The King Washington Notification of Review of Consumer Report is an official document that serves as a notification to individuals regarding the review of their consumer report. This document aims to provide detailed information about the process and purpose of reviewing a consumer report, ensuring transparency and compliance with regulatory standards. Reviewing a consumer report is an essential step in assessing an individual's creditworthiness, financial history, and overall reliability. It allows businesses, financial institutions, or potential employers to make informed decisions when offering services, granting loans, or hiring individuals. The King Washington Notification of Review of Consumer Report ensures that individuals are aware of this review process, their rights, and any potential implications it may have on their record. When it comes to different types of Notifications of Review of Consumer Report under the jurisdiction of King Washington, there may be variations depending on the specific industry or purpose. Some common examples include: 1. Employment-related Notifications: These notifications are directed towards individuals who are being considered for employment, either by a potential employer or their current employer conducting a periodic review. It informs individuals that their consumer report will be examined as part of the hiring or continuation process, with the aim of assessing their suitability for a specific role. 2. Credit-related Notifications: These notifications pertain to individuals seeking to obtain credit, such as applying for a loan, mortgage, or credit card. They inform the applicants that their consumer report will be reviewed by the lender or financial institution to evaluate their creditworthiness, repayment history, and overall financial stability. 3. Tenant-related Notifications: These notifications are relevant for individuals looking to rent a property. Landlords or property management companies may review consumer reports to assess prospective tenants' rental history, payment capabilities, and past evictions, ensuring a reliable and responsible tenant. 4. Insurance-related Notifications: In some cases, insurers may review consumer reports to determine insurance premiums or eligibility for coverage. Notifications in this context would inform individuals that their consumer report may be taken into consideration during the insurance underwriting process. It is important to note that the specific contents and requirements of the King Washington Notification of Review of Consumer Report may differ based on the industry, regulations, and applicable laws. These notifications aim to safeguard individuals' interests, promote fairness, and maintain confidentiality during the review process, while also highlighting the importance of accurate and up-to-date consumer information.

King Washington Notification of Review of Consumer Report

Description

How to fill out King Washington Notification Of Review Of Consumer Report?

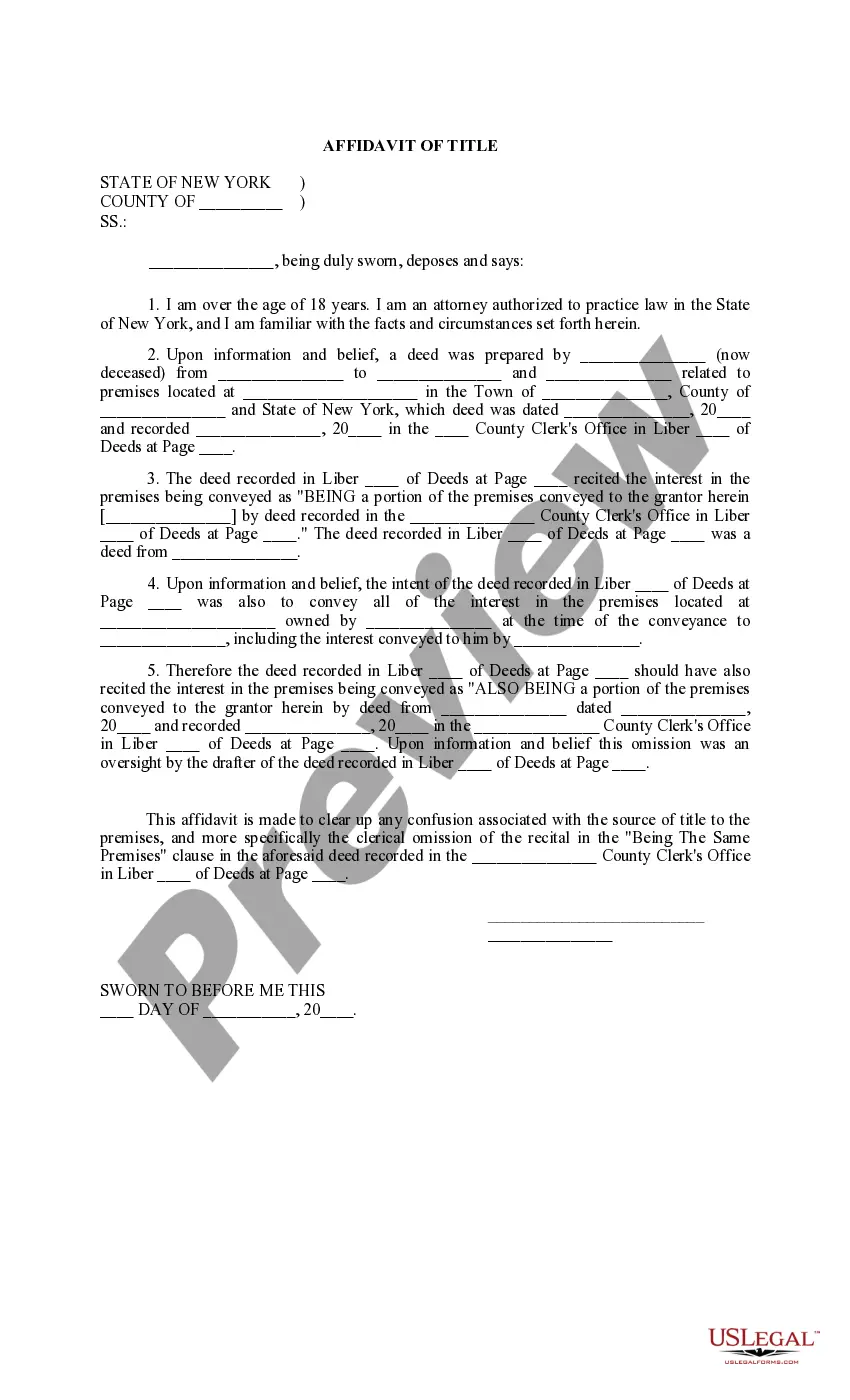

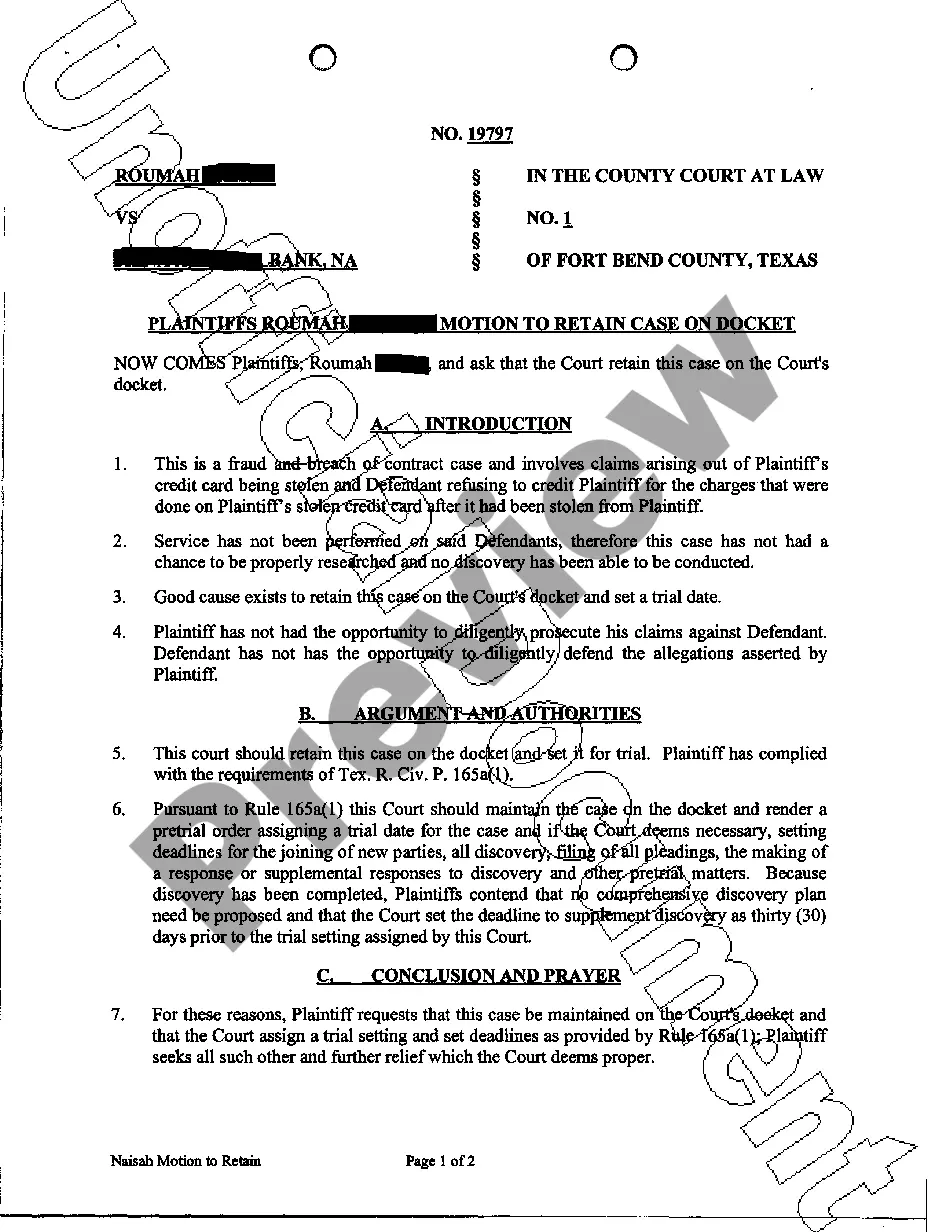

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the King Notification of Review of Consumer Report, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Consequently, if you need the recent version of the King Notification of Review of Consumer Report, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the King Notification of Review of Consumer Report:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your King Notification of Review of Consumer Report and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Real Reviews, By Real Experts Trusted Consumer Review is developed for consumers by consumers, with the purpose of bringing a clear and trustworthy orientation of the market. So that we can secure our health, finance and expectations.

Consumer Reports says its secret shoppers purchase all tested products at retail prices on behalf of the organization, that they do so anonymously, and that CR accepts no free samples in order to limit bias from bribery and to prevent being given better than average samples.

Consumer Reports Magazine April 2021 - Annual Auto Issue Single Issue Magazine January 1, 2021.

Consumer Reports is a nonprofit organization that offers unbiased, people- and data-driven insights on all the newest products on the market. The quality of its information is simply unmatched, and for under $60 per year, it is well worth it.

Overview. Consumer Reports has a consumer rating of 1.87 stars from 23 reviews indicating that most customers are generally dissatisfied with their purchases. Consumer Reports ranks 145th among Product Reviews sites.

Join Consumer Reports with a Print membership to get the latest ratings and reviews plus rigorous reporting on issues that impact consumers. You'll receive 13 issues of Consumer Reports magazine per year, including the annual Auto Issue and Buying Guide.

Consumer Reports is one of the most trusted sources for information and advice on consumer products and services, with more than 7 million paying members.

The online travel site TripAdvisor and restaurant review site Zagat topped their list of "Most Trusted Sites". OpenTable, which rates and reviews restaurants, the automotive website Edmunds.com, and Yelp , which also reviews restaurants and other local businesses, rounded out the top five.

Consumer Reports is a publication and independent, nonprofit member organization that has evaluated more than 9,000 consumer products and services since 1936. The publication is printed monthly and its buying guides, tests, evaluations, and comparisons are all based on the magazine's own in-house testing.

Consumer Reports is one of the most trusted sources for information and advice on consumer products and services, with more than 7 million paying members. Become a Member or call 1-800-333-0663.