Title: Mecklenburg North Carolina Resolution of Meeting of LLC Members to Set Officer Salary — A Comprehensive Guide Introduction: The Mecklenburg North Carolina Resolution of Meeting of LLC Members to Set Officer Salary is an integral part of the decision-making process for Limited Liability Companies (LCS) operating in Mecklenburg County, North Carolina. This crucial meeting allows members of the LLC to collectively determine and establish the compensation packages for their officers. In this detailed description, we will explore the different types of resolutions that can be created during such meetings and provide essential information for making informed decisions. Types of Mecklenburg North Carolina Resolutions for Setting Officer Salary: 1. Annual Salary Adjustment Resolution: This resolution focuses on reviewing the existing compensation structures and proposing adjustments to officer salaries on an annual basis. Members discuss and vote on proposed salary changes, considering factors such as performance, market trends, and the financial health of the LLC. 2. New Hire Officer Compensation Resolution: When appointing and establishing the compensation for new officers within an LLC, this resolution comes into play. Members discuss the proposed salary, taking into account the officer's qualifications, experience, and industry standards, while ensuring the company's financial stability. 3. Performance-based Bonus Resolution: In instances where officer salaries include performance-based bonuses, this resolution outlines the criteria for determining bonus amounts. Members analyze past performance data, goal achievements, and other relevant metrics to guide their decision-making process. 4. Expanded Responsibilities Resolution: If an officer's role or responsibilities expand significantly, an LLC's members use this resolution to review and adjust their compensation. Factors such as increased workload, additional skill requirements, or new leadership responsibilities are taken into consideration. 5. Special Circumstances Resolution: In certain unique situations, such as financial hardship or drastic market changes, this resolution is employed. It allows members to temporarily adjust officer salaries to react to unexpected challenges or opportunities. This resolution is usually subject to review and requires specific criteria to be met. Key Considerations for Mecklenburg North Carolina Resolutions: 1. Statutory Compliance: Members must ensure that all resolutions comply with the relevant laws and regulations set forth by the Mecklenburg County, North Carolina, and the State, including adhering to fiduciary duties and any specific requirements regarding LLC member voting procedures. 2. Equal Treatment: All officers should be treated fairly and equitably during the resolution process, regardless of their roles, seniority, or personal relationships. It is essential to uphold transparency and unbiased decision-making. 3. Documentation: Detailed minutes of the LLC members' meeting must be maintained, accurately documenting the discussions, proposals, and voting outcomes. These records serve as reliable references in case of future disputes or audits. 4. Communication: Clear and effective communication with officers is vital throughout the resolution process. It fosters transparency, helps manage expectations, and ensures that everyone understands the reasoning behind the salary decisions. Conclusion: The Mecklenburg North Carolina Resolution of Meeting of LLC Members to Set Officer Salary plays a significant role in establishing fair and competitive compensation for LLC officers. By implementing these resolutions thoughtfully and adhering to legal requirements and best practices, LLC members can foster a positive and productive working environment while maintaining the financial strength of their organization.

Mecklenburg North Carolina Resolution of Meeting of LLC Members to Set Officer Salary

Description

How to fill out Mecklenburg North Carolina Resolution Of Meeting Of LLC Members To Set Officer Salary?

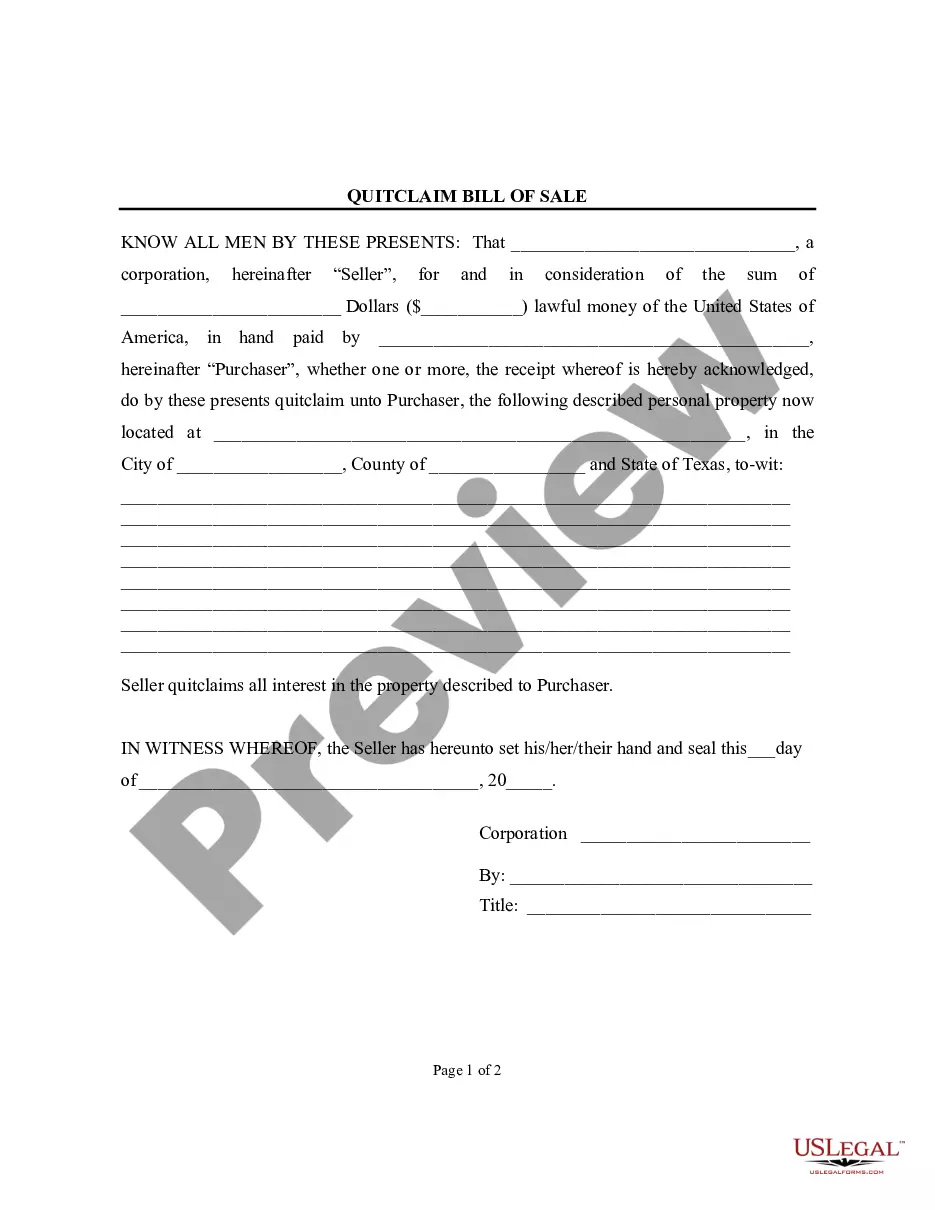

Draftwing paperwork, like Mecklenburg Resolution of Meeting of LLC Members to Set Officer Salary, to take care of your legal matters is a difficult and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task expensive. However, you can get your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents intended for different scenarios and life circumstances. We make sure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Mecklenburg Resolution of Meeting of LLC Members to Set Officer Salary form. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as easy! Here’s what you need to do before downloading Mecklenburg Resolution of Meeting of LLC Members to Set Officer Salary:

- Ensure that your template is specific to your state/county since the regulations for writing legal documents may vary from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Mecklenburg Resolution of Meeting of LLC Members to Set Officer Salary isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start utilizing our service and download the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment details.

- Your form is good to go. You can go ahead and download it.

It’s easy to find and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!