Title: Wayne Michigan Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank Keywords: Wayne Michigan, resolution of meeting, LLC members, borrow capital, designated bank Introduction: In Wayne, Michigan, a resolution of the meeting of LLC members to borrow capital from a designated bank is a crucial decision-making process. This resolution allows LLC members to secure financial resources required for business growth, expansion, or addressing immediate financial needs. The LLC members hold a meeting to discuss and formalize this resolution, ensuring unanimous agreement to proceed with borrowing capital from a designated bank. Below, we explore the details of this resolution and its importance for Wayne, Michigan-based LCS. Types of Wayne Michigan Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank: 1. Resolution for Business Expansion Capital: LLC members gather to discuss and pass a resolution regarding borrowing capital from a designated bank to fund the expansion plans of the LLC. This type of resolution includes a comprehensive business plan that justifies the need for additional capital to finance new projects, hire more employees, purchase equipment, or enter new markets. 2. Resolution for Working Capital: When an LLC requires additional funds to meet day-to-day expenses, pay salaries, purchase inventory, or fulfill short-term financial obligations, an LLC meeting is conducted to pass a resolution for borrowing working capital from a designated bank. This resolution focuses on stabilizing the company's finances and ensuring smooth operations. 3. Resolution for Investment Opportunities: LLC members convene a meeting to deliberate on investing in lucrative opportunities by borrowing capital from a designated bank. This resolution aims to capitalize on potential ventures, including real estate, startups, or acquisitions, which can yield significant returns on investment. Careful assessment and planning form the basis for this type of resolution. Importance and Procedure of the Resolution: During the LLC meeting, members conduct thorough discussions and present relevant financial reports, projections, and business plans that justify the need to borrow capital. These discussions lead to the passing of a resolution by unanimous consent or voting, outlining the LLC's decision to borrow capital from a designated bank. The resolution defines the borrowing amount, the specific financial institution from which the funding will be obtained, and the associated terms and conditions. It also designates authorized LLC representatives responsible for negotiating loan terms and executing the borrowing agreement. The resolution may also contain provisions such as interest rates, repayment schedules, collateral requirements, and any additional terms negotiated with the designated bank. This legal document ensures transparency and accountability within the LLC, protecting the members' interests and solidifying the commitment to repay the borrowed capital. Conclusion: Wayne, Michigan, resolves to borrow capital from designated banks through LLC member meetings to facilitate growth, secure working capital, or explore investment opportunities. These resolutions play a fundamental role in supporting the financial stability and development of LCS in Wayne, Michigan. Proper documentation and unanimous agreement within the LLC are paramount to guarantee responsible borrowing and the successful execution of the resolution's terms.

Wayne Michigan Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

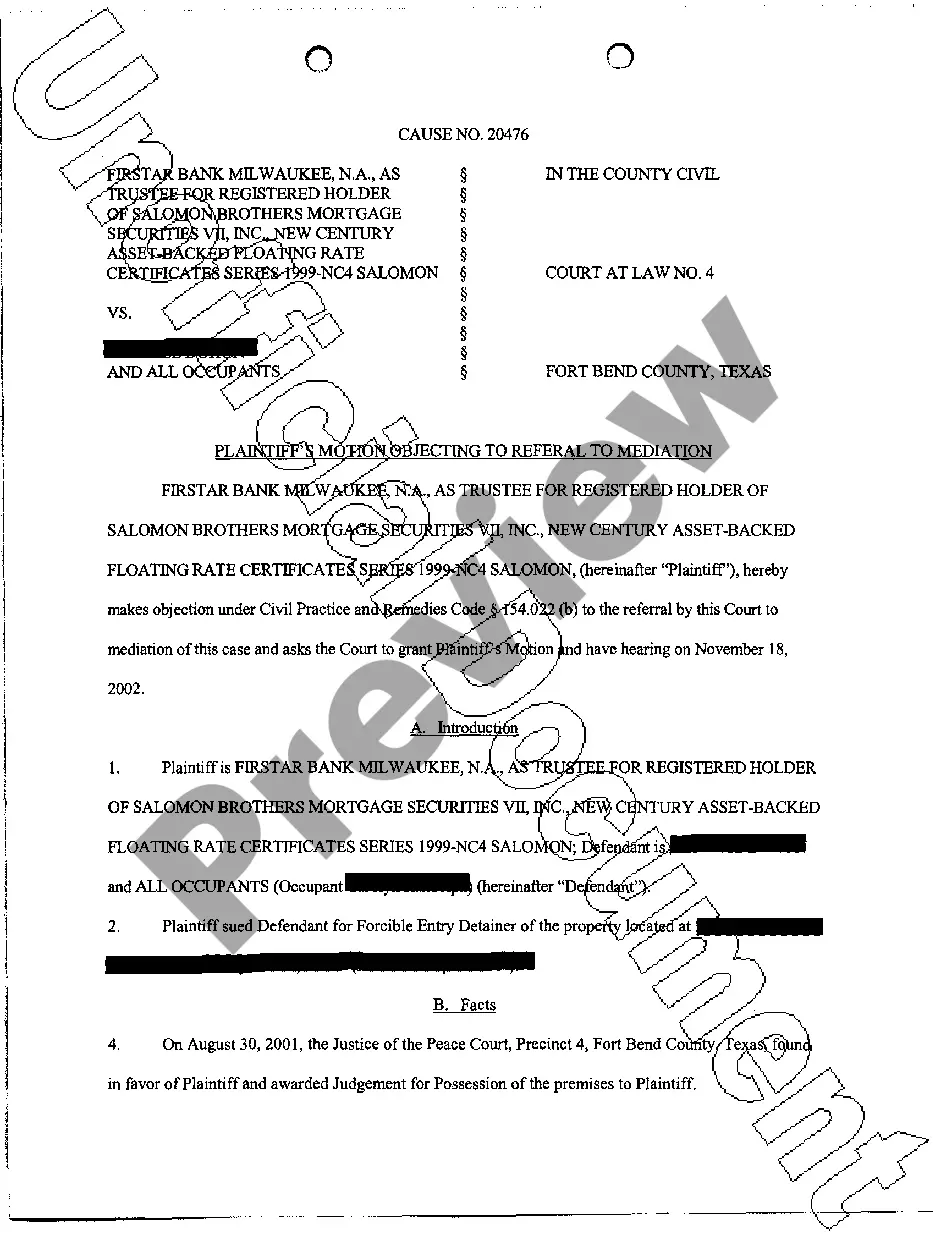

Description

How to fill out Wayne Michigan Resolution Of Meeting Of LLC Members To Borrow Capital From Designated Bank?

Whether you plan to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Wayne Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to get the Wayne Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank. Follow the instructions below:

- Make certain the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the proper one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Wayne Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!