Cuyahoga Ohio Exempt Survey is a comprehensive assessment conducted in Cuyahoga County, Ohio, to determine the eligibility for property tax exemptions. This survey is crucial for residents and property owners in Cuyahoga County who may qualify for exemptions under various circumstances. The exemptions aim to provide financial relief to individuals or organizations that meet specific criteria. The Cuyahoga Ohio Exempt Survey encompasses several types of surveys tailored to different categories of exemptions. These surveys include: 1. Homestead Exemption Survey: This survey assesses the qualification of homeowners aged 65 or older, or those who are permanently disabled, for property tax reductions. The Homestead Exemption provides significant tax relief for eligible homeowners in Cuyahoga County. 2. Veterans Exemption Survey: Cuyahoga Ohio Exempt Survey also includes an assessment for veterans who may be eligible for property tax exemptions. This survey determines the eligibility of veterans who have served in the armed forces, including those with disabilities resulting from their military service. 3. Disabled Exemption Survey: The Disabled Exemption Survey evaluates the eligibility of individuals who have permanent disabilities but do not qualify for the Homestead Exemption. It offers tax relief to disabled individuals living in Cuyahoga County. 4. Agricultural Exemption Survey: Designed for property owners engaged in agricultural activities, this survey determines whether the property qualifies for property tax exemptions based on agricultural use. Owners of agricultural lands and structures may be eligible for reduced property taxes. 5. Charitable Exemption Survey: Cuyahoga Ohio Exempt Survey extends to nonprofit organizations and charitable entities operating within the county. This survey assesses the eligibility for property tax exemptions, considering the organization's purpose and compliance with specific requirements. 6. Religious Exemption Survey: Similar to the Charitable Exemption Survey, this assessment focuses on religious organizations and determines their eligibility for property tax exemptions based on their religious activities and compliance with relevant regulations. Cuyahoga Ohio Exempt Survey plays a crucial role in ensuring fair assessment and appropriate exemptions for residents and organizations in Cuyahoga County. By conducting these surveys, the county aims to support eligible individuals and entities while maintaining the necessary tax revenue required for public services and infrastructure development. It is essential for property owners and eligible individuals to participate in these surveys to avail themselves of potential exemptions and tax relief opportunities.

Cuyahoga Ohio Exempt Survey

Description

How to fill out Cuyahoga Ohio Exempt Survey?

Drafting paperwork for the business or individual needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to generate Cuyahoga Exempt Survey without expert assistance.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Cuyahoga Exempt Survey by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Cuyahoga Exempt Survey:

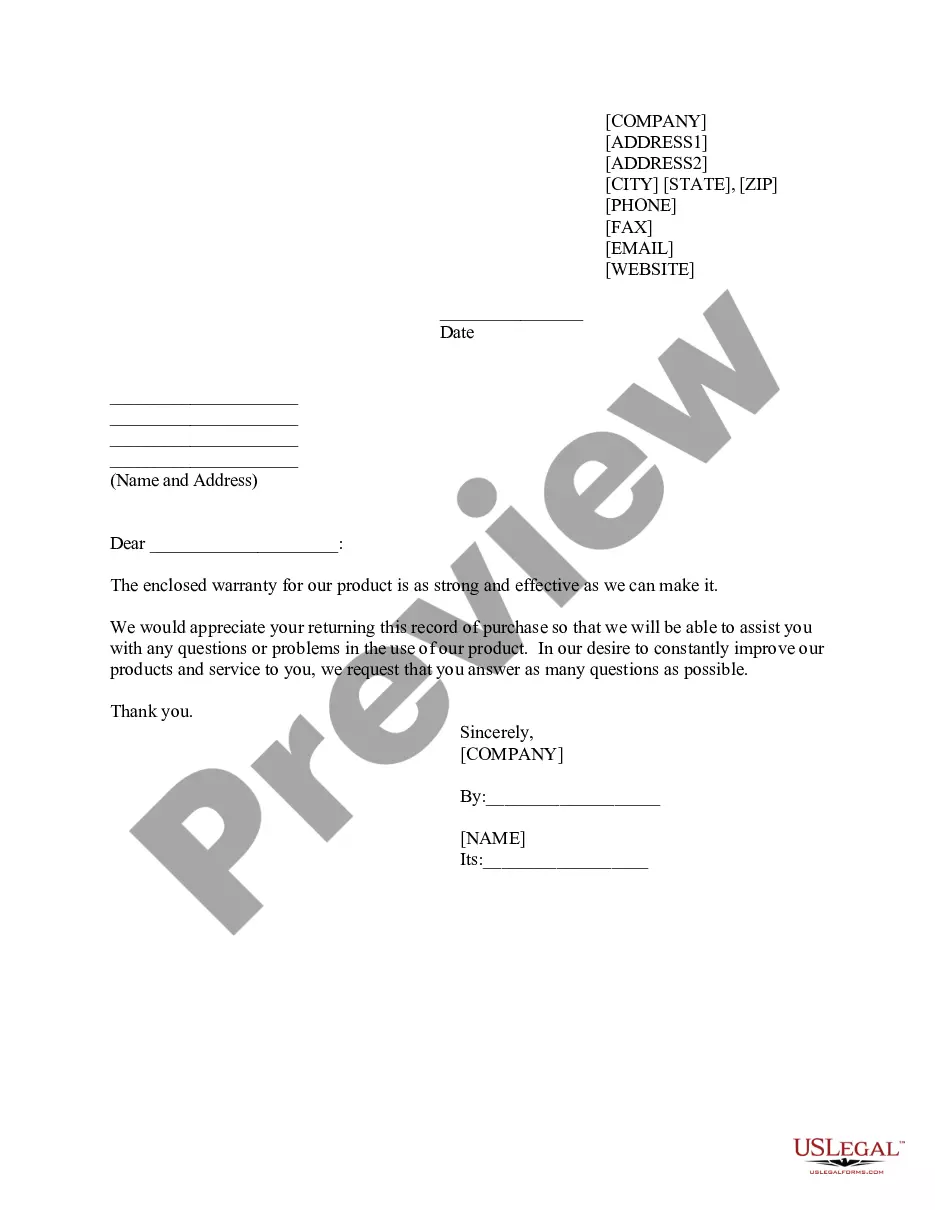

- Look through the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that suits your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any use case with just a few clicks!