Riverside, California Acceptance of Election in a Limited Liability Company (LLC) is a crucial process that a business entity must undertake to establish and operate legally in the state of California. An LLC is a popular business structure due to its flexibility, limited liability protection, and pass-through taxation benefits. To create an LLC in Riverside, California, potential business owners need to follow certain steps and file the necessary paperwork with the Secretary of State. The Acceptance of Election is an essential document that outlines the acceptance of the LLC's election to be treated either as a corporation, partnership, or sole proprietorship for tax purposes. This election declaration determines how the LLC will be taxed at the federal level. By submitting this paperwork to the Internal Revenue Service (IRS), the LLC ensures compliance with tax regulations and facilitates its smooth functioning in the business landscape. In Riverside, California, there are various types of Acceptance of Election in a Limited Liability Company LLC, primarily categorized based on the LLC's tax classification. The most common types of Riverside California Acceptance of Election in a Limited Liability Company LLC are as follows: 1. Riverside California Acceptance of Election for a Single-Member LLC: This type of acceptance is relevant for an LLC that has only one owner, also known as a single member. Single-member LCS have a simpler tax filing process compared to multi-member LCS. 2. Riverside California Acceptance of Election for a Multi-Member LLC: Multi-member LCS consist of two or more owners and require a specific acceptance of election declaration tailored to their unique tax situation. This type of acceptance ensures each member's proper tax reporting and liabilities within the LLC. 3. Riverside California Acceptance of Election as a Corporation LLC: Some LCS may wish to be taxed as a corporation to enjoy certain advantages or align with their desired operational structure. By electing to be treated as a corporation, an LLC agrees to comply with the tax regulations applicable to corporations, including filing corporate tax returns. 4. Riverside California Acceptance of Election as a Partnership LLC: For LCS that prefer to be taxed as a partnership, this type of acceptance declaration specifies the LLC's intention to share tax responsibilities among its members. Taxation in a partnership LLC occurs at the individual level, with each member reporting their share of income and losses on their personal tax returns. The Riverside California Acceptance of Election in a Limited Liability Company LLC is a vital component of establishing and maintaining a legally compliant business entity. It is advisable to consult with legal and tax professionals to ensure accurate completion and submission of the required paperwork to the Secretary of State and the IRS.

Riverside California Acceptance of Election in a Limited Liability Company LLC

Description

How to fill out Riverside California Acceptance Of Election In A Limited Liability Company LLC?

Drafting documents for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to create Riverside Acceptance of Election in a Limited Liability Company LLC without professional assistance.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Riverside Acceptance of Election in a Limited Liability Company LLC by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, follow the step-by-step guideline below to get the Riverside Acceptance of Election in a Limited Liability Company LLC:

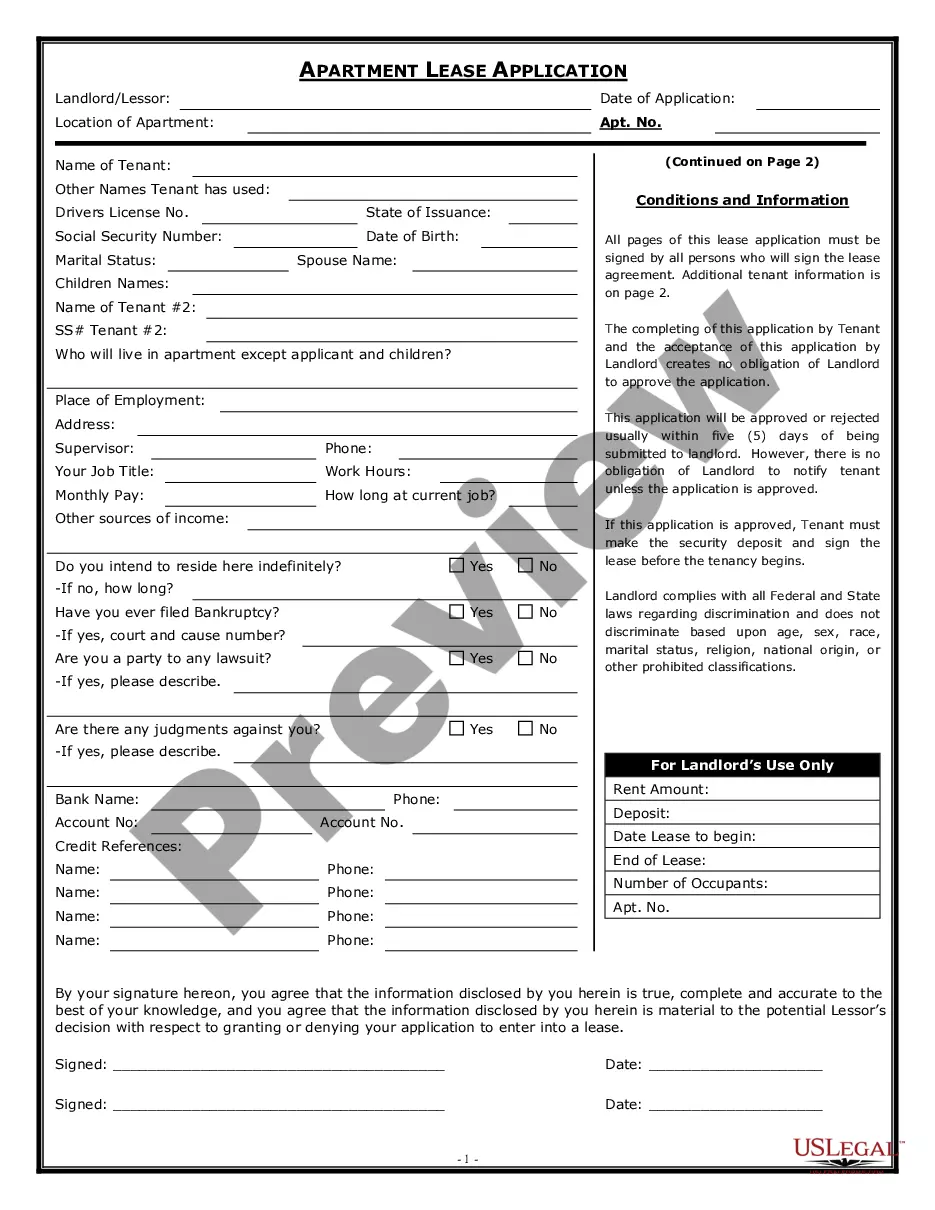

- Examine the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a couple of clicks!