Dallas Texas Resolution of Meeting of LLC Members to Purchase Real Estate

Description

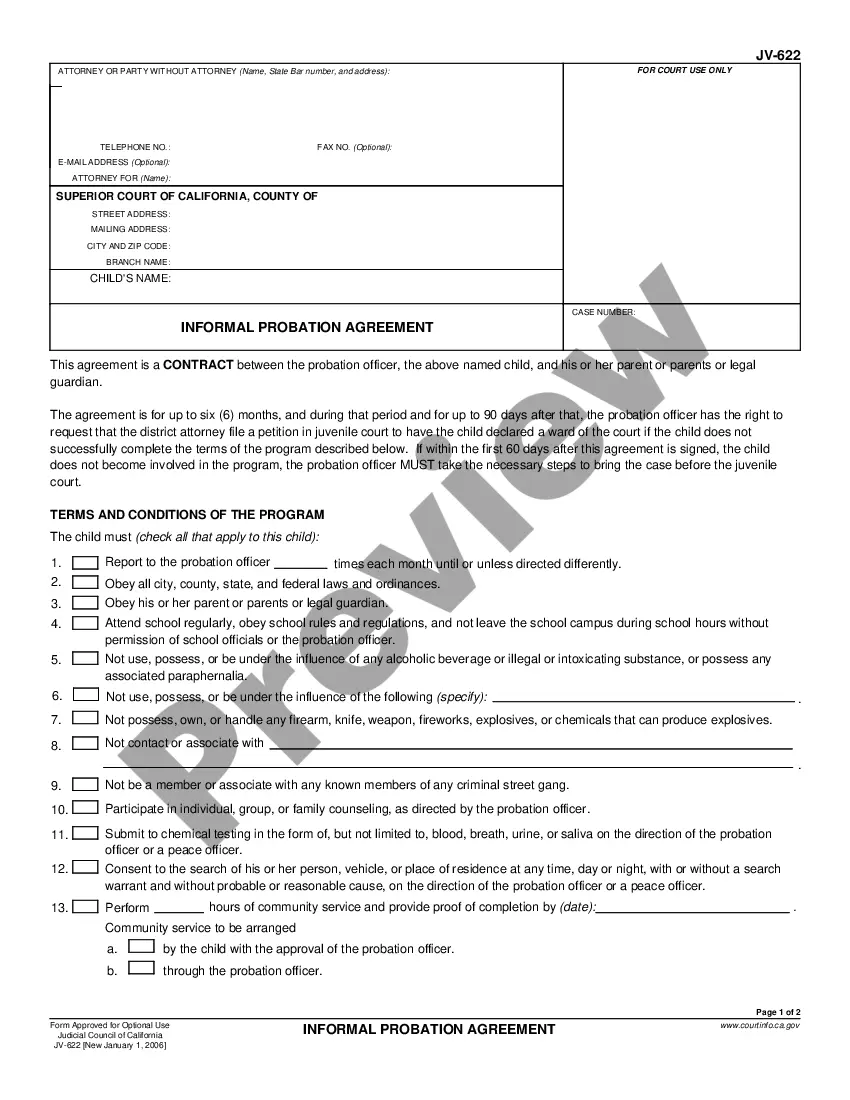

How to fill out Resolution Of Meeting Of LLC Members To Purchase Real Estate?

How long does it usually take you to draft a legal document.

Since each state has its own laws and regulations for various life situations, locating a Dallas Resolution of Meeting of LLC Members to Purchase Real Estate that meets all local requirements can be tiresome, and hiring a professional attorney is frequently costly.

Many online platforms provide the most popular state-specific documents for download, but utilizing the US Legal Forms library is the most beneficial.

Select the subscription plan that fits you best. Create an account on the platform or Log In to move on to payment methods. Complete the payment via PayPal or with your credit card. Change the file format if necessary. Hit Download to save the Dallas Resolution of Meeting of LLC Members to Purchase Real Estate. Print the document or utilize any preferred online editor to complete it electronically. Regardless of how often you need to utilize the obtained template, you can find all the files you've ever stored in your account by selecting the My documents tab. Give it a shot!

- US Legal Forms represents the most extensive online assortment of templates, categorized by states and areas of application.

- In addition to the Dallas Resolution of Meeting of LLC Members to Purchase Real Estate, you can discover any particular document to manage your business or personal affairs, adhering to your local stipulations.

- Professionals verify all templates for their accuracy, ensuring you can prepare your documents properly.

- Employing the service is quite simple.

- If you already possess an account on the platform and your subscription is active, you merely need to Log In, select the required template, and download it.

- You can store the file in your account at any time in the future.

- Conversely, if you are new to the platform, you will need to follow some additional steps before obtaining your Dallas Resolution of Meeting of LLC Members to Purchase Real Estate.

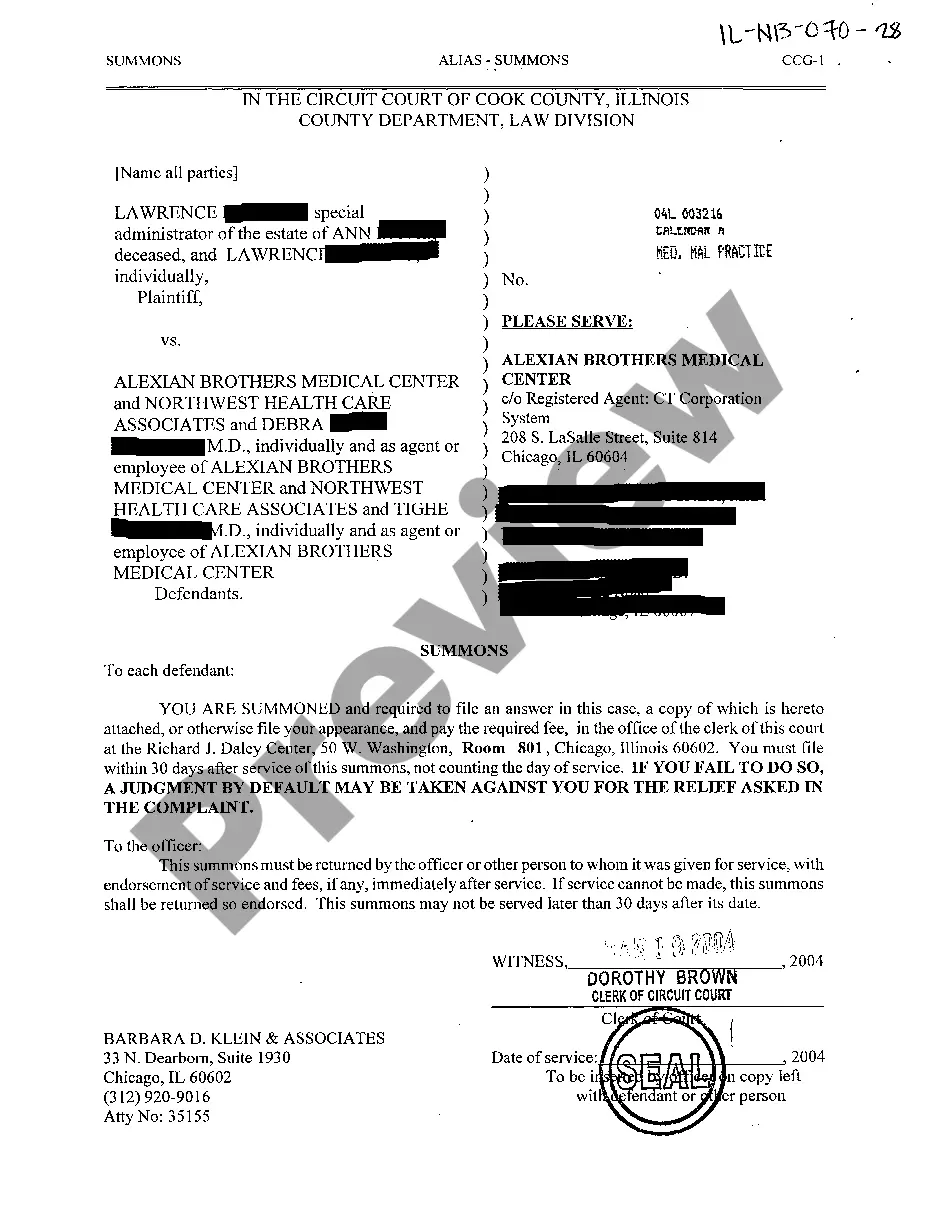

- Review the content of the page you're currently on.

- Examine the description of the template or Preview it (if accessible).

- Look for another document using the corresponding option in the header.

- Press Buy Now once you’re confident in the selected file.

Form popularity

FAQ

Most LLC Resolutions include the following sections: Date, time, and place of the meeting. Owners or members present. The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.

A corporate resolution outlines the decisions and actions made by a company's board of directors. A corporation might use a corporate resolution to establish itself as an independent legal entity, which is separate from the owners.

How To Write a Corporate Resolution Step by Step Step 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

An LLC resolution is a document describing an action taken by the managers or owners of a company, with a statement regarding the issue that needs to be voted on. This does not need to be a complicated document, and need only include necessary information.

A resolution in business refers to a proposal made during a meeting of the company's shareholders or directors. It is discussed, and its approval represents an official confirmation of an action of any kind that will be taken by the company.

Unlike LLCs, corporations are required to make resolutions. Therefore, they are used to preparing them when shareholders or the board of directors make decisions. Although an LLC is not required to make resolutions, there are many reasons for getting in the habit of maintaining resolutions.

An LLC corporate resolution is a record of a decision made through a vote by the board of directors or LLC members. Limited liability companies (LLCs) enjoy specific tax and legal benefits modeled after a corporate structure, although they are not corporations.

While banking resolutions are required for corporations (both for-profit and nonprofit), these resolutions are not a legal requirement for LLCs. However, there may be specific language in the Operating Agreement that makes an official resolution necessary.