Los Angeles California Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company In a Los Angeles California Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, members of the limited liability company (LLC) gather to discuss and determine the specific amount of annual disbursements that will be distributed to the company's members. Since an LLC is a flexible business structure, there can be different types of resolutions passed during this meeting. Here are a few examples: 1. Ordinary Disbursement Resolution: This type of resolution is typically passed when the LLC members agree to distribute a regular and predetermined amount of profit to each member annually. The resolution will outline the specific amount that each member will receive. 2. Variable Disbursement Resolution: In some cases, an LLC may decide to distribute the annual profit based on the individual contribution or ownership interest of each member. This type of resolution allows for the disbursement to vary based on each member's involvement, capital contribution, or percentage of ownership. 3. Capital Account Adjustment Resolution: This resolution may be passed if there are changes in the capital accounts of the LLC members during the year. It allows the members to adjust their capital accounts, which can influence the distribution of annual disbursements. 4. Special Disbursement Resolution: This resolution is passed when the LLC members decide to distribute a one-time or special disbursement outside the regular annual disbursements. It may be based on an exceptional event such as the sale of a significant asset or the receipt of an unexpected windfall. During the meeting, the LLC members will discuss and deliberate on the financial state of the company, taking into consideration factors like revenue, expenses, investments, and any other relevant financial information. They will consider the LLC's operating agreement, which sets out the guidelines for the disbursement of profits. The resolution of the meeting is drafted and must be approved by a majority or a specified percentage of the LLC members. It serves as a legal document that outlines the agreed-upon amount and method of distributing the annual disbursements. Keywords: Los Angeles, California, resolution, meeting, LLC members, annual disbursements, limited liability company, ordinary disbursement resolution, variable disbursement resolution, capital account adjustment resolution, special disbursement resolution, financial state, revenue, expenses, investments, operating agreement, legal document.

Los Angeles California Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Los Angeles California Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

Whether you plan to open your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business occurrence. All files are grouped by state and area of use, so picking a copy like Los Angeles Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Los Angeles Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company. Adhere to the instructions below:

- Make certain the sample fulfills your personal needs and state law requirements.

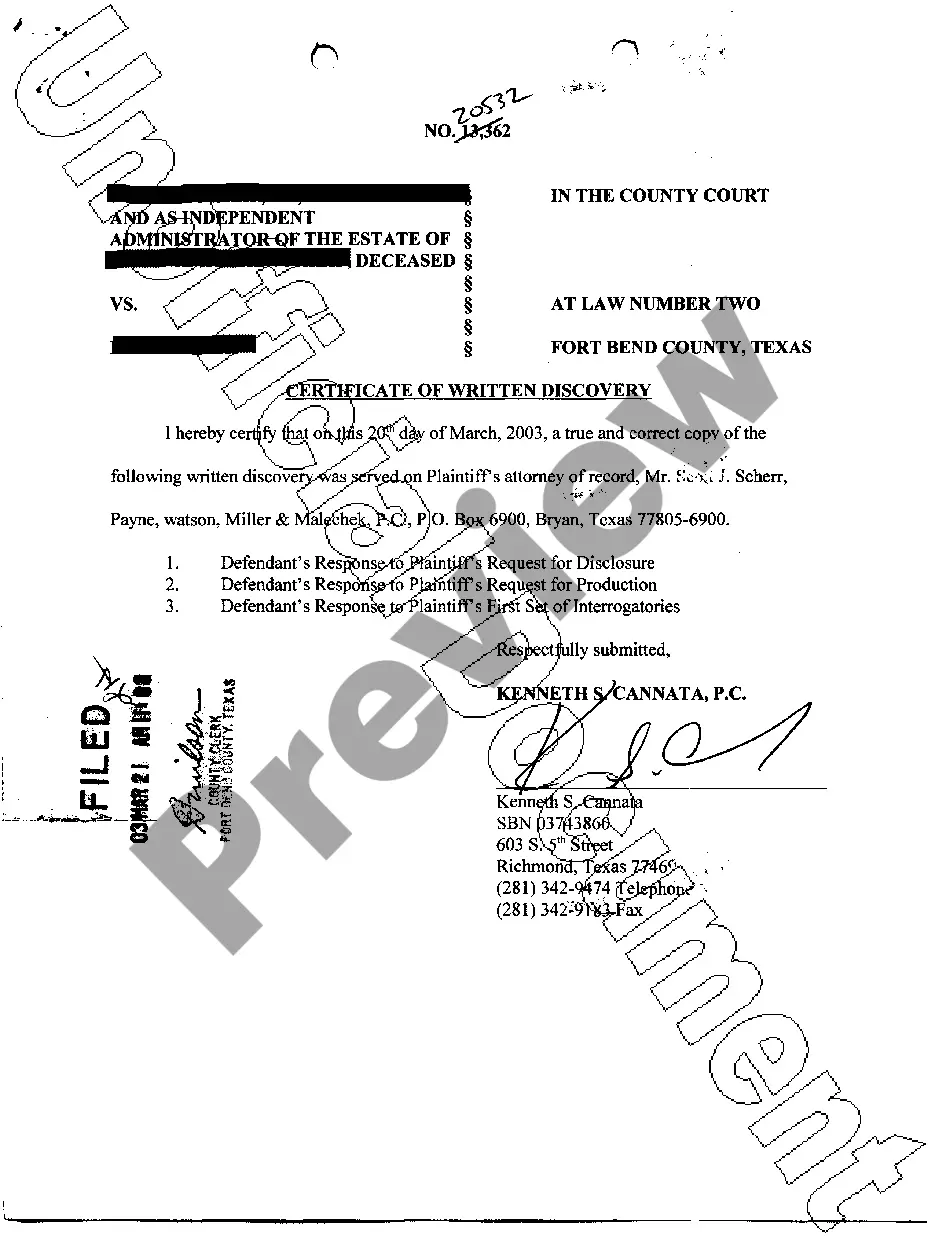

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file once you find the proper one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Los Angeles Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!