Cuyahoga County, located in Ohio, encompasses the vibrant city of Cleveland along with other surrounding municipalities. It is home to a diverse population and a hub for various industries, including finance, healthcare, manufacturing, and technology. In the realm of business, limited liability companies (LCS) often need to secure capital for various purposes, ranging from expansion plans to research and development initiatives. When an LLC based in Cuyahoga County aims to borrow funds from a designated bank, it is crucial to follow the proper procedures and legalities to ensure a smooth transaction. One essential step in the borrowing process is drafting a comprehensive resolution of the meeting of LLC members. This document outlines the LLC's decision to borrow capital and provides details regarding the designated bank from which the funds will be obtained. The resolution also states the purpose for which the capital will be borrowed and any specific terms or conditions that may apply. The Cuyahoga Ohio resolution of meeting of LLC members to borrow capital from a designated bank typically includes key elements such as: 1. Introduction: This section states the official name of the LLC, the date and location of the meeting, and the names and titles of LLC members present. 2. Purpose: The resolution clarifies why the LLC is seeking to borrow capital from a designated bank. This could include financing acquisitions, expanding operations, purchasing equipment, or any other valid business reason. 3. Authorization: LLC members authorize certain individuals, usually officers or managers of the company, to negotiate and execute any necessary loan agreement or documentation on behalf of the LLC. 4. Designated Bank: The resolution specifies the name of the designated bank from which the LLC intends to borrow capital. It may include the bank's address, contact details, and any specific loan officer or department responsible for handling the transaction. 5. Loan Amount and Terms: The resolution sets forth the intended loan amount, interest rates, repayment terms, and any other relevant financial details. These terms are typically negotiated between the LLC and the designated bank before the resolution is presented to the LLC members. 6. Signatures: Once the resolution is drafted, it requires the approval and signatures of the LLC members who participated in the meeting. Their signatures validate the decisions made during the meeting and demonstrate their agreement to move forward with the borrowing process. It is important to note that variations of the Cuyahoga Ohio resolution of meeting of LLC members to borrow capital from a designated bank may arise based on the specific needs and circumstances of each company. The resolution can be customized to address unique concerns, additional requirements, or specific loan programs offered by the designated bank. In conclusion, when an LLC based in Cuyahoga County, Ohio, decides to borrow capital from a designated bank, a thorough and well-drafted resolution of the meeting of LLC members becomes crucial. This legal document outlines the LLC's intentions, addresses the purpose and terms of the loan, and ensures compliance with the necessary procedures. By following the proper protocols, LCS in Cuyahoga County can facilitate effective and efficient borrowing transactions to support their business goals.

Cuyahoga Ohio Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

How to fill out Cuyahoga Ohio Resolution Of Meeting Of LLC Members To Borrow Capital From Designated Bank?

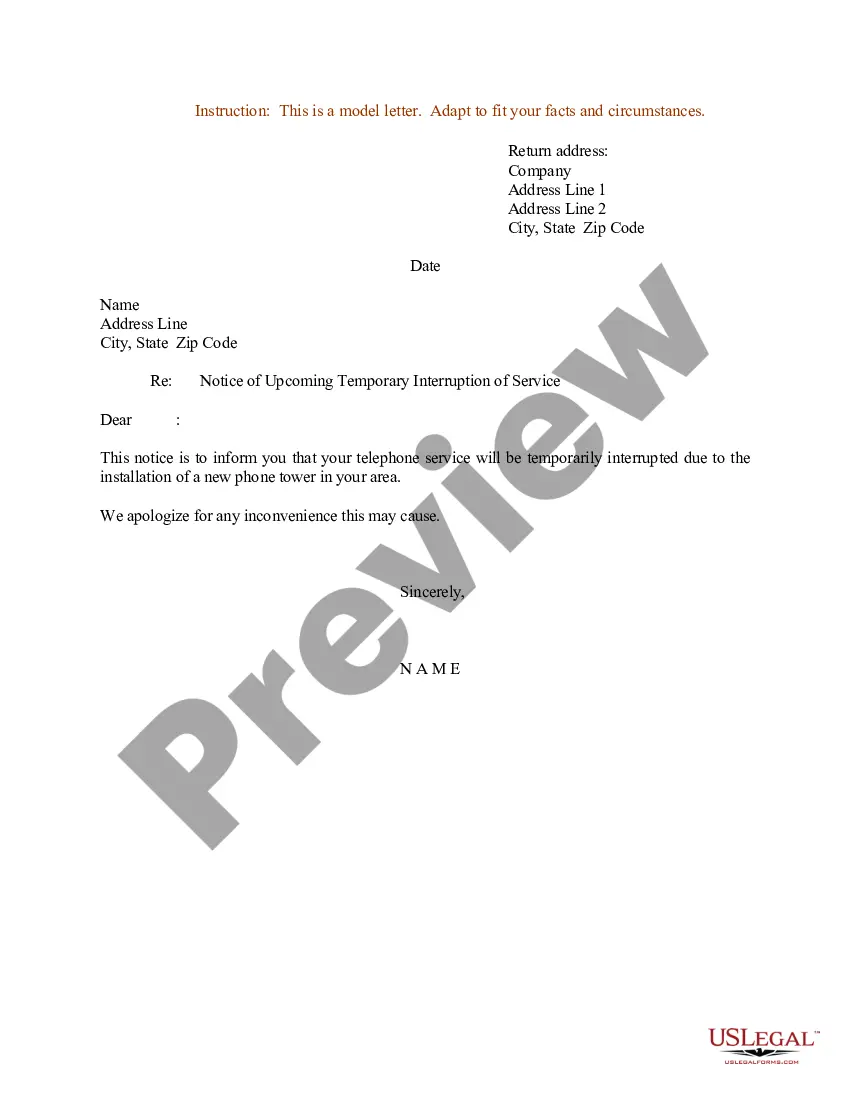

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a legal professional to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Cuyahoga Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario collected all in one place. Therefore, if you need the current version of the Cuyahoga Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Cuyahoga Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Cuyahoga Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank and download it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!