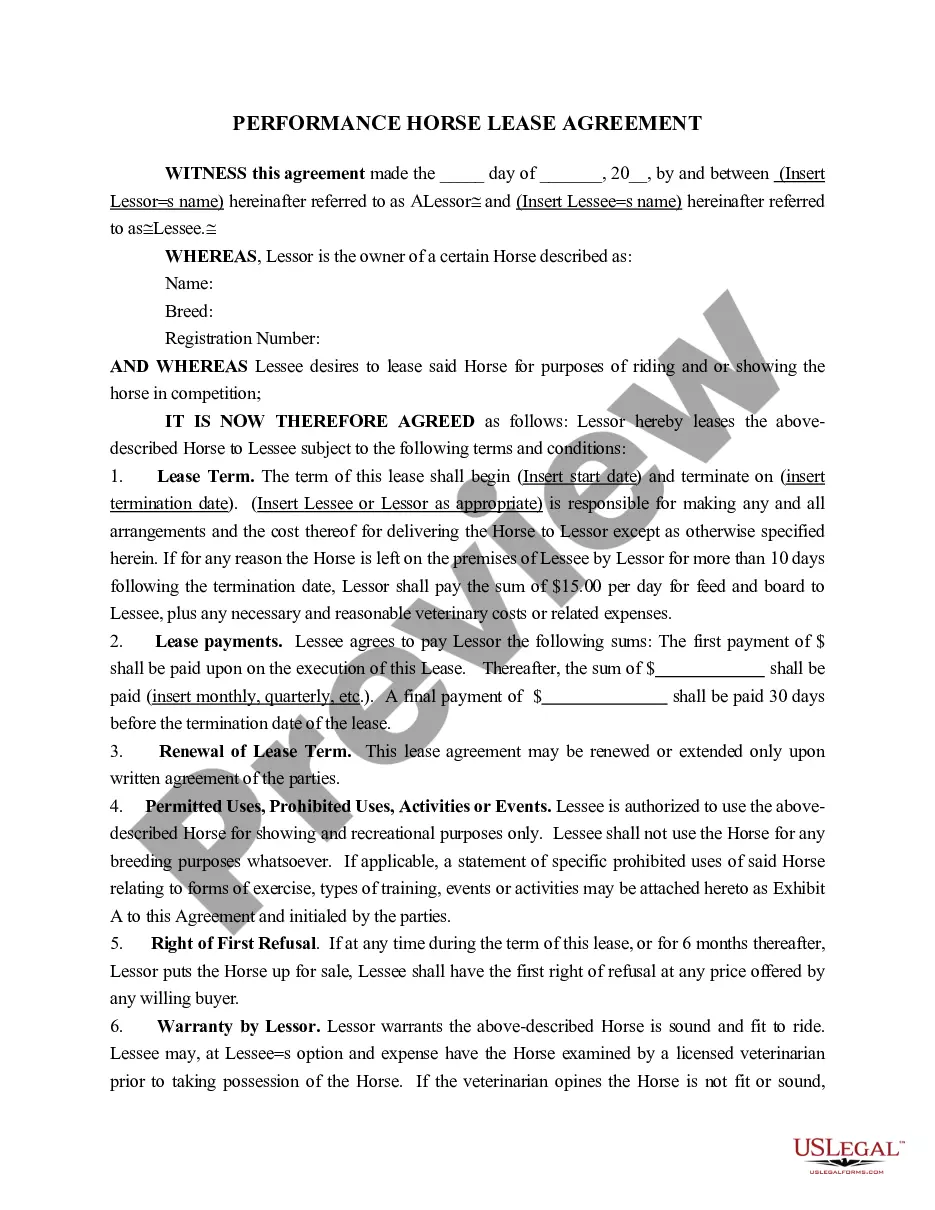

San Diego California Payroll Deduction Authorization Form

Description

How to fill out San Diego California Payroll Deduction Authorization Form?

Whether you intend to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business case. All files are collected by state and area of use, so opting for a copy like San Diego Payroll Deduction Authorization Form is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several additional steps to obtain the San Diego Payroll Deduction Authorization Form. Follow the guidelines below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Payroll Deduction Authorization Form in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!