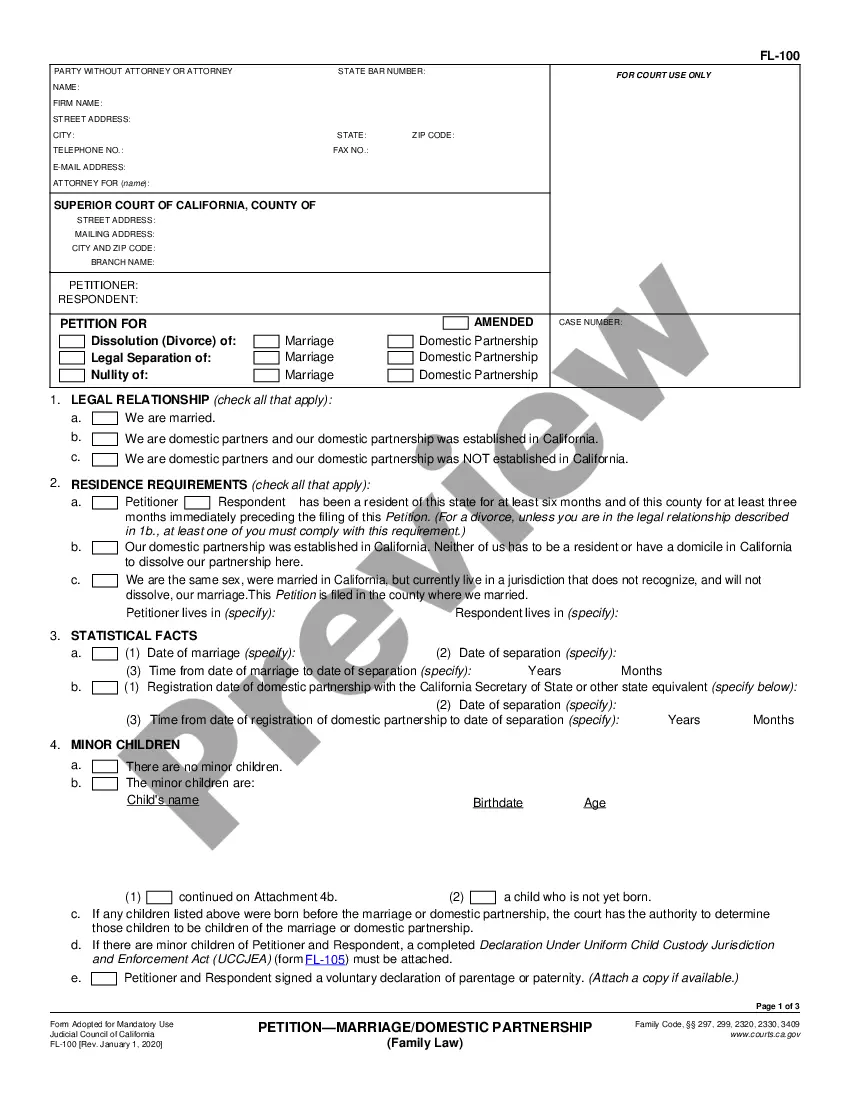

San Diego California Exempt Survey is a comprehensive and detailed analysis conducted to determine the exemptions and exclusions available in the local tax systems of San Diego, California. This survey aims to provide a thorough understanding of the various exemptions and exclusions provided by the local tax laws, which allows individuals and businesses to legally reduce their tax liabilities. The San Diego California Exempt Survey is designed to assist taxpayers, professionals, and organizations in navigating through the complex tax landscape and identifying potential tax savings opportunities. By conducting this survey, individuals and businesses can gain valuable insights into the specific exemptions and exclusions applicable to their specific circumstances, ensuring compliance with the tax laws while optimizing their financial resources. Keywords: San Diego, California, exempt survey, exemptions, exclusions, tax systems, tax liabilities, local tax laws, tax savings, taxpayers, professionals, organizations, financial resources, compliance. Types of San Diego California Exempt Survey: 1. Personal Exemption Survey: This survey focuses on the individual taxpayers and aims to identify the personal exemptions available to them under the San Diego tax laws. It provides detailed information regarding the criteria, limits, and application process for claiming exemptions for various purposes such as dependents, education, medical expenses, or charity contributions. 2. Business Exemption Survey: This survey is targeted towards businesses operating in San Diego, California, and aims to explore the exemptions and exclusions that businesses can avail. It provides an overview of the exemptions available for specific industries, investments, research and development activities, or environmentally friendly practices. Additionally, it may cover exemptions related to property, sales, use, or payroll taxes that businesses can utilize to reduce their overall tax burden. 3. Property Exemption Survey: This survey focuses specifically on property-related exemptions available under San Diego's tax laws. It provides valuable information about exemptions applicable to homeowners, agricultural properties, veterans, non-profit organizations, or historic properties. By conducting this survey, property owners can identify potential exemptions to reduce their property tax liabilities. Keywords: personal exemption survey, business exemption survey, property exemption survey, individual taxpayers, business owners, property-related exemptions, homeowners, agricultural properties, veterans, non-profit organizations, historic properties, tax burden.

San Diego California Exempt Survey

Description

How to fill out San Diego California Exempt Survey?

Drafting documents for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to create San Diego Exempt Survey without expert help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid San Diego Exempt Survey by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the San Diego Exempt Survey:

- Look through the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that suits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a couple of clicks!