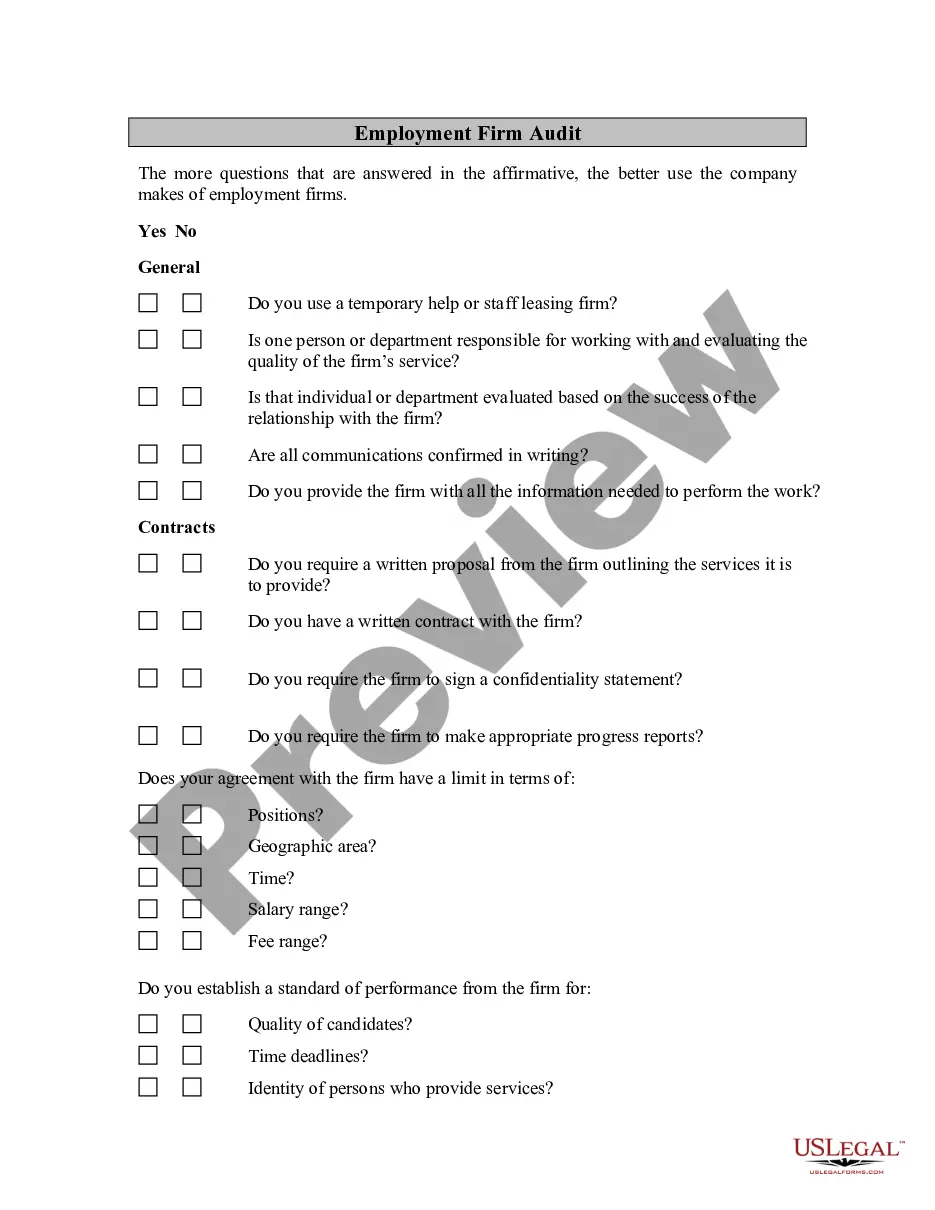

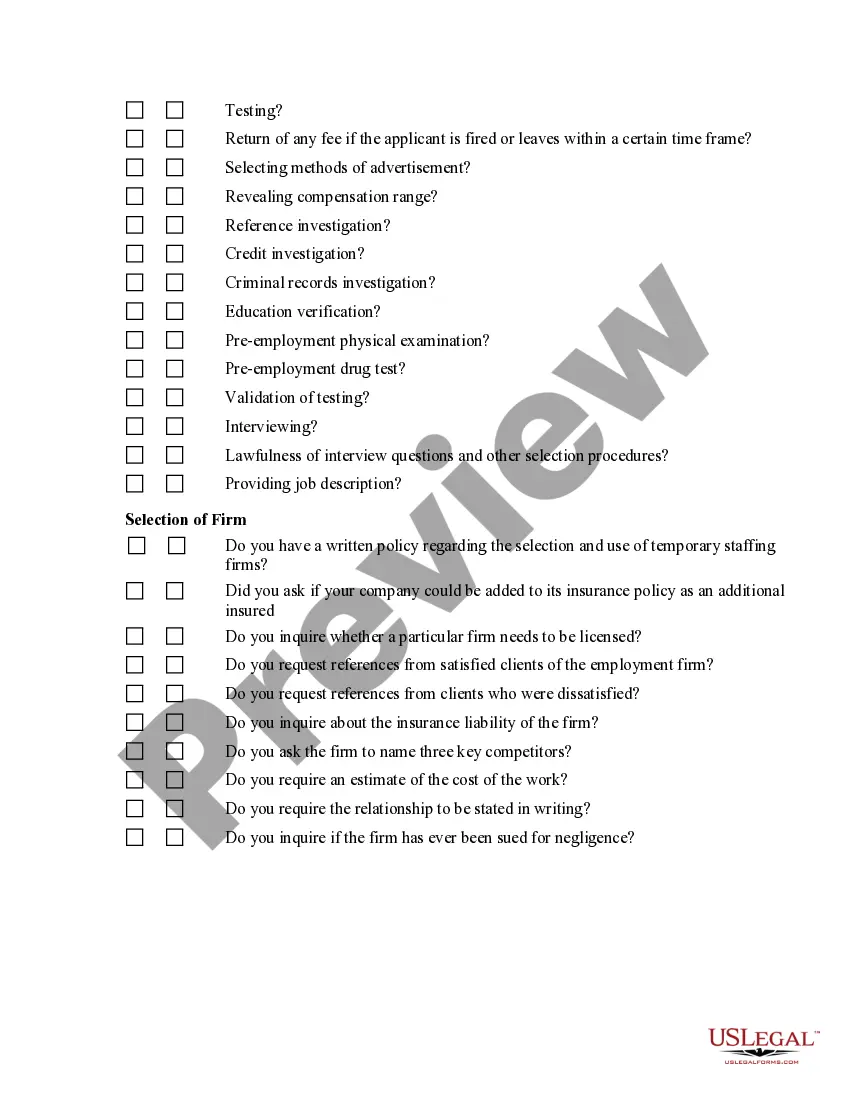

San Diego California Employment Firm Audit is a comprehensive examination and evaluation of the financial operations, records, policies, and procedures of an employment firm located in San Diego, California. This audit is typically conducted by external auditors or certified public accountants (CPA's) who specialize in examining the financial statements and internal controls of businesses to ensure compliance with applicable laws, regulations, and industry standards. The purpose of a San Diego California Employment Firm Audit is to provide an unbiased assessment of the employment firm's financial health, accuracy of financial reporting, risk management practices, and internal control systems. This thorough examination helps identify any potential financial irregularities, errors, or deficiencies in the employment firm's operations, enabling management to make informed decisions for improved organizational performance. During the audit process, auditors perform various procedures, including: 1. Financial statement analysis: Auditors scrutinize the firm's financial statements, such as the balance sheet, income statement, and cash flow statement, to ensure accuracy, completeness, and proper disclosure of financial information. 2. Internal control assessment: Auditors evaluate the existence and effectiveness of internal controls, such as segregation of duties, authorization procedures, and information systems security, to safeguard the firm's assets and prevent fraud or misappropriation. 3. Compliance testing: Auditors verify the employment firm's compliance with relevant laws, regulations, and industry-specific standards, such as labor laws, employment regulations, and tax requirements. 4. Risk assessment: Auditors assess the firm's risk management practices, including identification and evaluation of potential risks, control activities, risk mitigation strategies, and disaster recovery plans. 5. Employee payroll and benefits review: Auditors review employee payroll records, benefits programs, and related documentation to ensure accurate calculations, appropriate contributions, and compliance with relevant laws and regulations. Different types of San Diego California Employment Firm Audits can include: 1. Financial Statement Audit: This type of audit primarily focuses on examining an employment firm's financial statements and determining whether they present a true and fair view of its financial position, results of operations, and cash flows. 2. Internal Control Audit: This audit type emphasizes evaluating the effectiveness of internal controls, including risk assessment, control activities, information systems security, and compliance with applicable regulations and policies. 3. Compliance Audit: This audit specifically targets assessing the employment firm's adherence to legal requirements, employment regulations, tax obligations, and industry-specific standards. 4. Payroll Audit: This audit concentrates on reviewing payroll processes, assessing the accuracy and completeness of payroll records, ensuring compliance with labor laws, and verifying employee benefits calculations. In conclusion, a San Diego California Employment Firm Audit is a comprehensive evaluation of an employment firm's financial operations, internal controls, compliance with relevant regulations, and risk management practices. It aims to provide a detailed analysis for the firm's management, helping them make informed decisions to enhance financial integrity, mitigate risks, and improve business performance.

San Diego California Employment Firm Audit

Description

How to fill out San Diego California Employment Firm Audit?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the San Diego Employment Firm Audit, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the latest version of the San Diego Employment Firm Audit, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Diego Employment Firm Audit:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your San Diego Employment Firm Audit and save it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!