Palm Beach Florida Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

How to fill out Palm Beach Florida Resolution Of Meeting Of LLC Members To Borrow Capital From Designated Bank?

How much time does it typically take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, locating a Palm Beach Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank suiting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. In addition to the Palm Beach Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank, here you can find any specific document to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can retain the document in your profile at any time later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Palm Beach Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank:

- Check the content of the page you’re on.

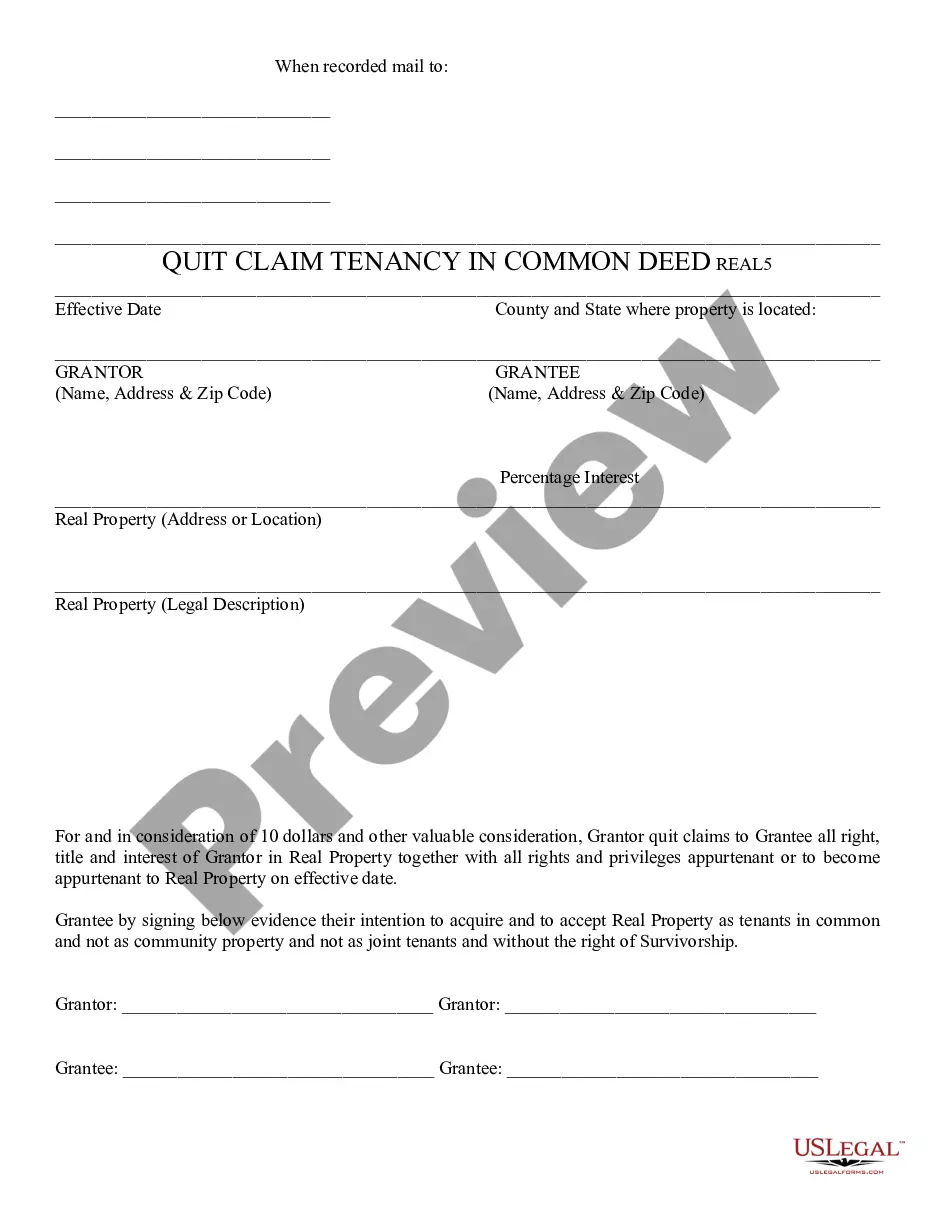

- Read the description of the template or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Palm Beach Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

One of the most important activities of a corporate board is to make resolutions. Resolutions are documents that record board decisions. Corporate resolutions can be made on many matters, including: Records of major transactions of the corporation. Approvals of contracts.

The banking resolution document is drafted and adopted by a company's members or Board of Directors to define the relationship, responsibilities and privileges that the members or directors maintain with respect to the company's banking needs.

Resolution is the restructuring of a bank by a resolution authority through the use of resolution tools in order to safeguard public interests, including the continuity of the bank's critical functions, financial stability and minimal costs to taxpayers.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

An LLC resolution to open a business bank account is a document that clearly shows the bank who has the authority to start an account on behalf of a limited liability company.

Most LLC Resolutions include the following sections: Date, time, and place of the meeting. Owners or members present. The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

An LLC corporate resolution is a record of a decision made through a vote by the board of directors or LLC members. Limited liability companies (LLCs) enjoy specific tax and legal benefits modeled after a corporate structure, although they are not corporations.

A banking resolution is the simplest way to authorize someone to open a bank account and provide signature for the business. This document is created by the owners for a limited liability company (LLC) or the board of directors for a corporation.

What Entities Need a Banking Resolution? While banking resolutions are required for corporations (both for-profit and nonprofit), these resolutions are not a legal requirement for LLCs. However, there may be specific language in the Operating Agreement that makes an official resolution necessary.