San Diego California Authorization of Consumer Report: A Comprehensive Guide In San Diego, California, the Authorization of Consumer Report refers to the process by which individuals grant permission to have their consumer reports accessed, reviewed, and used by businesses and organizations. This report is essential for employers, landlords, financial institutions, and other entities seeking to assess an individual's creditworthiness, rental history, employment background, or overall reliability. The San Diego California Authorization of Consumer Report ensures that businesses and organizations comply with the Fair Credit Reporting Act (FCRA) and all other applicable laws protecting consumer privacy rights. It requires these entities to obtain written consent from individuals before accessing their consumer reports and to inform them of their rights related to the information disclosed. There are various types of San Diego California Authorization of Consumer Report, each serving different purposes: 1. Employment Background Check Authorization: Many employers require job applicants to authorize a consumer report review. This enables employers to verify an applicant's employment history, education credentials, professional licensure, and criminal record, ensuring the hiring decision is well-informed and aligned with their business needs. 2. Tenant Screening Authorization: Landlords or property management companies typically request this type of consumer report authorization when considering rental applications. By conducting a tenant screening, they can assess an applicant's creditworthiness, rental history, previous evictions, and criminal background to ensure the property is entrusted to reliable tenants. 3. Credit Report Authorization: Financial institutions, such as banks or credit card companies, require consumers' authorization before accessing their credit reports. This authorization allows them to evaluate an individual's creditworthiness, payment history, outstanding debts, and credit utilization, enabling sound lending decisions and appropriate credit limits. 4. Insurance Coverage Authorization: Insurance companies often seek consumer report authorization to evaluate an individual's risk profile when providing coverage. This report helps insurers assess potential policyholders' claims history, driving records, credit information, and other factors impacting the risk associated with insuring them. These are just a few examples of the San Diego California Authorization of Consumer Report variations. It is important to note that while businesses and organizations rely on these reports to make informed decisions, they are ultimately obligated to protect individuals' information, ensure its accuracy, and use it solely for lawful purposes. In conclusion, the San Diego California Authorization of Consumer Report is a crucial process that safeguards individual privacy rights while enabling various entities to make informed decisions regarding employment, rental agreements, credit approvals, or insurance coverage. By obtaining written consent and following applicable laws and regulations, businesses and organizations can obtain the necessary information they need while respecting individuals' rights to privacy and fair treatment.

San Diego California Authorization of Consumer Report

Description

How to fill out San Diego California Authorization Of Consumer Report?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the San Diego Authorization of Consumer Report, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the San Diego Authorization of Consumer Report from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the San Diego Authorization of Consumer Report:

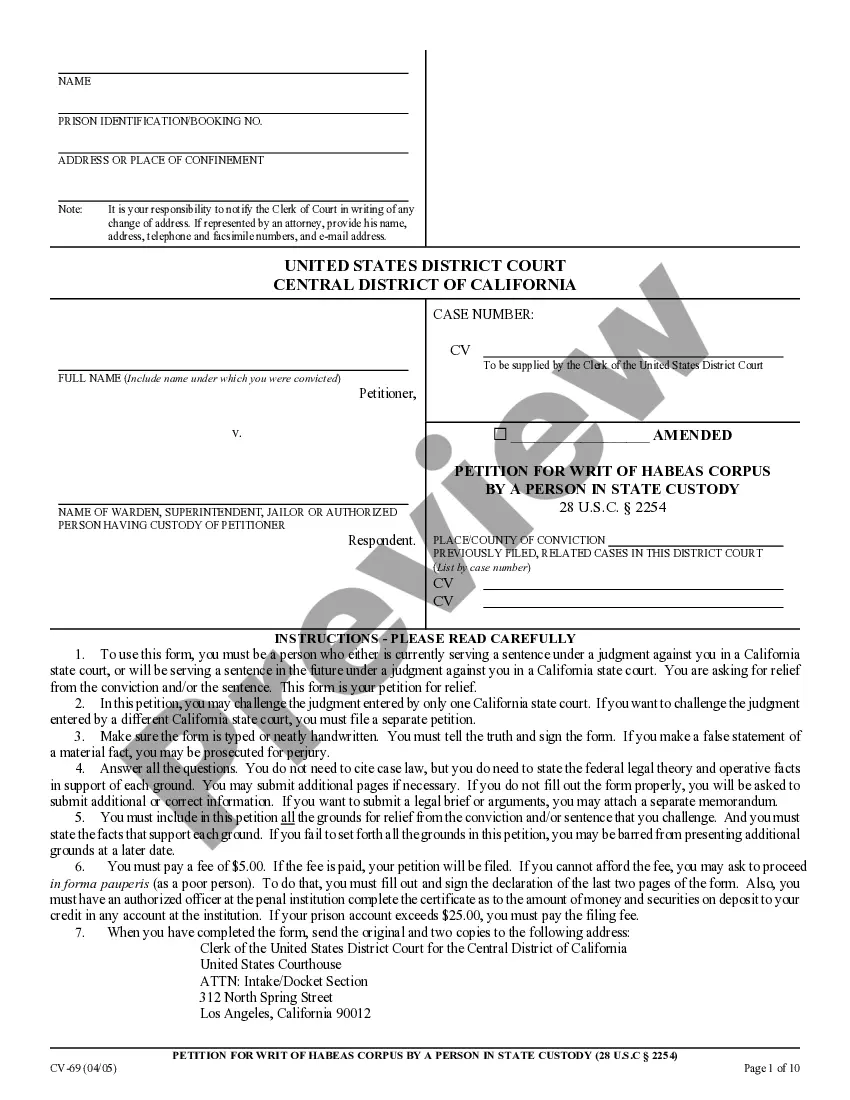

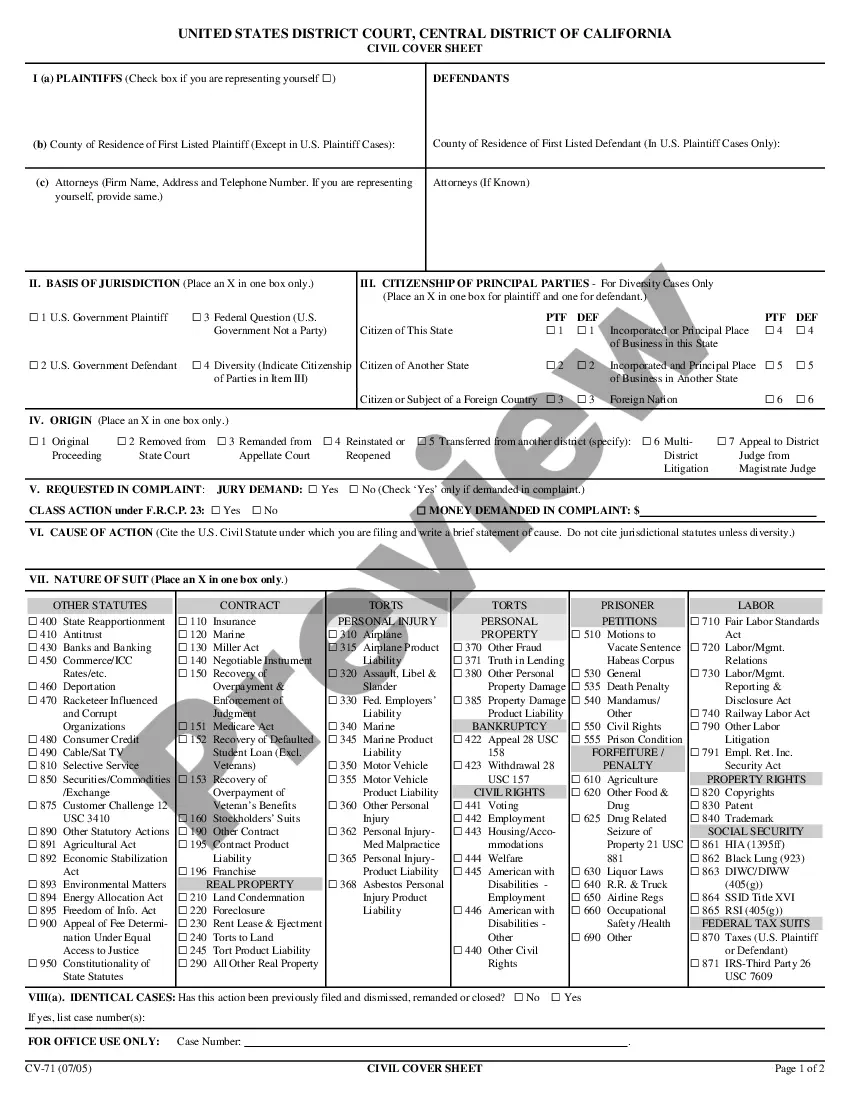

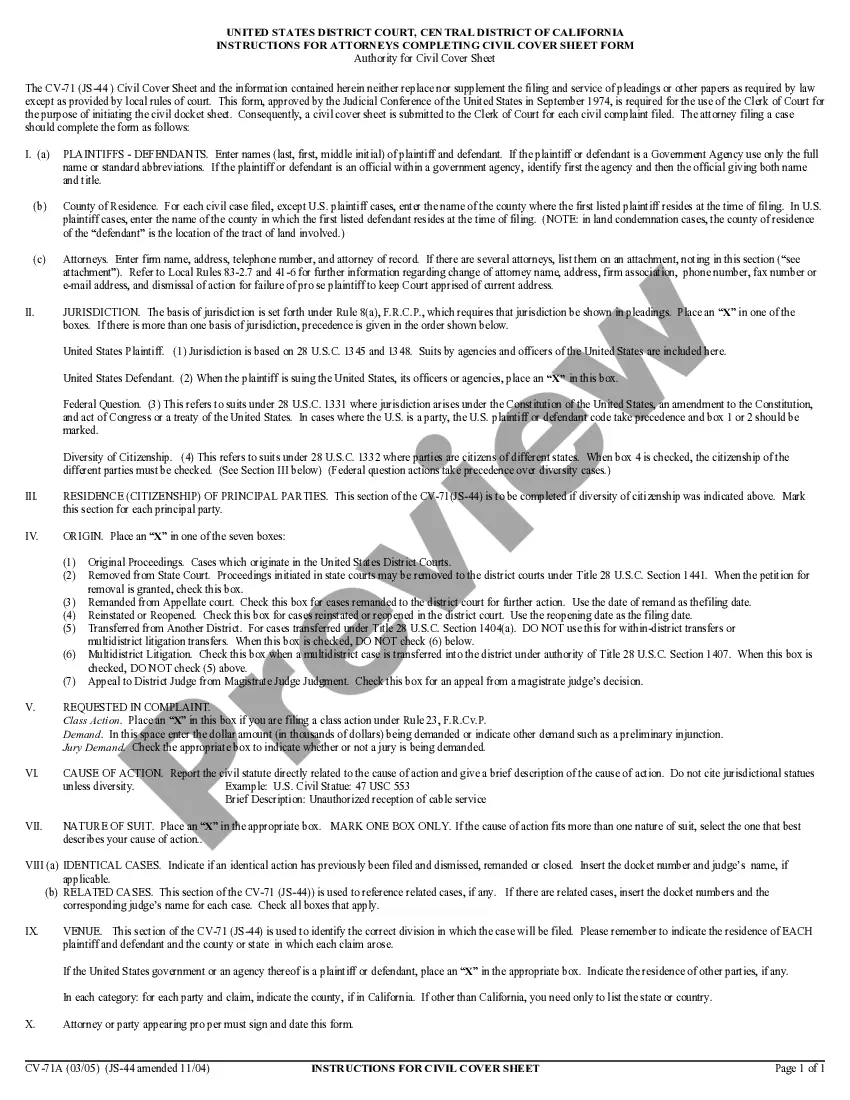

- Examine the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document once you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!