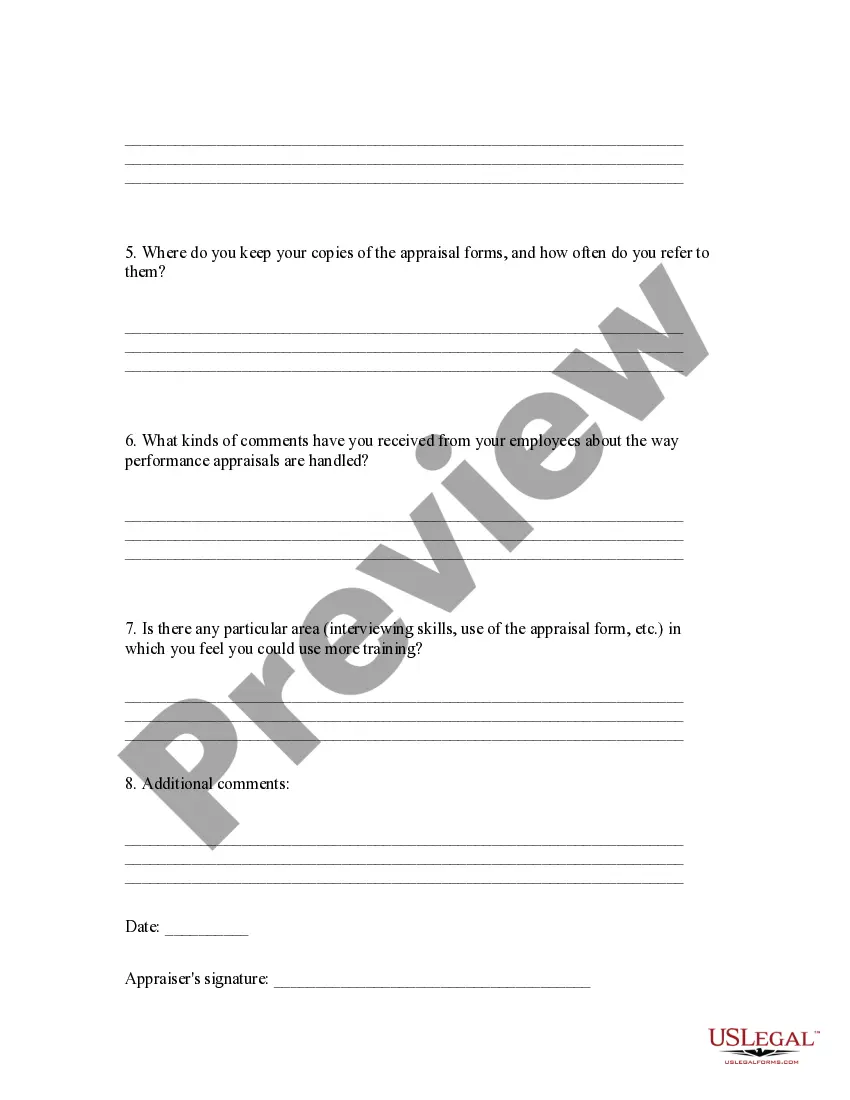

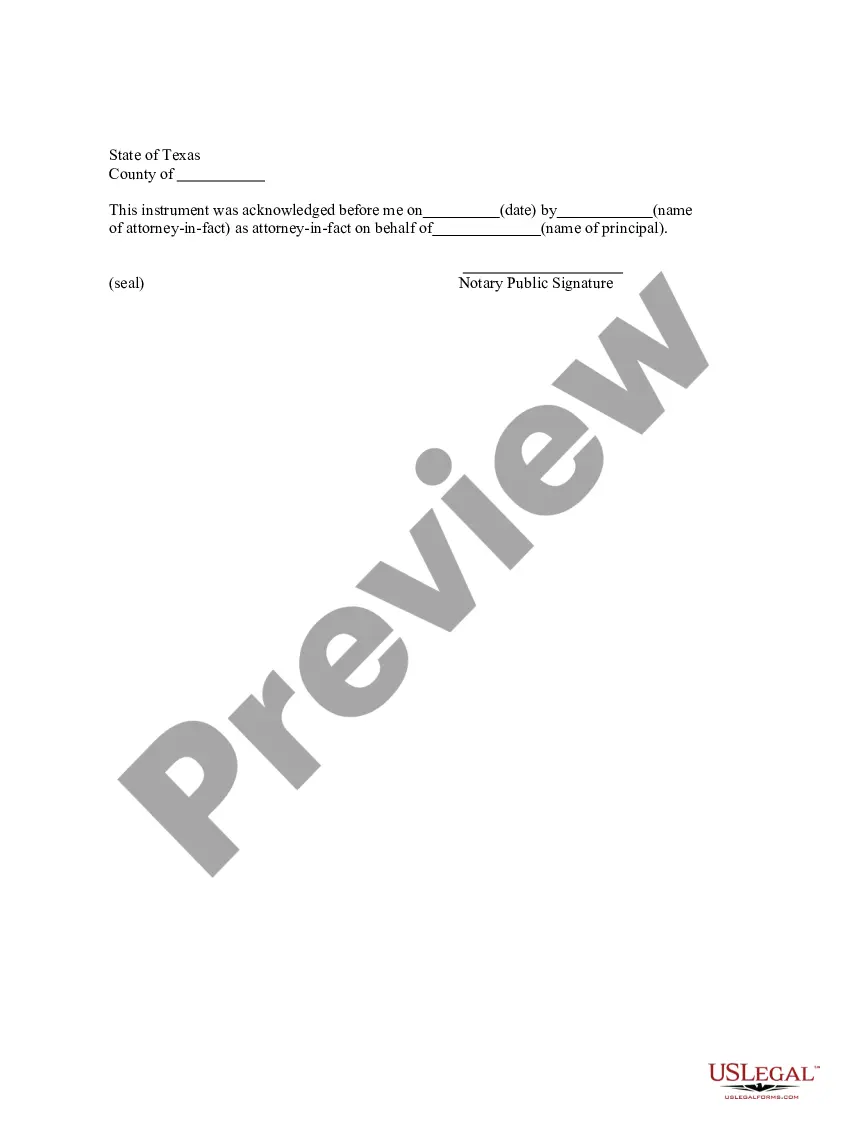

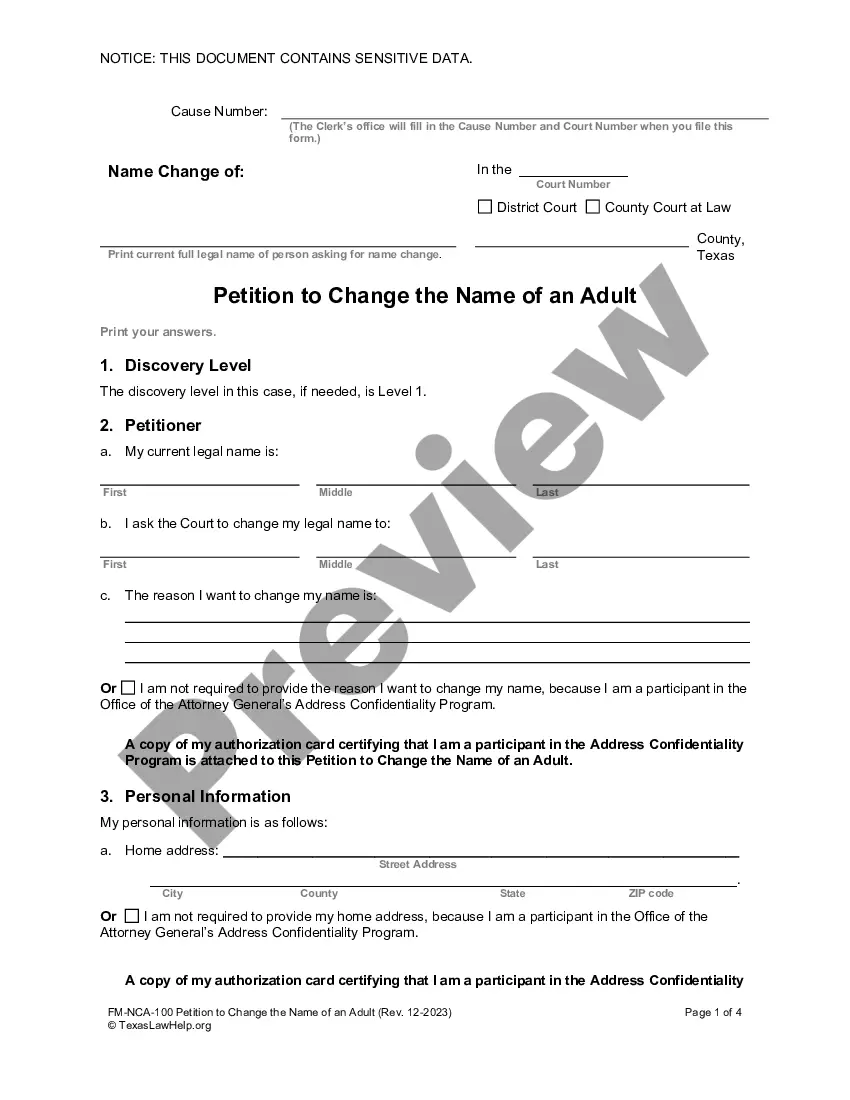

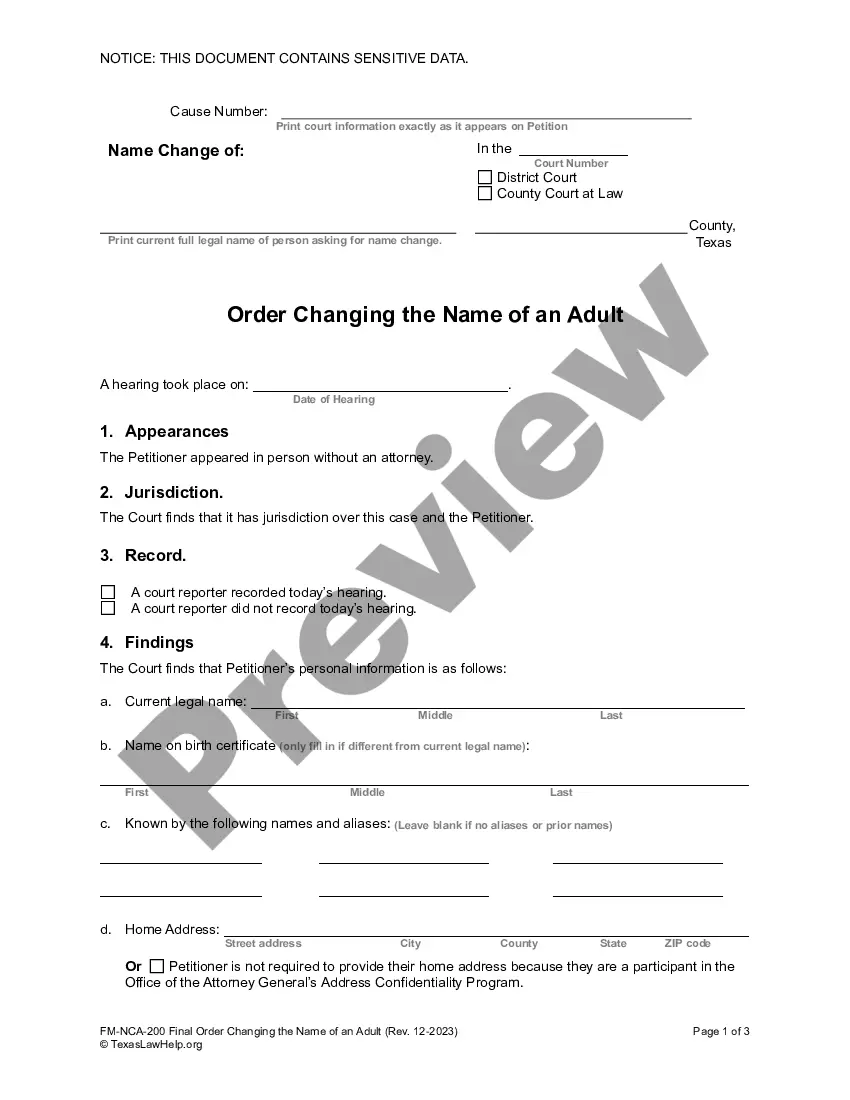

Dallas Texas Appraisal System Evaluation Form is a comprehensive assessment tool used in the city of Dallas, Texas to measure the effectiveness and efficiency of the appraisal system in place. This form serves as a means to evaluate and provide feedback on various aspects of the appraisal process, ensuring fair and accurate property assessments. The Dallas Texas Appraisal System Evaluation Form is designed to gather detailed information regarding the performance of the system and its components. It assesses the efficiency of the appraisal process, including the evaluation of properties, data collection methods, and documentation accuracy. It also evaluates the overall timeliness of assessments and any challenges faced during the process. This evaluation form focuses on key elements, such as the professionalism and knowledge of the appraisers, their understanding of market trends and property valuation techniques, and their adherence to ethical standards. It gathers insights on the accuracy and consistency of appraisals, ensuring that properties are assessed in a fair and unbiased manner. Different types of the Dallas Texas Appraisal System Evaluation Form may exist based on specific purposes or objectives. These may include: 1. Residential Property Appraisal Evaluation Form: This form focuses on the assessment of residential properties, including single-family homes, townhouses, and condominiums. It evaluates the appraisal procedures employed for residential properties and weighs factors specific to this property type. 2. Commercial Property Appraisal Evaluation Form: This form concentrates on evaluating the appraisal practices concerning commercial properties, such as office buildings, shopping centers, and industrial spaces. It emphasizes factors unique to commercial properties and the accuracy of their valuations. 3. Agricultural Property Appraisal Evaluation Form: This form assesses the appraisal techniques used for agricultural properties, including farmland, ranches, and orchards. It focuses on factors relevant to agricultural land, such as soil quality, crop productivity, and market conditions. 4. Special Property Appraisal Evaluation Form: This form is designed to evaluate the appraisal methodologies applied to unique properties, such as historical buildings, government-owned properties, or properties with unique features or restrictions. It considers the specialized knowledge and skills required to appraise such properties accurately. The Dallas Texas Appraisal System Evaluation Form plays a vital role in maintaining transparency, ensuring accountability, and enhancing the overall appraisal system's quality within the city of Dallas, Texas. It serves as a valuable feedback mechanism for continuous improvement, providing insights into areas that require attention and highlighting best practices within the appraisal process.

Dallas Texas Appraisal System Evaluation Form

Description

How to fill out Dallas Texas Appraisal System Evaluation Form?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Dallas Appraisal System Evaluation Form, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Dallas Appraisal System Evaluation Form from the My Forms tab.

For new users, it's necessary to make several more steps to get the Dallas Appraisal System Evaluation Form:

- Take a look at the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Applications cannot be filed before the date you qualify for the exemption. If you are a single or married homeowner filing together, you may be eligible to apply online.

An appraisal cap is a means to limit how quickly the taxable value of a property may increase. It does not necessarily keep the property taxes from increasing since the taxable value is only one of the two factors used to determine the levy on each individual property.

Most properties may be protested online via the Internet by using the uFile Online Protest Program on the website of the Dallas Central Appraisal District at . The online protest for residential and commercial property must be submitted by the deadline on or before midnight on .

If you are dissatisfied with your appraised value or if errors exist in the appraisal records regarding your property, you should file a Form 50-132, Notice of Protest (PDF) with the ARB. In most cases, you have until May 15 or 30 days from the date the appraisal district notice is delivered whichever date is later.

Applications cannot be filed before the date you qualify for the exemption. If you are a single or married homeowner filing together, you may be eligible to apply online.

Q: When is the deadline to protest my property value? A: In Texas, a hearing request must be submitted my May 15th of the tax year. Texas Tax Protest offers a discount for homeowners that sign up for our service prior to May 1st. Sign up early!

To start the process of appealing the appraised value of your property, or if you suspect an error has been made, you should first file a Form 50-132 Notice of Protest. This form is available online at the Bexar Appraisal District website in English and Spanish; click on the Appraisal Review Board (ARB) heading.

Homestead "Capped" Limitation: The Texas Constitution provides that property with a homestead exemption may not be increased in value more than 10% per year, excluding any new improvements made. This provision takes effect the first year following the year the owner qualified for a homestead.

What is a homestead cap value? Effective January 1, 2008, the Texas Property Tax Code, Section 23.23, states that a residential homestead is limited to a 10% increase. Rules: Limitations take affect one year after you receive your Homestead Exemption.

To conduct an automated protest, you'll need to have your property tax notice or bill available. Then, simply visit your county appraisal district website. If you already have an online account with your appraisal district, log in.