The Wayne Michigan Personnel Payroll Associate Checklist is a comprehensive guide designed to assist payroll associates in efficiently processing payroll and ensuring accuracy in Wayne, Michigan. This checklist includes various tasks and responsibilities that need to be completed on a regular basis to ensure compliance with state and federal regulations. Keywords: Wayne Michigan, personnel payroll associate, checklist, tasks, responsibilities, payroll processing, accuracy, compliance, state regulations, federal regulations. Different Types of Wayne Michigan Personnel Payroll Associate Checklists: 1. Monthly Payroll Processing Checklist: This checklist covers tasks specific to the monthly payroll processing cycle, including data entry, timesheet verification, deductions and benefits verification, paycheck distribution, and tax reporting. 2. Year-End Payroll Processing Checklist: This checklist focuses on tasks required at the end of the year for payroll processing purposes, such as preparing W-2 forms, tax reporting and reconciliations, reviewing annual leave balances, updating employee records, and ensuring compliance with any changes in tax laws. 3. New Employee Onboarding Checklist: This checklist outlines the steps to be followed when bringing a new employee onboard, such as verifying personal information, completing tax and benefit forms, setting up direct deposit, and explaining employment policies. 4. Employee Termination Checklist: This checklist helps ensure a smooth payroll process when an employee leaves the organization. It includes tasks such as finalizing salary and benefits, processing the final paycheck, terminating benefits, and updating records. 5. Payroll Compliance Checklist: This checklist emphasizes tasks related to compliance with local, state, and federal regulations governing payroll. It includes auditing payroll records, ensuring accurate tax and deduction calculations, and monitoring changes in employment laws. The Wayne Michigan Personnel Payroll Associate Checklist aims to streamline payroll processes, reduce errors, and maintain compliance with regulations. By using these checklists, payroll associates can stay organized, ensure accuracy, and contribute to a well-functioning payroll system.

Wayne Michigan Personnel Payroll Associate Checklist

Description

How to fill out Wayne Michigan Personnel Payroll Associate Checklist?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Wayne Personnel Payroll Associate Checklist, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Wayne Personnel Payroll Associate Checklist from the My Forms tab.

For new users, it's necessary to make some more steps to get the Wayne Personnel Payroll Associate Checklist:

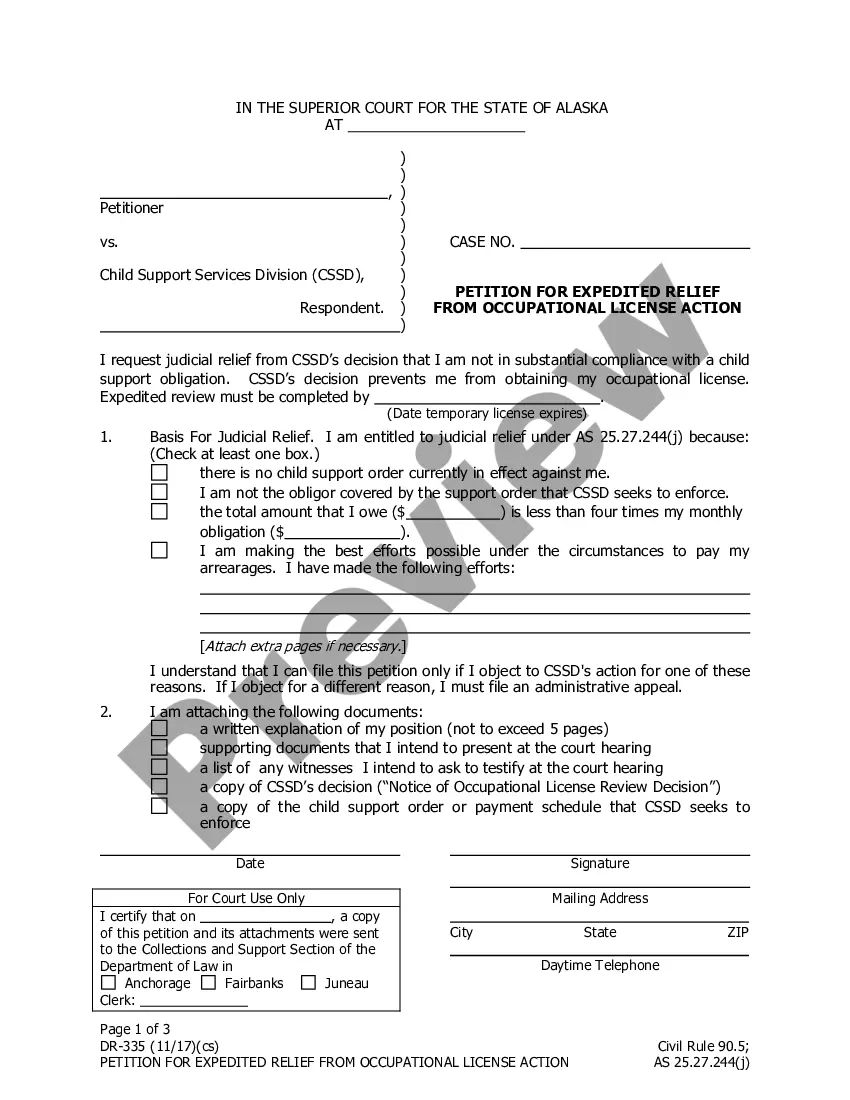

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!