Maricopa, Arizona Resolution of Meeting of LLC Members to Authorize Expense Accounts In Maricopa, Arizona, LLC members convene meetings to discuss and authorize expense accounts, ensuring efficient financial management and investment opportunities within the organization. This resolution plays a crucial role in maintaining transparency and accountability while facilitating smoother day-to-day operations. Typically, there can be different types of Maricopa, Arizona resolutions of meetings of LLC members to authorize expense accounts, depending on the specific requirements and nature of the LLC. Here are a few common ones: 1. Regular Expense Account Authorization Resolution: This resolution authorizes routine expenses incurred by the LLC, such as rent payments, utility bills, office supplies, marketing expenses, and other day-to-day operating costs. It ensures that the LLC members are in agreement regarding the allocation of funds for the smooth functioning of the business. 2. Capital Expense Account Authorization Resolution: LLC members can pass this resolution to authorize significant capital expenses, including equipment purchases, infrastructure development, renovations, or other substantial investments crucial for the growth and development of the company. This resolution often requires to be detailed financial planning and analysis to ensure proper utilization of funds. 3. Travel and Entertainment Expense Account Authorization Resolution: If the LLC engages in frequent business-related travel or incurs entertainment expenses for client meetings, this resolution seeks to authorize such expenses. It defines the framework for reimbursing LLC members for expenses related to travel, accommodations, meals, client entertainment, and other associated costs. 4. Special Project Expense Account Authorization Resolution: When the LLC embarks on a specific project or undertaking with significant financial implications, LLC members may pass this resolution to authorize a separate expense account dedicated to funding that project. This ensures proper budgeting, safeguarding the resources allocated exclusively to the project, and providing a clear understanding of financial commitments among members. 5. Emergency Expense Account Authorization Resolution: Sometimes, unforeseen circumstances or emergencies might arise, requiring immediate financial decisions. This resolution empowers LLC members to authorize an emergency expense account, ensuring the timely availability of funds to address urgent matters, such as repairs, legal fees, unexpected dues, or any other unexpected expenses that may jeopardize the LLC's smooth functioning. In conclusion, Maricopa, Arizona resolutions of meetings of LLC members to authorize expense accounts outline the financial guidelines and decision-making processes necessary for effective budget management, growth, and sustainability of an LLC. These resolutions help establish clarity, accountability, and control over expenditures within the LLC, allowing members to work together towards achieving their common goals.

Maricopa Arizona Resolution of Meeting of LLC Members to Authorize Expense Accounts

Description

How to fill out Maricopa Arizona Resolution Of Meeting Of LLC Members To Authorize Expense Accounts?

Preparing papers for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to generate Maricopa Resolution of Meeting of LLC Members to Authorize Expense Accounts without professional assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Maricopa Resolution of Meeting of LLC Members to Authorize Expense Accounts on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Maricopa Resolution of Meeting of LLC Members to Authorize Expense Accounts:

- Examine the page you've opened and verify if it has the document you require.

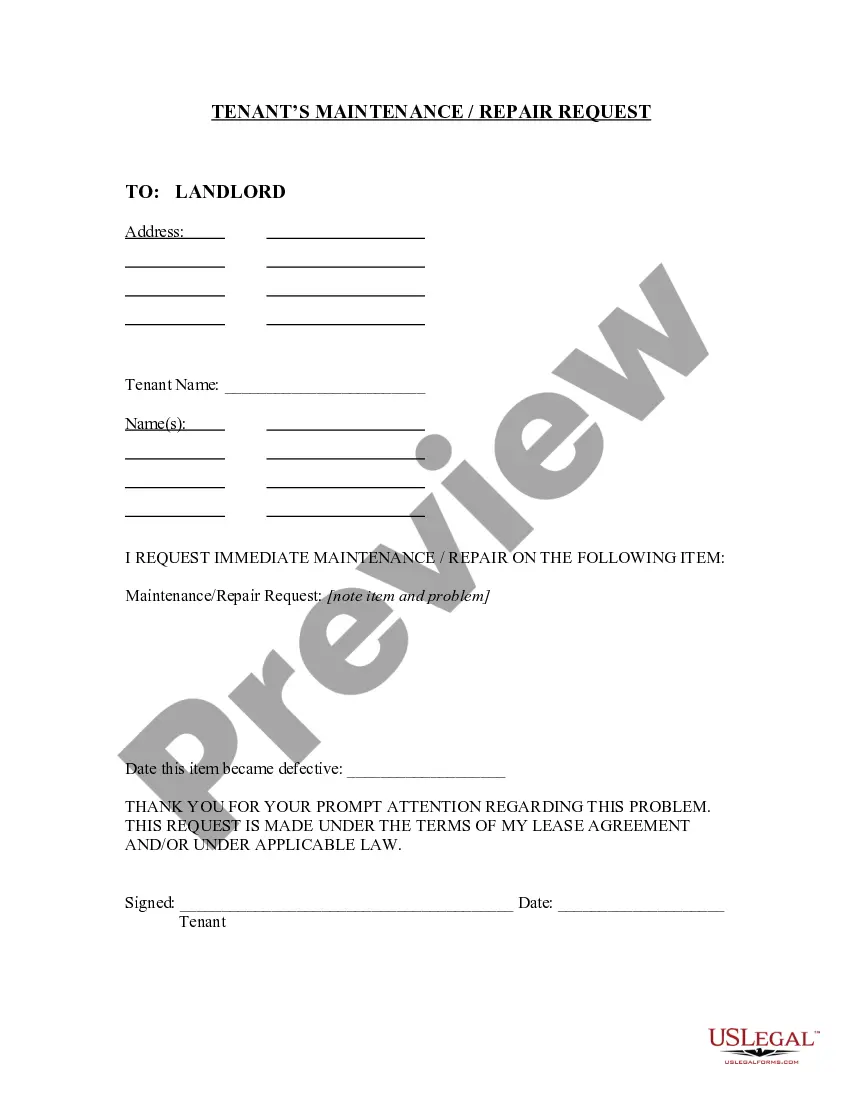

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any scenario with just a couple of clicks!