The Hennepin Minnesota Authorization of Consumer Report is a legal document that allows organizations and employers to request and review an individual's personal information from consumer report agencies. This authorization form ensures compliance with the Fair Credit Reporting Act (FCRA) regulations and safeguards the privacy rights of individuals. Keywords: Hennepin Minnesota, Authorization of Consumer Report, legal document, organizations, employers, personal information, consumer report agencies, Fair Credit Reporting Act (FCRA), compliance, privacy rights. There are a few types of Hennepin Minnesota Authorization of Consumer Reports that may be relevant to individuals or organizations: 1. Employment Background Checks: This type of consumer report is commonly used by employers to screen potential employees. It helps employers verify an applicant's background, education, employment history, criminal record, and credit information. The Hennepin Minnesota Authorization of Consumer Report allows employers to request and review this information to ensure a safe and qualified workforce. 2. Tenant Screening: Landlords and property owners may use consumer reports to evaluate potential tenants for rental properties. The Hennepin Minnesota Authorization of Consumer Report enables landlords to verify an applicant's creditworthiness, criminal background, eviction history, and rental references, helping them make informed decisions about potential tenants. 3. Financial Loan Applications: Financial institutions, such as banks or credit unions, may require consumer reports when individuals apply for loans or credit cards. This type of Hennepin Minnesota Authorization of Consumer Report allows lenders to assess an applicant's creditworthiness, payment history, outstanding debts, and any previous delinquencies before granting credit. 4. Insurance Underwriting: Insurance companies often require consumer reports to determine an individual's risk level when offering coverage. The Hennepin Minnesota Authorization of Consumer Report enables insurers to examine an applicant's driving record, claims history, credit information, and any previous insurance coverage to assess the potential risks associated with providing insurance coverage. It is important to note that any organization or individual requesting a consumer report must obtain the individual's written authorization, demonstrating their consent to access their personal information. The Hennepin Minnesota Authorization of Consumer Report plays a crucial role in ensuring that such requests comply with legal regulations and protect individuals' privacy rights.

Hennepin Minnesota Authorization of Consumer Report

Description

How to fill out Hennepin Minnesota Authorization Of Consumer Report?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official paperwork that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any personal or business objective utilized in your region, including the Hennepin Authorization of Consumer Report.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Hennepin Authorization of Consumer Report will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to obtain the Hennepin Authorization of Consumer Report:

- Ensure you have opened the right page with your localised form.

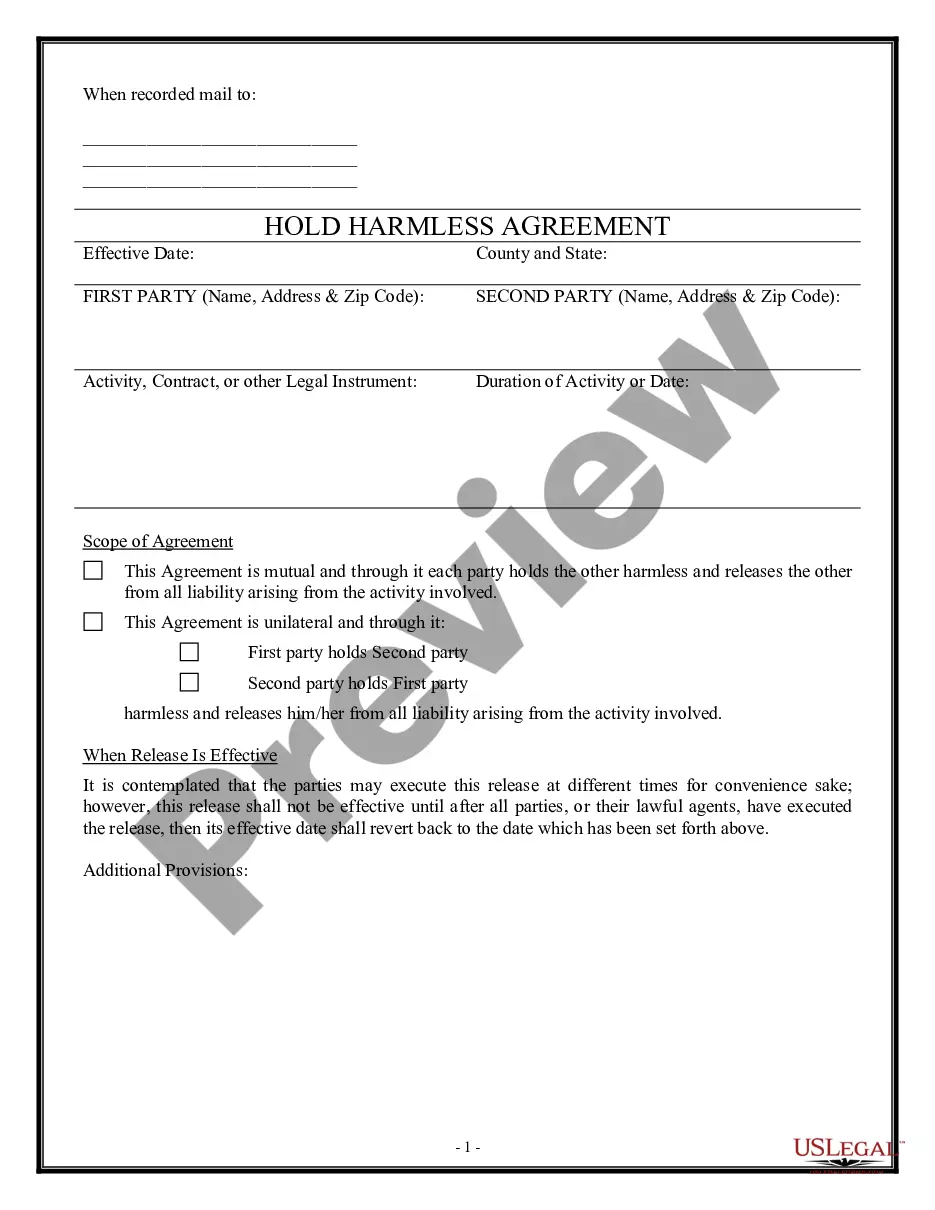

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your needs.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Hennepin Authorization of Consumer Report on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!