Cuyahoga Ohio Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is an important decision-making process within an LLC operating in Cuyahoga County, Ohio. It involves a meeting where LLC members determine the exact amount of money that will be disbursed to each member annually. During this meeting, LLC members gather to discuss and decide upon the allocation of profits to the company's members. This discussion revolves around setting the specific amount of money that will be distributed to each member as their share of the annual profits. The members need to carefully consider various factors such as the financial performance of the company, projected earnings, and individual contributions made by each member. The Cuyahoga Ohio Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company can be categorized into different types based on the approaches taken by the members: 1. Equal Distribution: This resolution type refers to an agreement where all members of the LLC receive an equal share of the annual disbursements. Regardless of the individual contributions made to the company or variations in the capital investments, the amount distributed to each member remains the same. 2. Proportional Distribution: In this resolution type, the LLC's members agree to allocate the annual disbursements based on the percentage of ownership or capital contribution. Each member receives a proportionate share according to their stake in the company. For example, if a member owns 30% of the company, they would receive 30% of the annual disbursement. 3. Performance-Based Distribution: Some LCS prefer to reward members based on their individual performance or contributions to the company's success. In this case, the Cuyahoga Ohio Resolution of Meeting of LLC Members may specify a variable disbursement amount based on criteria such as sales targets achieved, projects completed, or other measurable individual accomplishments. 4. Hybrid Distribution: LCS may choose hybrid resolutions, which combine elements of both equal and proportional distributions. This can involve a baseline equal distribution across all members, with additional disbursements allocated proportionally based on factors such as capital contributions, ownership percentages, or individual performance. It is crucial for the meeting participants to document the Cuyahoga Ohio Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company accurately. Minutes of the meeting should be prepared, highlighting the agreed-upon disbursement amount, the resolution type chosen, and any specific conditions or criteria that may apply. Overall, this Cuyahoga Ohio Resolution of Meeting of LLC Members is a vital step in ensuring fair and transparent allocation of profits within an LLC, promoting harmony and motivation among its members.

Cuyahoga Ohio Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Cuyahoga Ohio Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

How much time does it normally take you to create a legal document? Given that every state has its laws and regulations for every life situation, locating a Cuyahoga Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company suiting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Aside from the Cuyahoga Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, here you can get any specific document to run your business or personal affairs, complying with your county requirements. Specialists check all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can get the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Cuyahoga Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company:

- Check the content of the page you’re on.

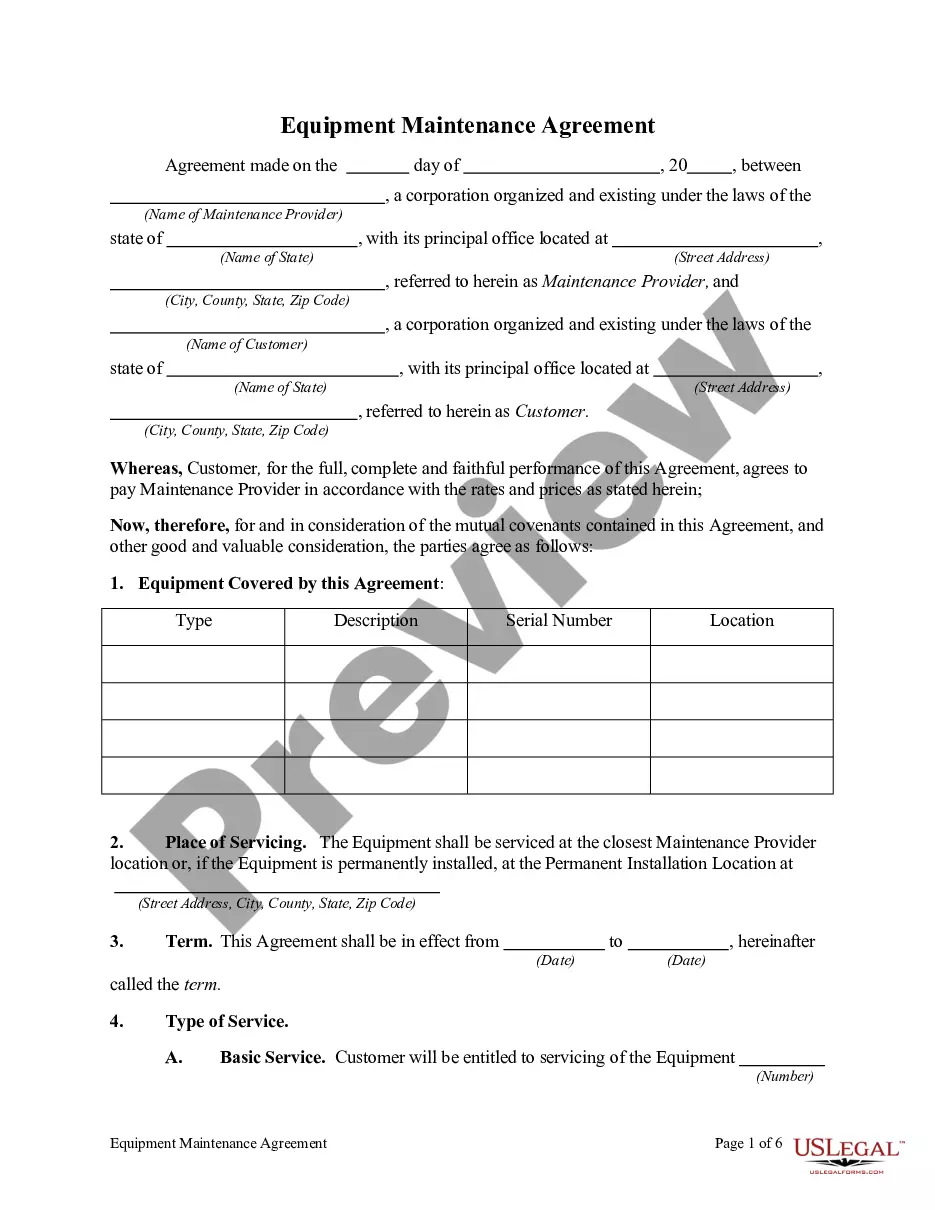

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Cuyahoga Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!