Cuyahoga Ohio Training Expense Agreement is a contractual agreement between an employer and an employee regarding the reimbursement or payment of training expenses. These agreements are specifically designed to outline the terms and conditions under which the employer will bear the costs associated with an employee's training and development activities. One of the common types of Cuyahoga Ohio Training Expense Agreement is a tuition reimbursement agreement. This agreement relates to the employer's commitment to cover the costs of an employee's educational pursuits such as college courses, certifications, or degree programs. The agreement may specify certain conditions, such as a minimum grade requirement or a commitment to stay with the company for a specified period. Another type of Cuyahoga Ohio Training Expense Agreement is a professional development agreement. This agreement covers various forms of training and development activities that enhance an employee's skills and knowledge relevant to their job role. These can include seminars, workshops, conferences, or specialized training programs. The agreement usually outlines the permissible expenses, reimbursement procedures, and any specific requirements or expectations. The Cuyahoga Ohio Training Expense Agreements typically include essential elements, such as: 1. Expenses Covered: The agreement clearly delineates the types of training expenses that the employer is willing to cover. This can include tuition fees, course materials, travel and accommodation costs, registration fees, or any other related expenses. 2. Reimbursement Process: The agreement defines the procedure that the employee must follow to seek reimbursement for their training expenses. It may specify the forms or documents required, the timelines for submission, and the method of reimbursement (e.g., direct payment or reimbursement upon documentation). 3. Qualifying Criteria: Certain conditions or eligibility criteria are outlined in the agreement, which an employee must meet to be eligible for training expense reimbursement. For example, the agreement may require the employee to attain a specific grade or performance level, maintain a certain employment duration, or commit to utilizing the acquired skills within the organization. 4. Repayment Obligation: In some cases, the agreement may include provisions requiring the employee to repay a portion or all of the training expenses if they leave the company within a specified period following the completion of the training. This helps protect the employer's investment in training. It is crucial for both employers and employees to understand the terms and conditions stated in the Cuyahoga Ohio Training Expense Agreement. These agreements not only demonstrate the employer's commitment to employee development but also ensure clarity and fairness in training-related expenses.

Cuyahoga Ohio Training Expense Agreement

Description

How to fill out Cuyahoga Ohio Training Expense Agreement?

Whether you plan to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any personal or business case. All files are grouped by state and area of use, so picking a copy like Cuyahoga Training Expense Agreement is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to get the Cuyahoga Training Expense Agreement. Adhere to the instructions below:

- Make certain the sample meets your personal needs and state law regulations.

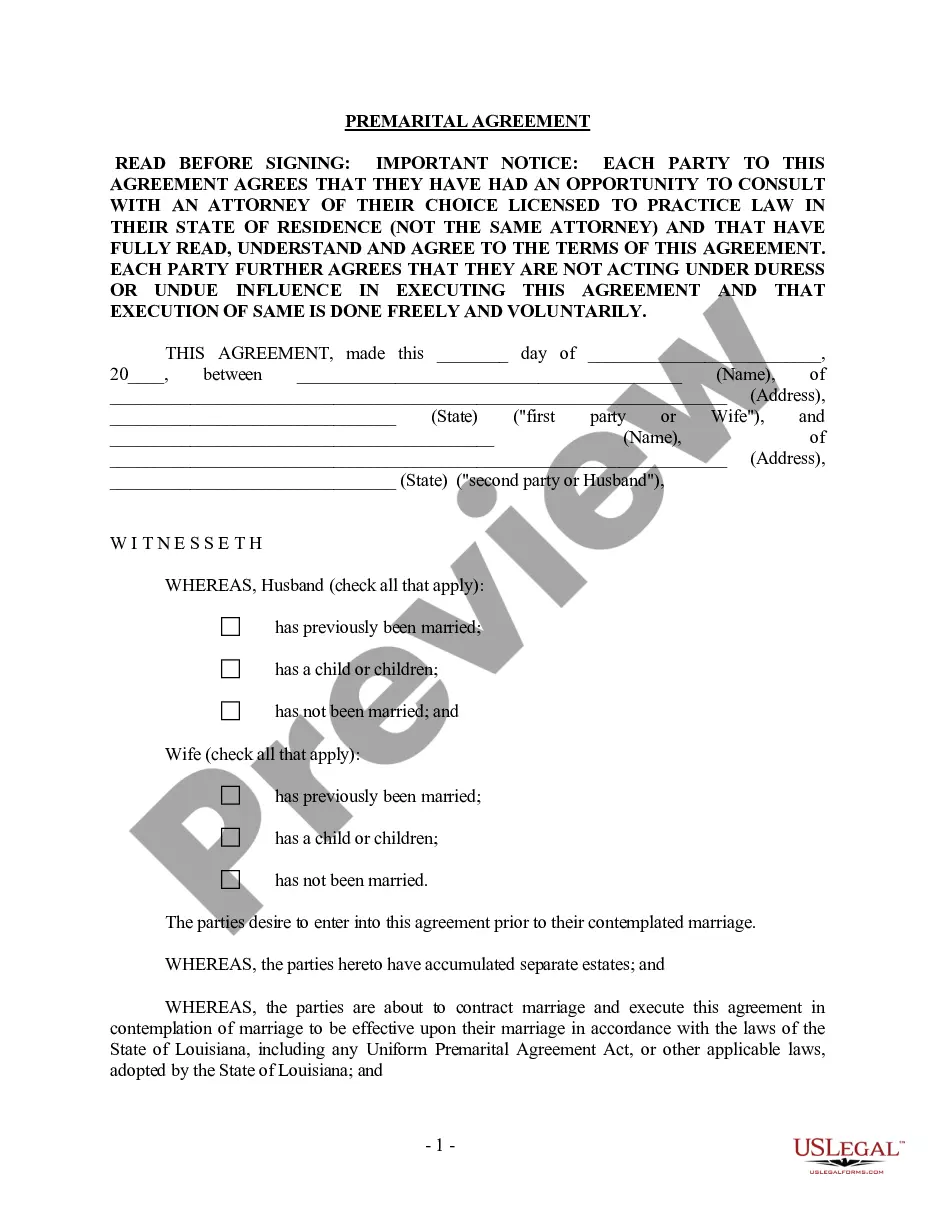

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Cuyahoga Training Expense Agreement in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!