Mecklenburg North Carolina Acceptance of Election in a Limited Liability Company LLC is a legal process that allows a limited liability company (LLC) to elect to be treated as an S Corporation for federal tax purposes. This election offers certain tax advantages and can be beneficial for LCS seeking to optimize their tax liabilities. To understand the Mecklenburg North Carolina Acceptance of Election in a Limited Liability Company LLC, it is important to discuss the requirements and steps involved in the process. Firstly, an LLC must be eligible to elect S Corporation status. This means the LLC must have no more than 100 shareholders, all of whom are U.S. citizens or residents, and only one class of stock. Additionally, the owners must complete and submit Form 2553, Election by a Small Business Corporation, to the Internal Revenue Service (IRS) within the specified timeframe. It is crucial to note that the Mecklenburg North Carolina Acceptance of Election in a Limited Liability Company LLC is specific to the state of North Carolina, and the acceptance documents would be filed with the Mecklenburg County's Department of Revenue. The filing process involves submitting the required forms and any applicable fees to the county jurisdiction responsible for overseeing LCS. There are several types of Mecklenburg North Carolina Acceptance of Election in a Limited Liability Company LLC, including: 1. Initial Acceptance of Election: This is the first election filed by an LLC to be treated as an S Corporation in North Carolina. It establishes the LLC's S Corporation status for federal tax purposes. 2. Subsequent Acceptance of Election: If an LLC had previously elected S Corporation status but later terminated it, this type of acceptance allows the LLC to re-elect S Corporation status. 3. Amended Acceptance of Election: In case an LLC needs to make changes to its original election, such as correcting errors or updating information, an amended acceptance of election is filed to ensure the accuracy and validity of the election. It is important for LLC owners to consult a qualified attorney or tax professional to ensure compliance with the detailed requirements of the Mecklenburg North Carolina Acceptance of Election in a Limited Liability Company LLC process. These professionals will assist in completing the required documentation, determine the most advantageous tax position for the LLC, and ensure that all relevant deadlines and filing procedures are followed accurately. By understanding the Mecklenburg North Carolina Acceptance of Election in a Limited Liability Company LLC and its various types, LLC owners can navigate the process effectively and make informed decisions regarding their company's tax status.

Mecklenburg North Carolina Acceptance of Election in a Limited Liability Company LLC

Description

How to fill out Mecklenburg North Carolina Acceptance Of Election In A Limited Liability Company LLC?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Mecklenburg Acceptance of Election in a Limited Liability Company LLC, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Mecklenburg Acceptance of Election in a Limited Liability Company LLC from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Mecklenburg Acceptance of Election in a Limited Liability Company LLC:

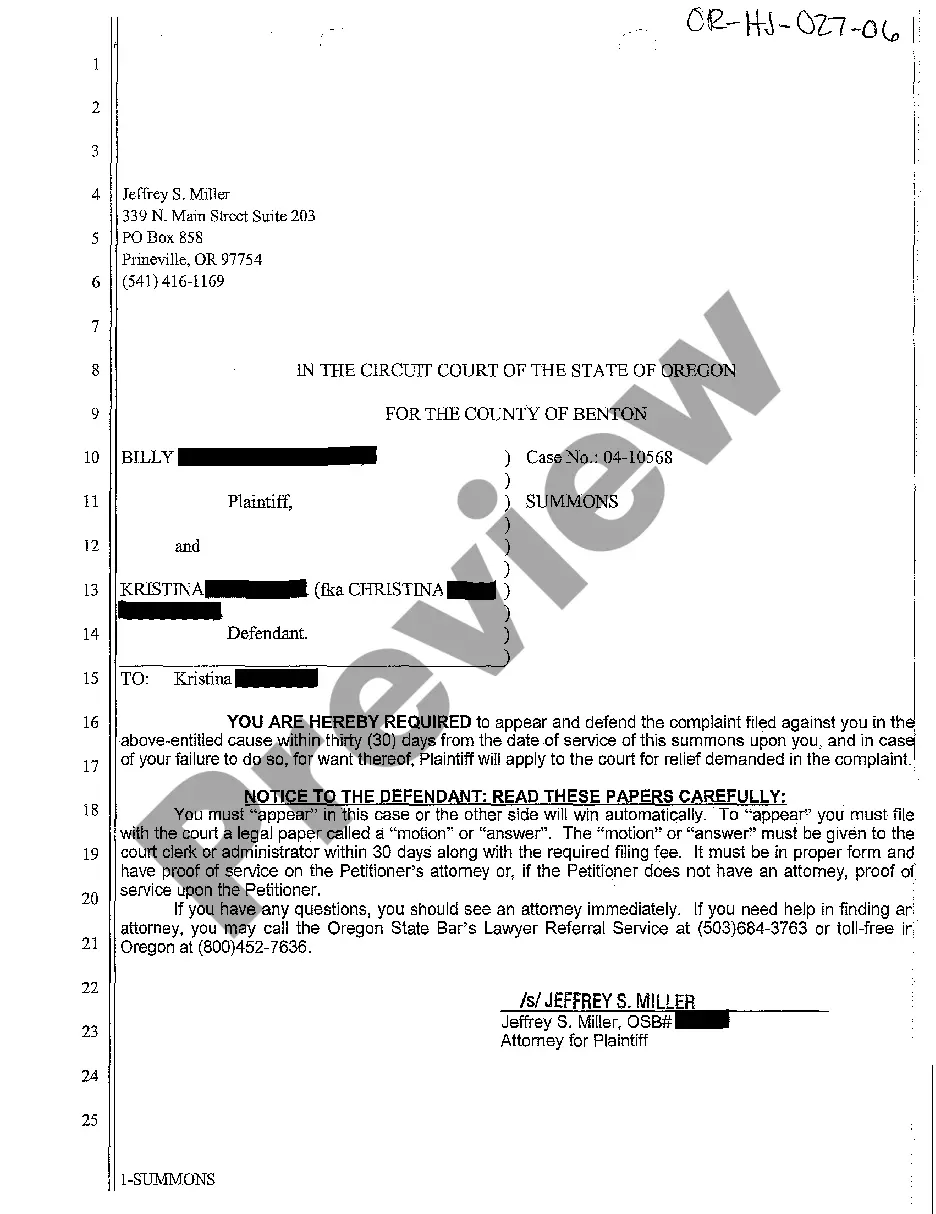

- Take a look at the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!