Allegheny Pennsylvania Resolution of Meeting of LLC Members to Set Attendance Allowance is a formal document that outlines the decision made by members of a limited liability company (LLC) in Allegheny, Pennsylvania, regarding the establishment of an attendance allowance policy. This policy determines the compensation or benefits offered to LLC members based on their attendance and participation in meetings. The purpose of this resolution is to ensure transparency and fairness in recognizing the commitment and involvement of LLC members in the decision-making process. It aims to motivate members to actively contribute their expertise, time, and efforts for the betterment of the LLC, ultimately leading to its growth and success. There can be different types of Allegheny Pennsylvania Resolution of Meeting of LLC Members to Set Attendance Allowance, depending on the specific criteria, parameters, and benefits determined by the LLC members. Some common types of attendance allowance policies include: 1. Flat Attendance Allowance: LLC members receive a fixed compensation or benefit for attending each meeting, regardless of the length, purpose, or significance of the meeting. This type of policy ensures that members are recognized for their attendance, regardless of the meeting's specific circumstances. 2. Meeting Duration-based Allowance: LLC members are compensated based on the duration of their attendance at each meeting. A predetermined hourly or daily rate is established to calculate the allowance, ensuring that members are rewarded appropriately for dedicating their time during lengthy or significant meetings. 3. Meeting Importance-based Allowance: LLC members receive a variable allowance, which varies based on the significance of the meeting. For crucial decisions, strategic planning sessions, or board meetings, members may be entitled to a higher allowance to acknowledge the importance of their presence and contribution. 4. Performance-based Allowance: In addition to attendance, LLC members' performance and productivity are considered in determining their allowance. This type of policy incentivizes active participation, engagement, and a proactive approach towards achieving the LLC's goals and objectives. Before adopting any type of attendance allowance policy, LLC members must conduct a formal meeting and pass a resolution. The resolution should include details such as the method of calculation, frequency of disbursement, eligibility criteria, and any additional conditions or requirements for availing the allowance. It is essential to ensure compliance with Allegheny, Pennsylvania's laws, regulations, and LLC operating agreement provisions when drafting and implementing such resolutions. By establishing an Allegheny Pennsylvania Resolution of Meeting of LLC Members to Set Attendance Allowance, the LLC aims to foster increased commitment, attendance, and participation among its members. This, in turn, strengthens decision-making processes and propels the LLC towards achieving its strategic objectives.

Allegheny Pennsylvania Resolution of Meeting of LLC Members to Set Attendance Allowance

Description

How to fill out Allegheny Pennsylvania Resolution Of Meeting Of LLC Members To Set Attendance Allowance?

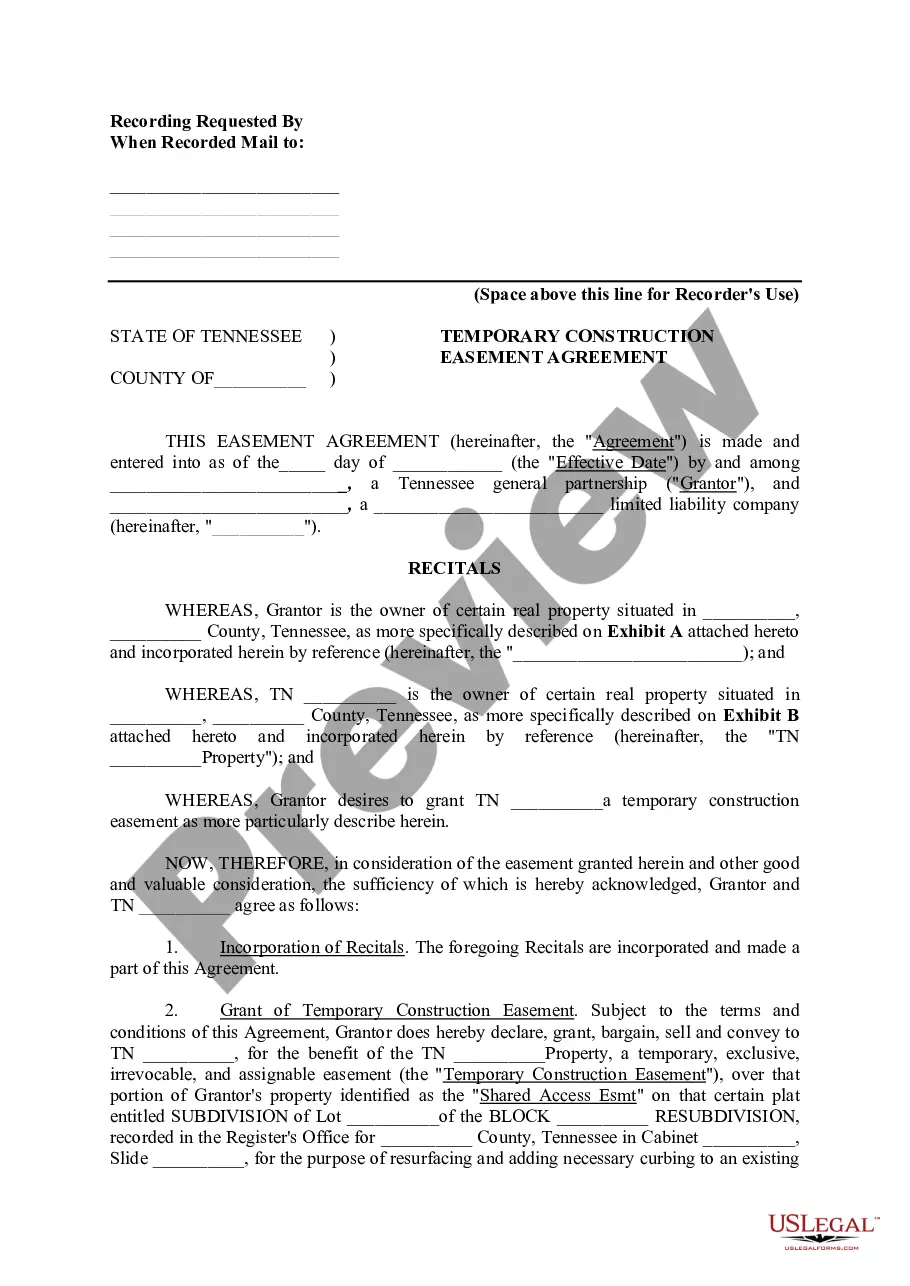

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Allegheny Resolution of Meeting of LLC Members to Set Attendance Allowance meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Apart from the Allegheny Resolution of Meeting of LLC Members to Set Attendance Allowance, here you can get any specific document to run your business or individual affairs, complying with your county requirements. Experts verify all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can pick the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Allegheny Resolution of Meeting of LLC Members to Set Attendance Allowance:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Allegheny Resolution of Meeting of LLC Members to Set Attendance Allowance.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!