Travis Texas Payroll Deduction Authorization Form is a crucial document that allows employees to authorize payroll deductions for various purposes in Travis County, Texas. The form is used by employers to ensure accurate and lawful deduction of funds from an employee's wages. This comprehensive form collects essential information such as employee details, employer details, and specifics regarding the deduction purpose. It serves as an agreement between the employer and employee, outlining the terms and conditions of the authorized payroll deduction. By signing this form, employees grant permission to the employer to deduct specific amounts from their wages. The Travis Texas Payroll Deduction Authorization Form caters to various types of deductions, depending on the employee's individual needs. Some common categories include: 1. Tax Deductions: This type of deduction typically includes federal, state, and local income taxes, as well as social security and Medicare taxes. It ensures proper withholding of these mandatory taxes from the employee's paycheck. 2. Benefit Deductions: This category includes deductions related to employee benefits such as health insurance premiums, retirement contributions, or flexible spending account allocations. 3. Loan Repayment Deductions: Employees can authorize deductions to repay loans taken from their employer, such as advance salary loans or educational assistance loans. 4. Garnishments and Levies: In cases where an employee owes a debt or faces legal obligations, such as child support or tax levies, the employer may deduct a portion of the wages to fulfill these obligations. 5. Voluntary Deductions: This type of deduction encompasses optional programs or contributions, such as charitable donations, union dues, or voluntary retirement savings. It is important to note that the Travis Texas Payroll Deduction Authorization Form must comply with applicable state and federal laws governing wage deductions. The form should clearly specify the deduction amount, frequency, and duration to avoid any confusion or disputes between the employer and employee. Employers typically keep a copy of the signed form in the employee's personnel files and provide a copy to the employee for their records. Regular review and updating of the form ensure that employees' deductions accurately reflect their preferences and any changes in circumstances. By using the Travis Texas Payroll Deduction Authorization Form, both employers and employees can ensure transparency, legality, and proper management of payroll deductions.

Travis Texas Payroll Deduction Authorization Form

Description

How to fill out Travis Texas Payroll Deduction Authorization Form?

Whether you intend to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Travis Payroll Deduction Authorization Form is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to get the Travis Payroll Deduction Authorization Form. Follow the instructions below:

- Make certain the sample fulfills your individual needs and state law requirements.

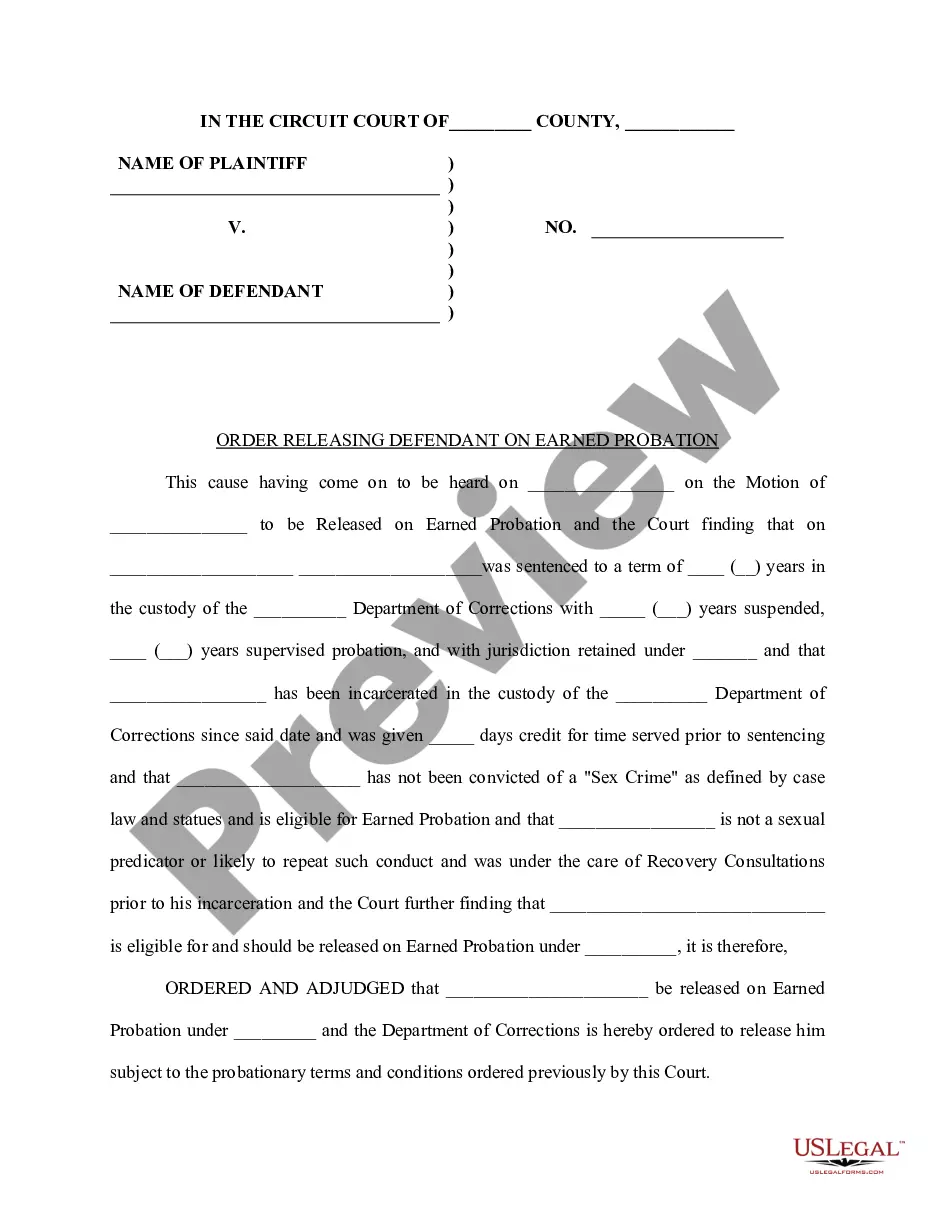

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Travis Payroll Deduction Authorization Form in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!