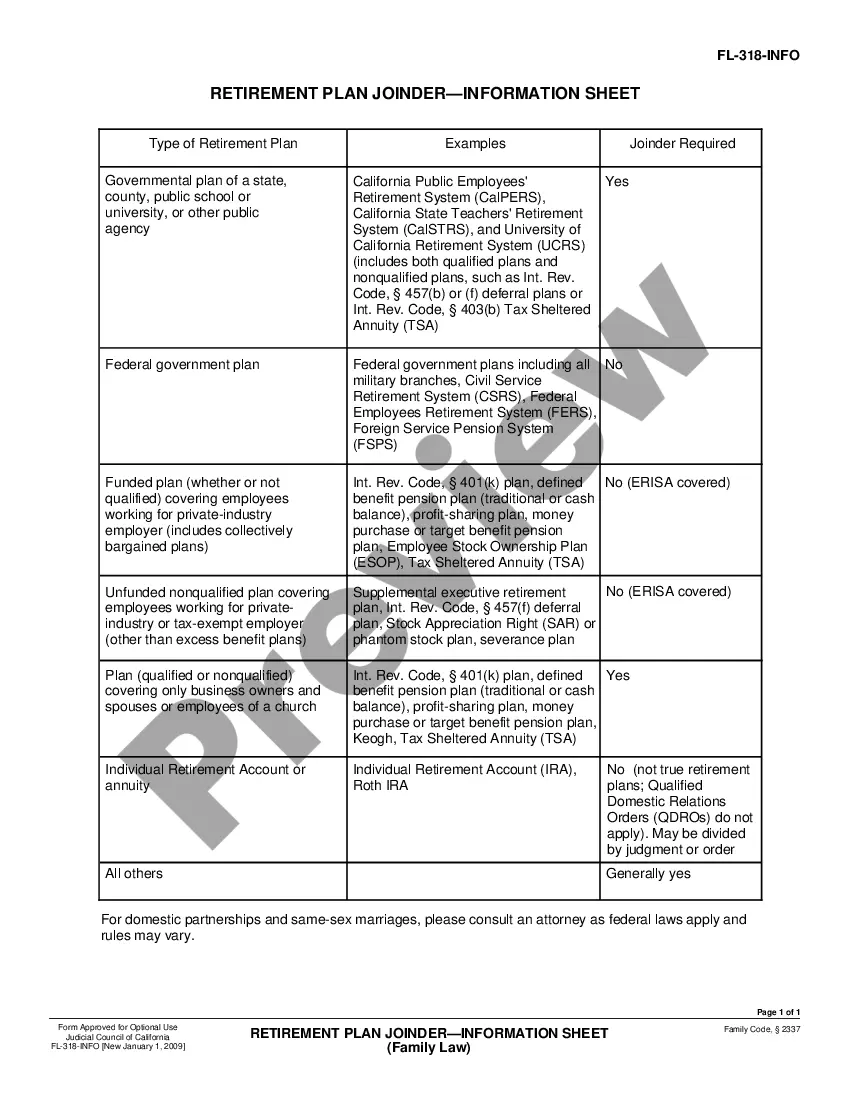

Riverside California Model Statement of ERICA Rights is a comprehensive document that outlines the legal rights and protections provided to employees under the Employee Retirement Income Security Act (ERICA) in Riverside, California. ERICA is a federal law that sets standards for private sector employee benefit plans, including retirement plans, health insurance, and other employee welfare benefits. The Riverside California Model Statement of ERICA Rights serves as a standardized template that employers in Riverside can use to fulfill their obligations under ERICA. It is designed to inform employees about their rights and entitlements related to their employee benefit plans. The Model Statement of ERICA Rights contains key information pertaining to employees' rights, such as the eligibility requirements for participation in the benefit plans, the criteria for vesting of benefits, and the procedures for filing a claim or appealing a denied claim. It also outlines the fiduciary responsibilities of the employers and plan administrators in managing the benefit plans and safeguarding the employees' interests. Moreover, the Model Statement provides information on the legal remedies available to employees in the event of a plan violation or breach of fiduciary duties. It emphasizes the employees' rights to bring a civil lawsuit to recover benefits, seek enforcement of ERICA regulations, or obtain equitable relief. While the Riverside California Model Statement of ERICA Rights is a standardized template, there may be variations or customized versions created by individual employers in accordance with their specific benefit plans or requirements. These variations may include additional details specific to the employer's plan, such as plan-specific contact information, procedures for requesting plan documents, or specific provisions related to unique benefit offerings. In summary, the Riverside California Model Statement of ERICA Rights is a critical document that serves to educate employees about their rights and protections regarding their employee benefit plans. Employers in Riverside use this template to ensure compliance with ERICA regulations and to foster transparency and fairness in managing employee benefits.

Riverside California Model Statement of ERISA Rights

Description

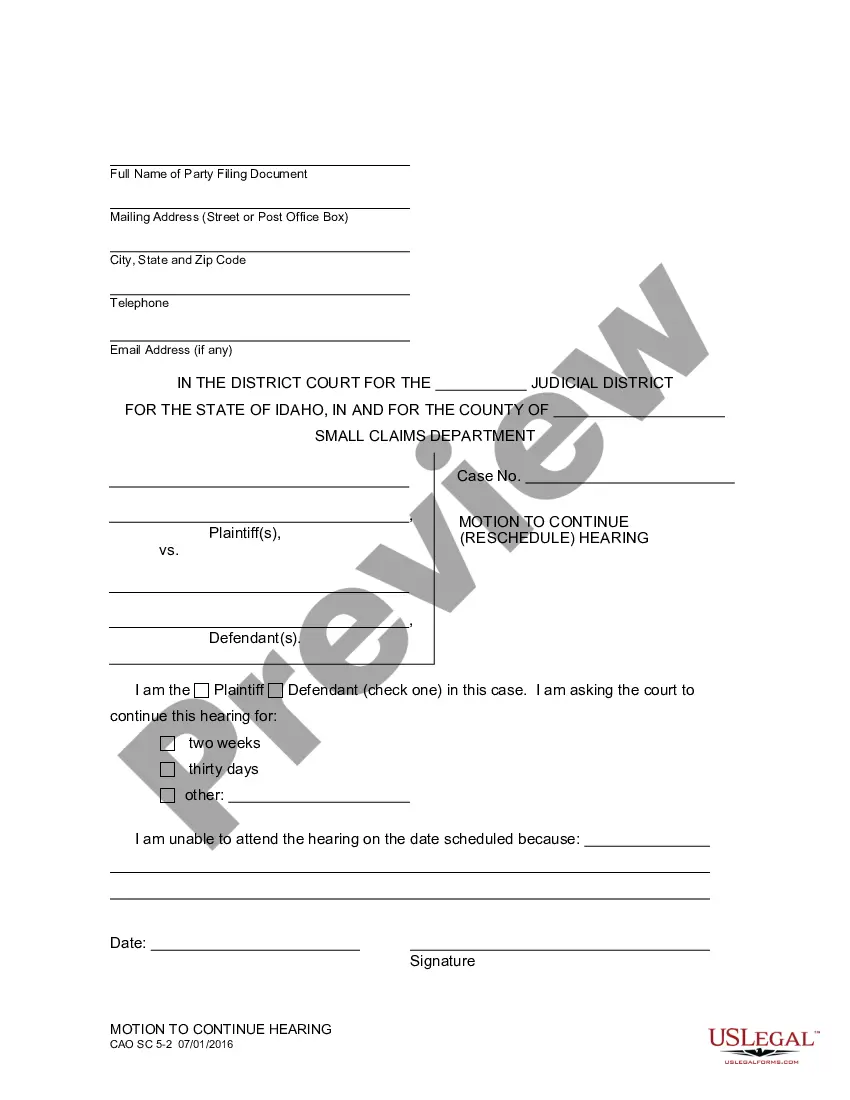

How to fill out Riverside California Model Statement Of ERISA Rights?

If you need to find a trustworthy legal form provider to obtain the Riverside Model Statement of ERISA Rights, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can browse from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support make it easy to find and complete different documents.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply select to search or browse Riverside Model Statement of ERISA Rights, either by a keyword or by the state/county the form is intended for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Riverside Model Statement of ERISA Rights template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be instantly ready for download as soon as the payment is completed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes these tasks less pricey and more reasonably priced. Set up your first company, organize your advance care planning, create a real estate agreement, or complete the Riverside Model Statement of ERISA Rights - all from the convenience of your home.

Join US Legal Forms now!

Form popularity

FAQ

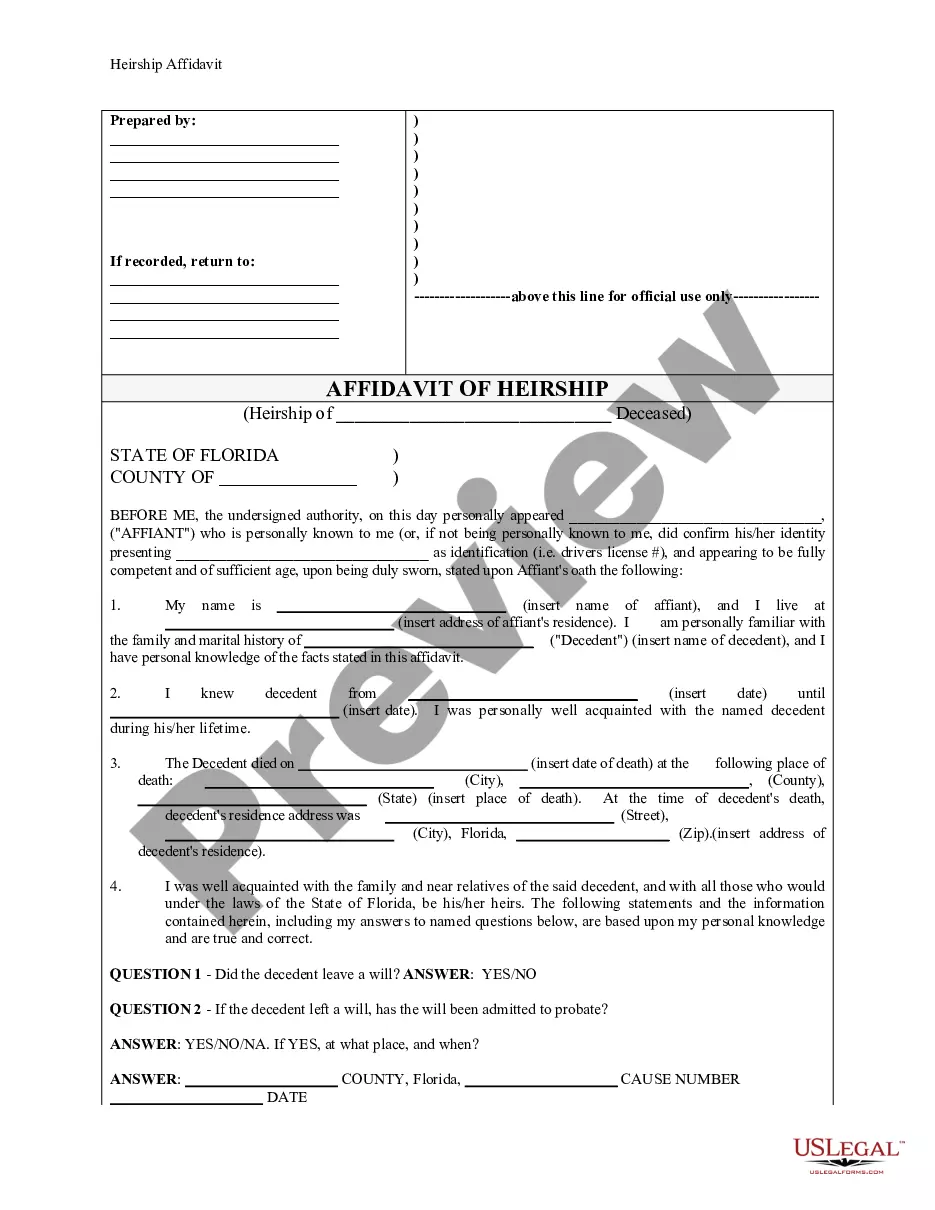

ERISA protects the interests of employee benefit plan participants and their beneficiaries. It requires plan sponsors to provide plan information to participants. It establishes standards of conduct for plan managers and other fiduciaries.

The plan must answer specific questions such as the plan name, the plan's IRS-assigned number, the employer's name and address, and a statement of health and accountability rights.

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans.

Fiduciaries under ERISA do not include attorneys, accountants, actuaries, third party administrators, record keepers, individuals who act solely in their professional capacities, and individuals who perform solely ministerial tasks for a plan or plan administrator.

Employees participating in retirement plans have several important rights under the Employee Retirement Income Security Act (ERISA). Among them are the right to disclosure of important plan information and a timely and fair process for benefit claims.

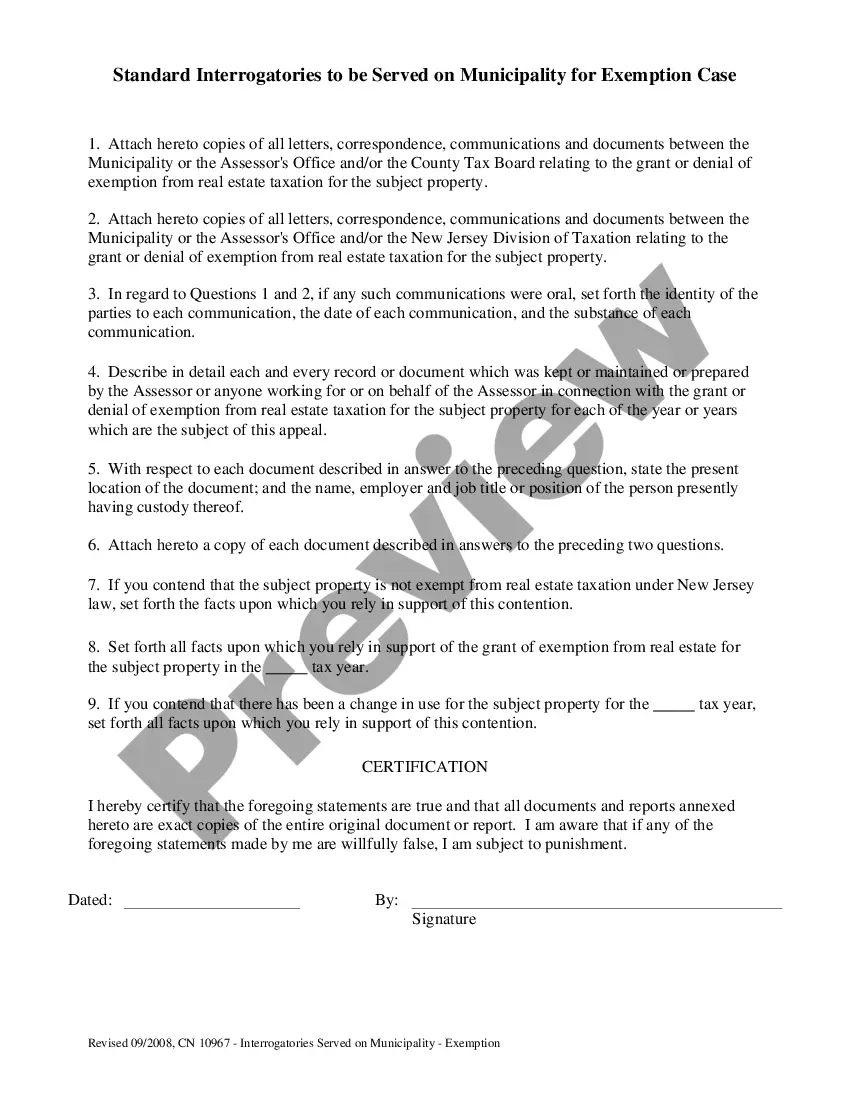

The Summary Plan Description (SPD) is one of the important 401(k) plan documents that provides plan participants (and their beneficiaries) with the most important details of their benefit plan, like eligibility requirements or participation dates, benefit calculations, plan management instructions, and general member

The summary plan description (SPD) is simply a summary of the plan document required to be written in such a way that the participants of the benefits plan can easily understand it. Unlike the plan document, the SPD is required to be distributed to plan participants.

The summary plan description is an important document that tells participants what the plan provides and how it operates. It provides information on when an employee can begin to participate in the plan and how to file a claim for benefits.

An SPD must contain all of the following information: The plan name. The plan sponsor/employer's name and address. The plan sponsor's EIN. The plan administrator's name, address, and phone number. Designation of any named fiduciaries, if other than the plan administrator, e.g., claim fiduciary.

The Employee Retirement Income Security Act (ERISA) requires plan administrators to give to participants and beneficiaries a Summary Plan Description (SPD) describing their rights, benefits, and responsibilities under the plan in understandable language. The SPD includes such information as: Name and type of plan.