Dallas Texas Exempt Survey is a detailed evaluation tool used to identify and record properties or businesses within Dallas, Texas that are exempt from certain taxes or regulations. The survey aims to maintain accurate records and ensure compliance with local laws. By conducting this analysis, the local authorities can effectively monitor and manage exempt properties and businesses. The Dallas Texas Exempt Survey is conducted by government agencies or surveying firms specialized in tax evaluation. It involves a comprehensive inspection and assessment of various factors, including property size, use, and ownership, as well as business activities and operations. The surveyors carefully review relevant documents and conduct on-site visits to gather accurate information. Keywords: Dallas Texas Exempt Survey, tax evaluation, exempt properties, regulations, compliance, government agencies, surveying firms, property size, property use, property ownership, business activities, operations, relevant documents, on-site visits. Types of Dallas Texas Exempt Surveys: 1. Property Tax Exempt Survey: This survey specifically focuses on identifying properties within Dallas, Texas that are exempt from property taxes. Examples of tax-exempt properties may include religious buildings, governmental facilities, or nonprofit organizations. 2. Business Tax Exempt Survey: This survey is conducted to identify businesses operating in Dallas, Texas that are exempt from certain tax obligations. It aims to assess if businesses meet the criteria to qualify for tax exemptions, such as being a nonprofit organization, engaging in specific activities, or having a certain size or structure. 3. Zoning Exempt Survey: This type of survey pertains to properties or businesses that are exempt from certain zoning restrictions or regulations. It ensures that land-use regulations are appropriately applied and exceptions are granted to eligible properties or businesses within Dallas, Texas. 4. Regulatory Exempt Survey: This survey focuses on identifying properties or businesses in Dallas, Texas that are exempt from specific regulations imposed by local authorities. It aims to determine if the exemptions granted align with the city's policies and if the exempt entities fulfill the necessary requirements. Keywords: Property Tax Exempt Survey, Business Tax Exempt Survey, Zoning Exempt Survey, Regulatory Exempt Survey, tax exemptions, zoning restrictions, land-use regulations, local authorities, nonprofit organizations, governmental facilities, criteria, policies, requirements.

Dallas Texas Exempt Survey

Description

How to fill out Dallas Texas Exempt Survey?

Drafting papers for the business or individual needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to generate Dallas Exempt Survey without expert assistance.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Dallas Exempt Survey by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Dallas Exempt Survey:

- Examine the page you've opened and check if it has the document you need.

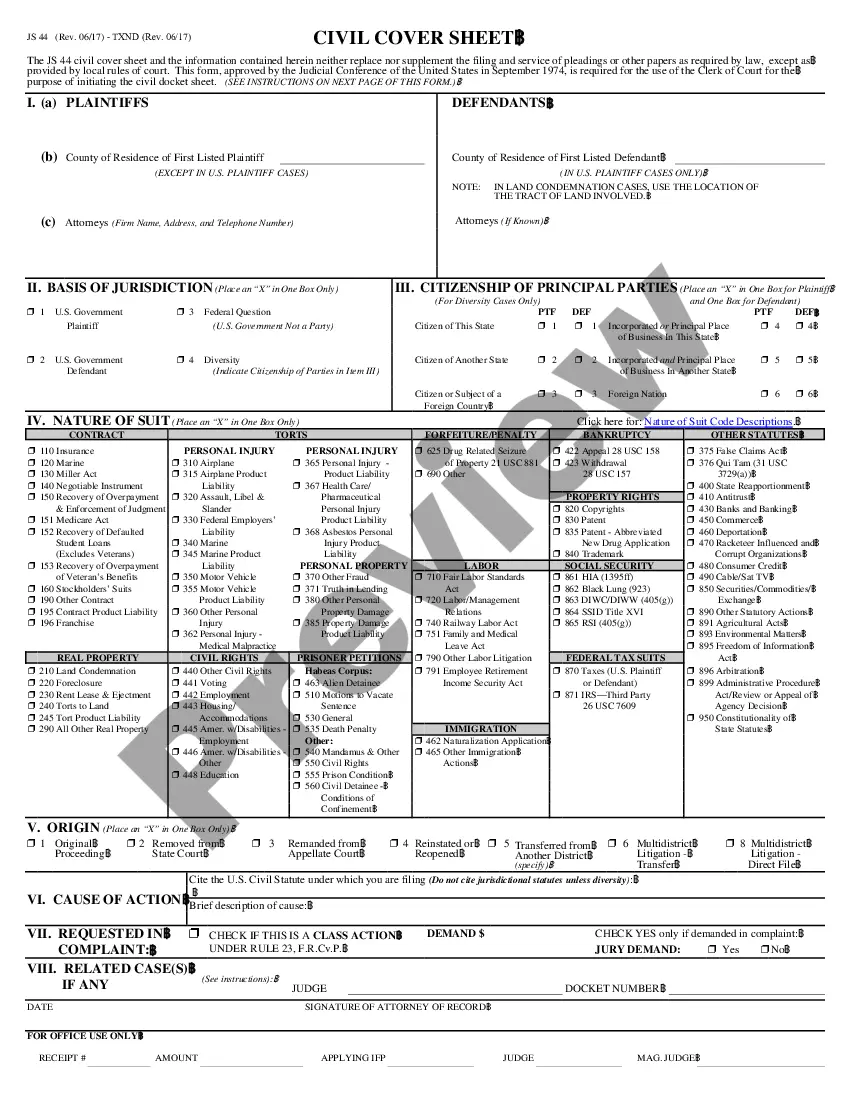

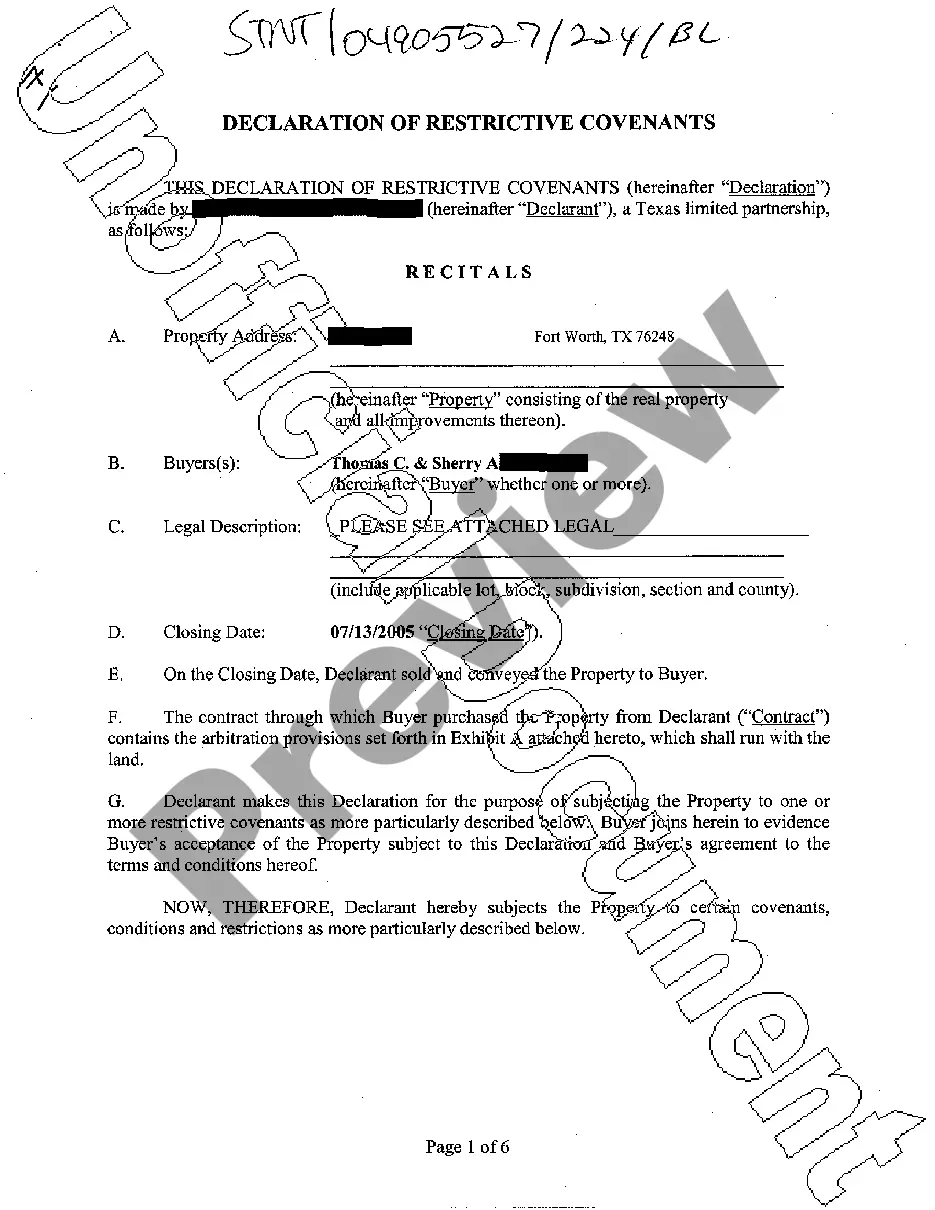

- To achieve this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any use case with just a couple of clicks!