Maricopa, Arizona FCRA Certification Letter to Consumer Reporting Agency — Detailed Description The Maricopa, Arizona FCRA Certification Letter to Consumer Reporting Agency is an essential document that ensures compliance with the Fair Credit Reporting Act (FCRA) regulations. When an individual in Maricopa, Arizona wishes to dispute inaccurate or outdated information on their credit report, they can use this letter to notify the consumer reporting agency (CRA) appropriately. The FCRA Certification Letter is a formal means for consumers to exercise their rights and protect their credit reputation. It allows individuals to address discrepancies, such as incorrect personal information, unauthorized transactions, or outdated accounts that possibly affect their creditworthiness. Key elements typically included in the Maricopa, Arizona FCRA Certification Letter are: 1. Consumer Information: The letter begins by providing the consumer's full name, complete address, and social security number to ensure accuracy in finding their credit file. 2. Explanation of the Dispute: The letter includes a clear and concise description of the inaccurate information being disputed. It is essential to provide specific details, such as account numbers or dates, to help the CRA investigate the disputed items effectively. 3. Supporting Documents: If available, the consumer may attach copies of relevant documents that support their dispute, such as payment receipts, bank statements, or any other proof of errors. 4. Request for Investigation: The letter states the consumer's request for a thorough investigation into the disputed items listed. The CRA is responsible for verifying the accuracy of the reported information with the credit furnished or source within 30 days of receiving the letter. 5. Dispute Resolution Deadline: The Maricopa, Arizona FCRA Certification Letter should include a request for the CRA to remove or correct the inaccurate information or provide a detailed explanation within a specific timeframe, usually 30 days, as mandated by FCRA guidelines. Different Types of Maricopa, Arizona FCRA Certification Letter to Consumer Reporting Agency: 1. Initial Dispute Letter: This type of FCRA Certification Letter is used when a consumer initially discovers inaccurate information on their credit report and wishes to initiate the dispute process. 2. Follow-Up Dispute Letter: If the consumer does not receive a satisfactory response from the CRA within the given timeframe, they can send a follow-up letter demanding further investigation and resolution of the dispute. 3. Debt Validation Letter: This variation of the FCRA Certification Letter is specifically used when a consumer wants to dispute the validity of a debt that appears on their credit report. It requests the credit reporting agency to provide evidence of the debt's existence and validity. 4. Identity Theft Dispute Letter: In cases of identity theft, where fraudulent accounts or unauthorized transactions are listed on an individual's credit report, this specific FCRA Certification Letter form is used to alert the CRA and request immediate corrective actions. Remember, it is crucial for individuals in Maricopa, Arizona to keep copies of all correspondence and supporting documents related to their FCRA Certification Letter for future reference and potential legal actions, if necessary.

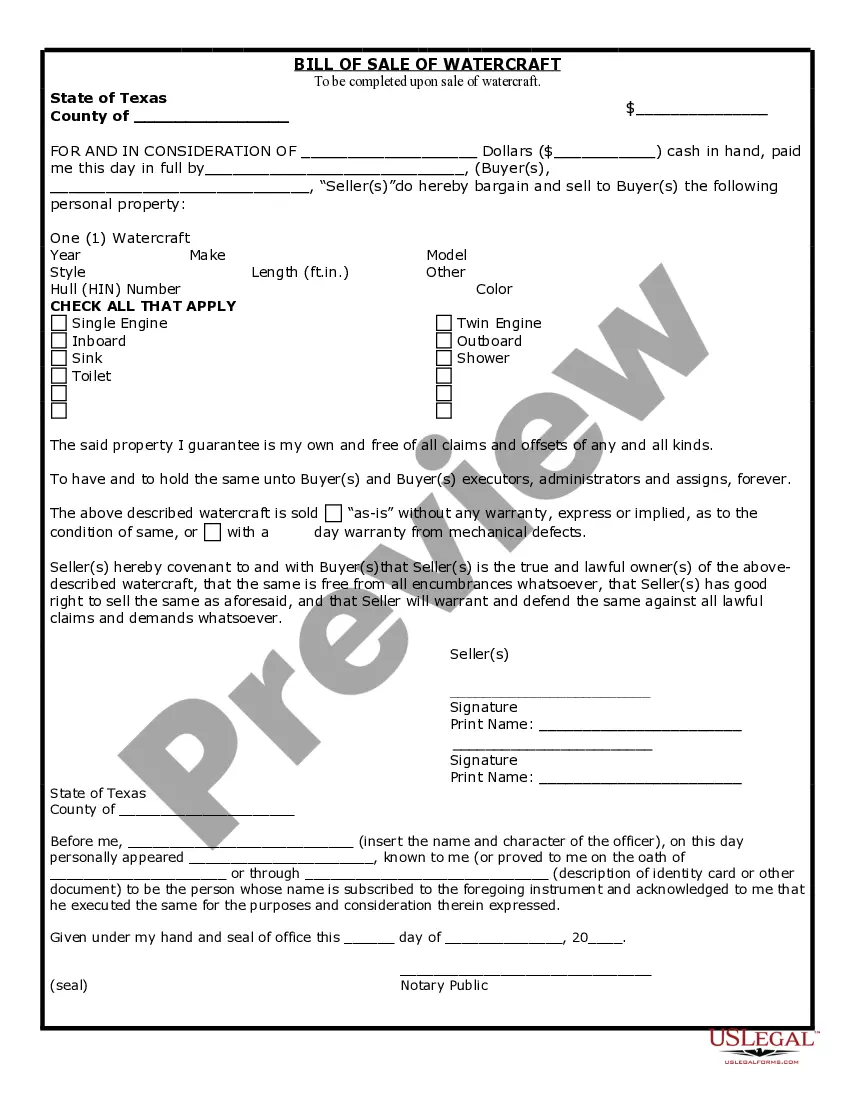

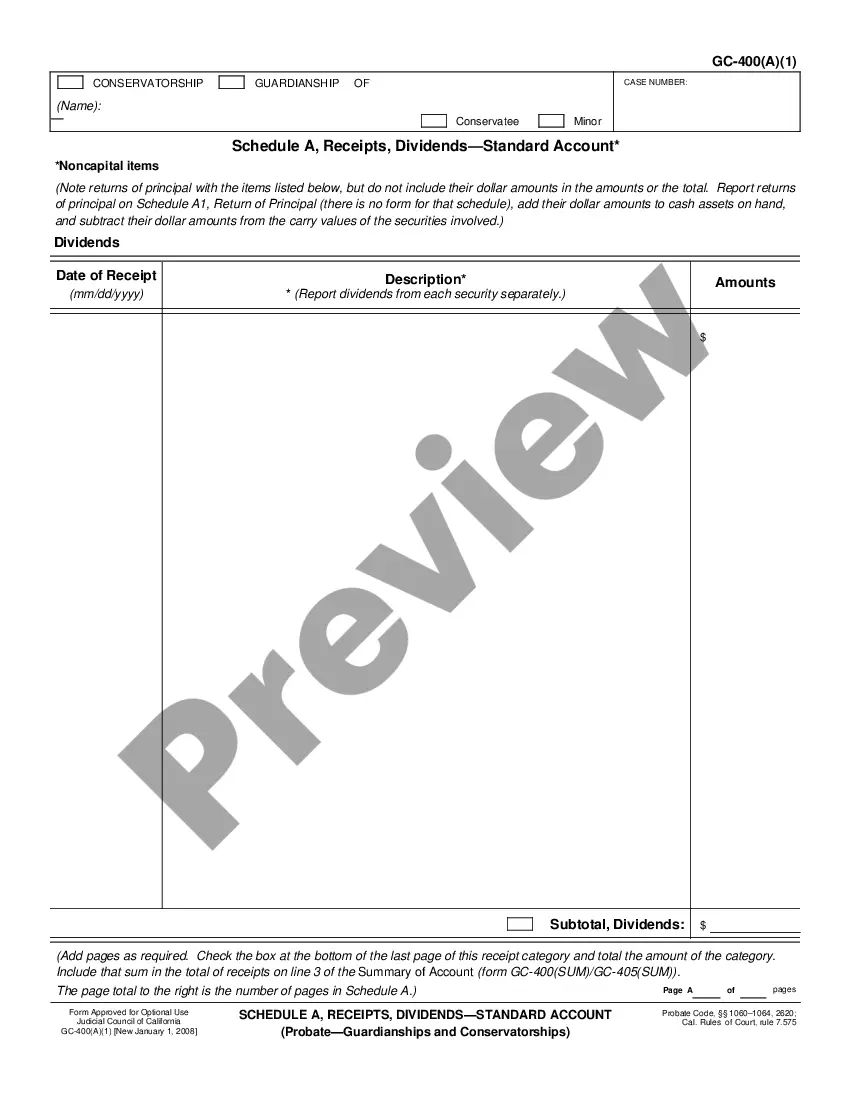

Maricopa Arizona FCRA Certification Letter to Consumer Reporting Agency

Description

How to fill out Maricopa Arizona FCRA Certification Letter To Consumer Reporting Agency?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask an attorney to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Maricopa FCRA Certification Letter to Consumer Reporting Agency, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Consequently, if you need the latest version of the Maricopa FCRA Certification Letter to Consumer Reporting Agency, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Maricopa FCRA Certification Letter to Consumer Reporting Agency:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Maricopa FCRA Certification Letter to Consumer Reporting Agency and download it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

The FCRA regulates the collection, distribution and use of consumer information, which includes Consumer Reports, also known as employment background checks. Background checks can contain information from a variety of sources, including credit reports, employment verifications and criminal record searches.

FAIR CREDIT REPORTING ACT/REGULATION V. Section 623 of the FCRA and Regulation V generally provide that a furnisher must not furnish inaccurate consumer information to a CRA, and that furnishers must investigate a consumer's dispute that the furnished information is inaccurate or incomplete.

Four Basic Steps to FCRA Compliance Step 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must:Step 2: Certification To The Consumer Reporting Agency.Step 3: Provide Applicant With Pre-Adverse Action Documents.Step 4: Notify Applicant Of Adverse Action.

Pre-Adverse Action The pre-adverse action letter can be delivered via electronic or hard copy form. Its purpose is to inform the applicant that you will not hire them for the position based on information uncovered in the background check.

Today, FCRA compliance is mandatory for any employer using a third party to conduct background checks. As an employer, when you are choosing a background check provider you need to ensure that your provider is a certified FCRA-compliant Credit Reporting Agency (CRA).

The FCRA requires any prospective user of a consumer report, for example, a lender, insurer, landlord, or employer, among others, to have a legally permissible purpose to obtain a report. Legally Permissible Purposes.

Updated April 29, 2022. An adverse action notice is sent to an individual when rejected based on information in a credit report or background check (consumer report). It is required when a person is denied employment, housing, credit, or insurance. Federal Laws Fair Credit Reporting Act (FCRA)

Upon making a determination that a dispute is frivolous or irrelevant, the furnisher must notify the consumer of the determination not later than five business days after making the determination, by mail or, if authorized by the consumer for that purpose, by any other means available to the furnisher.

You must provide the notice either before you furnish the negative information or within 30 days of furnishing it. You may include the notice with a notice of default, a billing statement, or another item sent to the consumer, but you cannot send it with a Truth In Lending Act notification.

What is FCRA Compliance? FCRA compliance is designed to protect consumers. The FCRA regulates employers that use background reports and the Consumer Reporting Agencies (CRAs) (aka background screening companies) that provide the information.