Title: Nassau New York Resolution of Meeting of LLC Members to Borrow Capital from Member — Explained Description: In this article, we will examine the significance and various aspects of the Nassau New York Resolution of Meeting of LLC Members to Borrow Capital from Member. This resolution plays a crucial role when limited liability companies (LCS) in Nassau, New York, require additional capital from their members. We will discuss the process, key considerations, and different types of resolutions that can be used in such situations. Keywords: Nassau New York Resolution, LLC Members, Borrow Capital, Meeting, Member, Limited Liability Companies, Additional Capital 1. Importance of Nassau New York Resolution of Meeting of LLC Members to Borrow Capital from Member: The Nassau New York Resolution serves as a formal mechanism for LCS to obtain capital from their members. This document outlines the terms, conditions, and obligations associated with borrowing capital. It ensures transparency and protects the interests of both the LLC and its members. 2. Process of Drafting the Resolution: The process of drafting a Nassau New York Resolution of Meeting of LLC Members to Borrow Capital from Member involves several steps. The members must convene a meeting and address the capital requirement. During the meeting, they discuss the terms, interest rate, repayment schedule, and any collateral or guarantees involved. A resolution is then documented and approved by the LLC members. 3. Key Considerations for Borrowing Capital: a) Purpose: The resolution should state the purpose for which the capital is required, such as expanding business operations, purchasing assets, or funding specific projects. b) Loan Amount: The resolution must specify the exact amount of capital needed from the member, ensuring it aligns with the LLC's financial requirements. c) Interest Rate: The resolution should outline the agreed-upon interest rate that will apply to the borrowed capital. This rate should be fair and mutually beneficial for both parties. d) Repayment Schedule: The resolution should define the duration and schedule of loan repayments, including any interest payments and penalties for late payment. e) Collateral or Guarantees: If applicable, the resolution should mention any collateral or guarantees provided by the LLC to secure the borrowed capital. 4. Different Types of Nassau New York Resolutions of Meeting of LLC Members to Borrow Capital from Member: a) Temporary Capital Loan Resolution: When an LLC requires short-term capital for a specific purpose, this resolution outlines the terms and conditions of the loan along with the repayment schedule. b) Long-Term Capital Loan Resolution: In cases where an LLC seeks significant capital for investment or expansion purposes over an extended period, this resolution provides comprehensive details about loan terms and repayment structure. c) Capital Line of Credit Resolution: For LCS with recurring capital needs, this resolution establishes a line of credit agreement with a member, enabling them to borrow as needed within the predetermined limits. Conclusion: A Nassau New York Resolution of Meeting of LLC Members to Borrow Capital from Member is a vital document that enables LCS in Nassau, New York, to secure additional capital from their members. Understanding the importance, process, key considerations, and available types of resolutions is crucial for LCS looking to meet their financial requirements efficiently.

Nassau New York Resolution of Meeting of LLC Members to Borrow Capital from Member

Description

How to fill out Nassau New York Resolution Of Meeting Of LLC Members To Borrow Capital From Member?

Drafting paperwork for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create Nassau Resolution of Meeting of LLC Members to Borrow Capital from Member without expert help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Nassau Resolution of Meeting of LLC Members to Borrow Capital from Member on your own, using the US Legal Forms web library. It is the greatest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Nassau Resolution of Meeting of LLC Members to Borrow Capital from Member:

- Look through the page you've opened and check if it has the document you require.

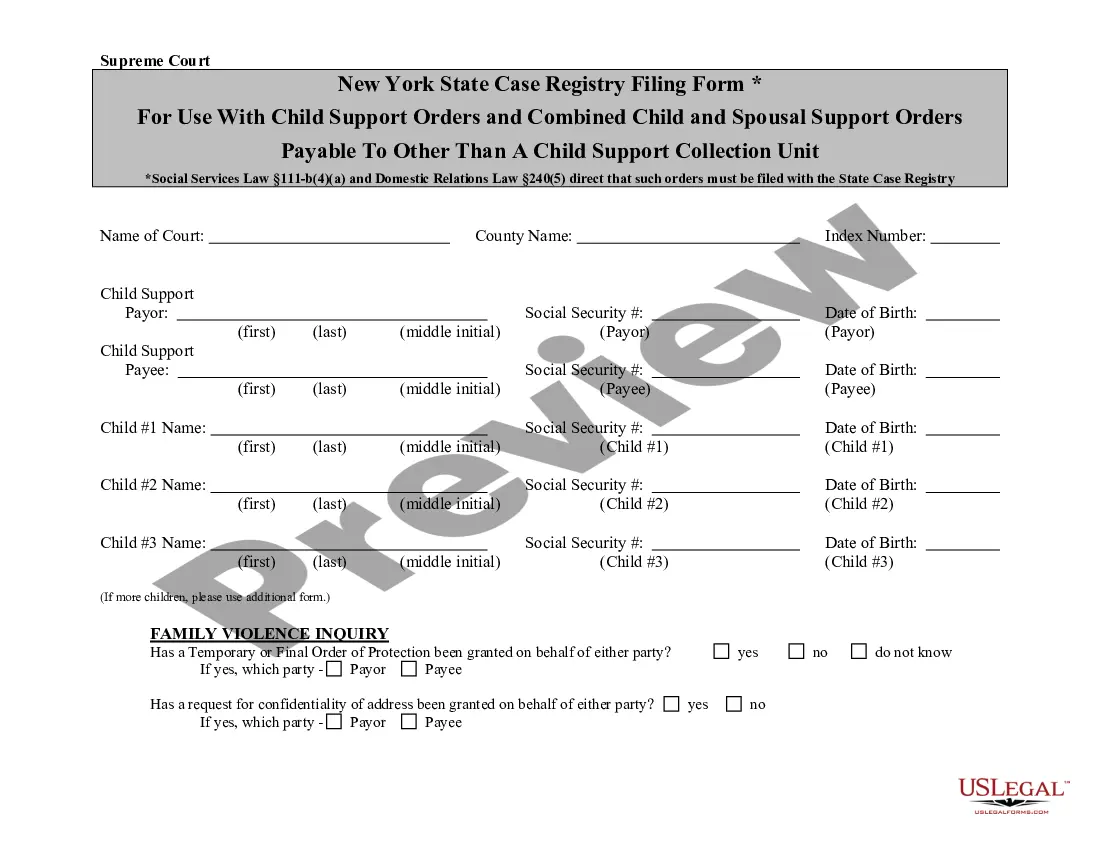

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that fits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any use case with just a couple of clicks!