Collin Texas Summary Plan Description Checklist is a comprehensive document that outlines the key elements and provisions of a summary plan description (SPD) specifically related to the Collin, Texas area. This checklist serves as a guide for employers, plan administrators, and benefits professionals to ensure that the SPD complies with all relevant laws and regulations, provides accurate and detailed information, and effectively communicates the benefits and terms of the plan to plan participants. The Collin Texas Summary Plan Description Checklist covers various areas necessary for a thorough SPD, including: 1. Plan Information: This section outlines the name, effective date, and purpose of the plan, as well as any plan amendments and restatements. 2. Plan Sponsor and Administrator: It details the employer or organization sponsoring the plan, along with the contact information for the plan administrator or designated representative. 3. Participant Eligibility: This section explains the criteria for employees to become eligible to participate in the plan, such as length of service, job classification, or age requirements. 4. Benefit Coverage: It includes a comprehensive description of the benefits offered, such as health insurance, retirement plans, disability coverage, life insurance, and other ancillary benefits. 5. Enrollment Procedure: This highlights the procedure for employees to enroll in the plan, including deadlines, required forms, and any waiting periods. 6. Contribution and Matching Policies: It outlines the employee and employer contributions required for each benefit, including any matching programs, profit-sharing arrangements, or salary deferral options. 7. Vesting and Portability: This section explains the conditions under which employees become "vested" or entitled to their employer-funded benefits and whether there are any portability options upon termination or retirement. 8. Plan Investment Options: It details the available investment choices for retirement plans or other investment-based benefits, including information on risk levels, performance, and fees. 9. Claims and Appeals Procedures: It outlines the process for filing claims, appealing denied claims, and obtaining external review if necessary, in compliance with the Employee Retirement Income Security Act (ERICA). 10. General Plan Information: This section includes important details such as plan termination provisions, amendment procedures, fiduciary responsibilities, and any other legal notifications required. While the Collin Texas Summary Plan Description Checklist serves as a general guide, it can be further tailored to specific types of plans, such as health insurance SPD checklist, retirement plan SPD checklist, or disability plan SPD checklist. These variations ensure that the content aligns with the unique requirements and nuances of each type of plan.

Collin Texas Summary Plan Description Checklist

Description

How to fill out Collin Texas Summary Plan Description Checklist?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Collin Summary Plan Description Checklist, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business occasions. All the forms can be used many times: once you purchase a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Collin Summary Plan Description Checklist from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Collin Summary Plan Description Checklist:

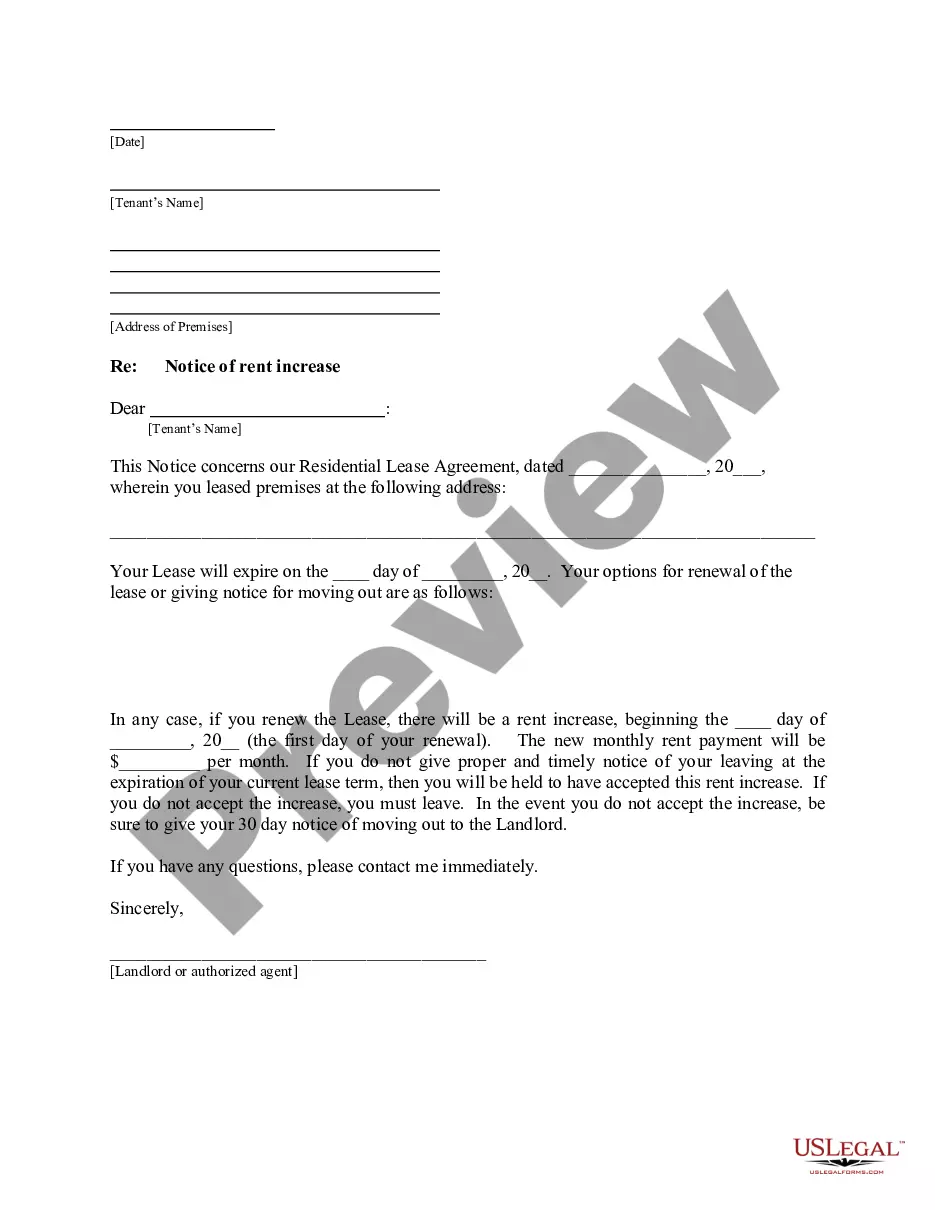

- Analyze the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!