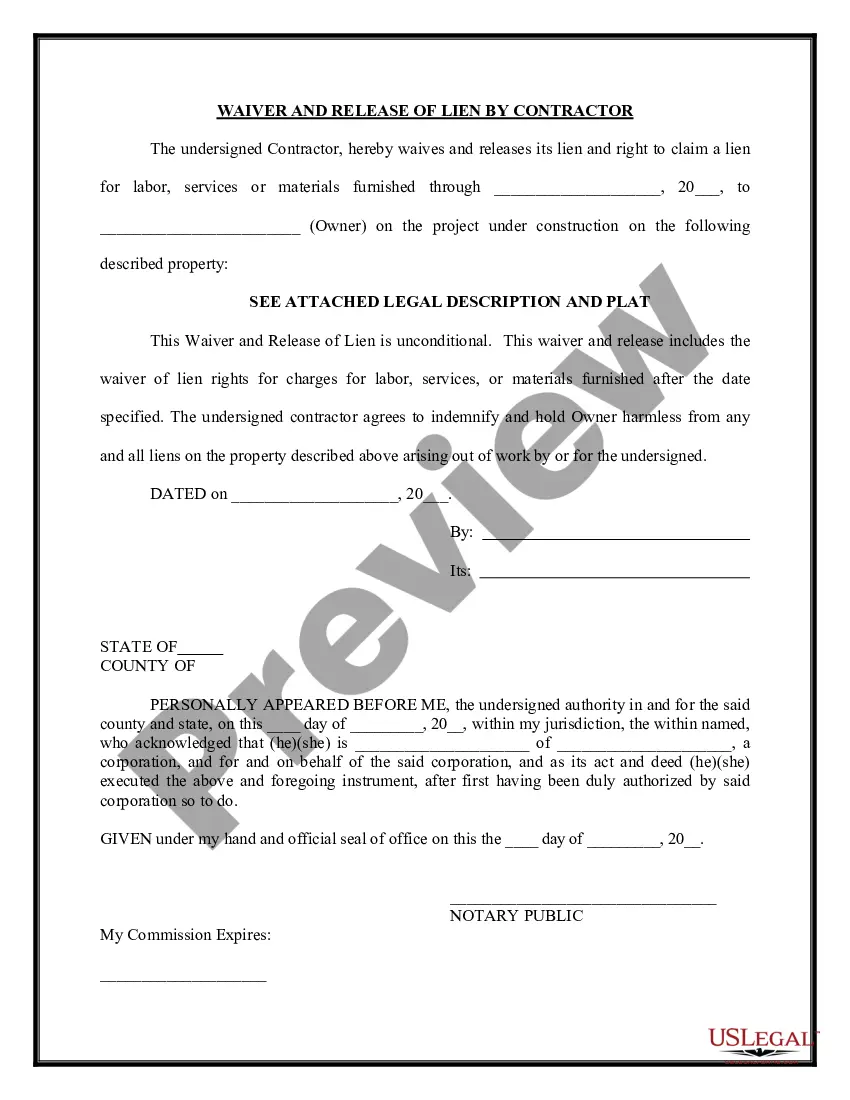

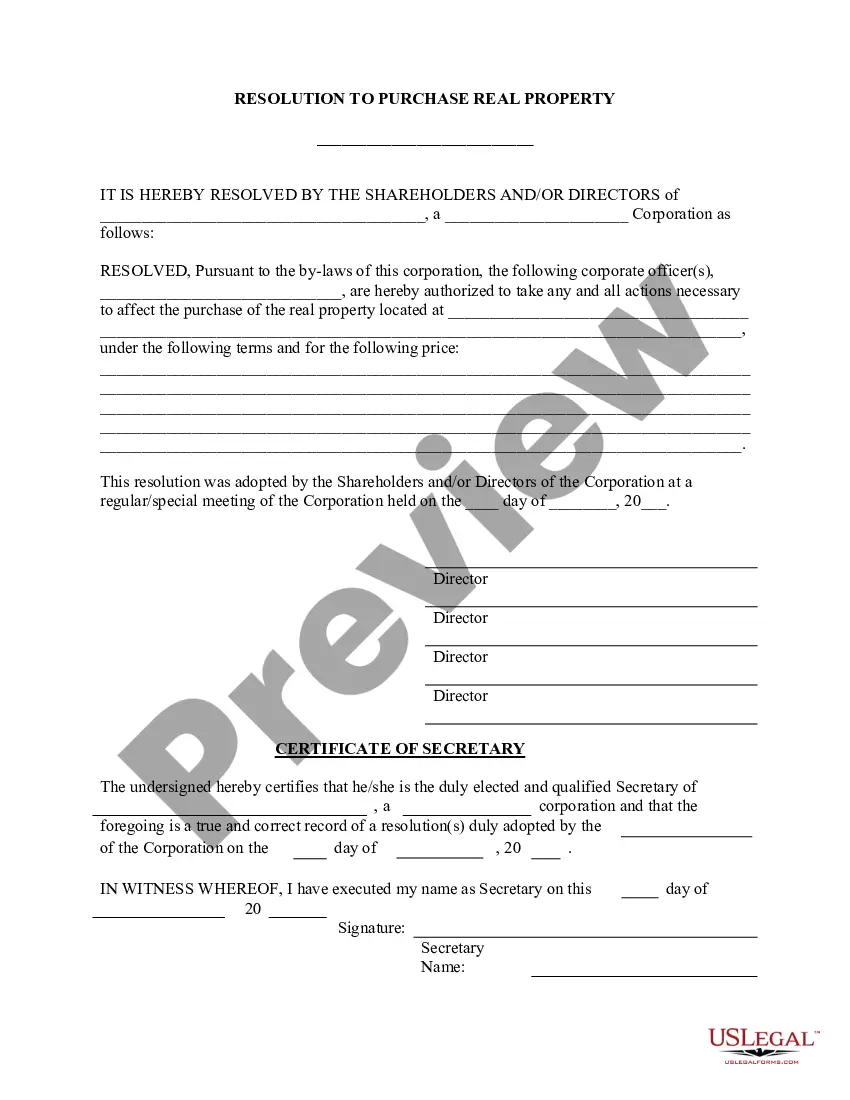

Title: Chicago Illinois FCRA Certification Letter to Consumer Reporting Agency: An In-depth Overview Introduction: In the bustling city of Chicago, Illinois, the Fair Credit Reporting Act (FCRA) Certification Letter to Consumer Reporting Agency plays a crucial role in regulating the consumer credit reporting process. This comprehensive guide will provide an in-depth look into what this certification letter entails, its purpose, and shed light on different types of FCRA Certification Letters prevalent in Chicago, Illinois. 1. What is the FCRA Certification Letter? The FCRA Certification Letter serves as a written communication addressed to a Consumer Reporting Agency (CRA) in accordance with the guidelines prescribed by the FCRA. It provides an individual's explicit consent to release their consumer credit information to the requesting party. 2. Purpose of the FCRA Certification Letter: The primary objective of the FCRA Certification Letter is to ensure that a consumer's private credit information is handled responsibly by the Crash. It seeks to guarantee that the release of sensitive credit data is only granted by the consumer's informed consent, thus safeguarding their privacy rights. Types of Chicago Illinois FCRA Certification Letters to Consumer Reporting Agency: a) Employment Background Check FCRA Certification Letter: An employer may request this type of FCRA certification letter when conducting background checks on prospective employees. By acquiring explicit consent, the employer gains authorization to access the consumer's credit history and employment-related information as part of the hiring process. b) Tenant Screening FCRA Certification Letter: Landlords and property managers often utilize this certification letter to obtain a consumer's credit information as part of the tenant screening process. It allows them access to credit reports, eviction records, and other relevant data to evaluate rental suitability. c) Loan Application FCRA Certification Letter: Lenders, whether for personal loans, mortgages, or other financing options, may require consumers to sign this certification letter. It authorizes the lender to access the consumer's credit reports to evaluate creditworthiness, helping determine loan eligibility and interest rates. d) Consumer Credit Monitoring FCRA Certification Letter: Consumers who subscribe to credit monitoring services often provide this certification letter to authorize the monitoring agency to access their credit reports regularly. This ensures timely alerts and notifications about any updates or potential fraudulent activities. Conclusion: Chicago Illinois FCRA Certification Letters to Consumer Reporting Agencies are instrumental in protecting consumers' rights. Whether for employment purposes, tenant screenings, loan applications, or credit monitoring, these letters enable individuals to grant explicit permission for accessing their credit data. By ensuring compliance with the FCRA guidelines, Chicago residents can trust that their confidential information is handled responsibly, contributing to a more secure and reliable credit reporting system.

Chicago Illinois FCRA Certification Letter to Consumer Reporting Agency

Description

How to fill out Chicago Illinois FCRA Certification Letter To Consumer Reporting Agency?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Chicago FCRA Certification Letter to Consumer Reporting Agency, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Chicago FCRA Certification Letter to Consumer Reporting Agency from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Chicago FCRA Certification Letter to Consumer Reporting Agency:

- Examine the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!