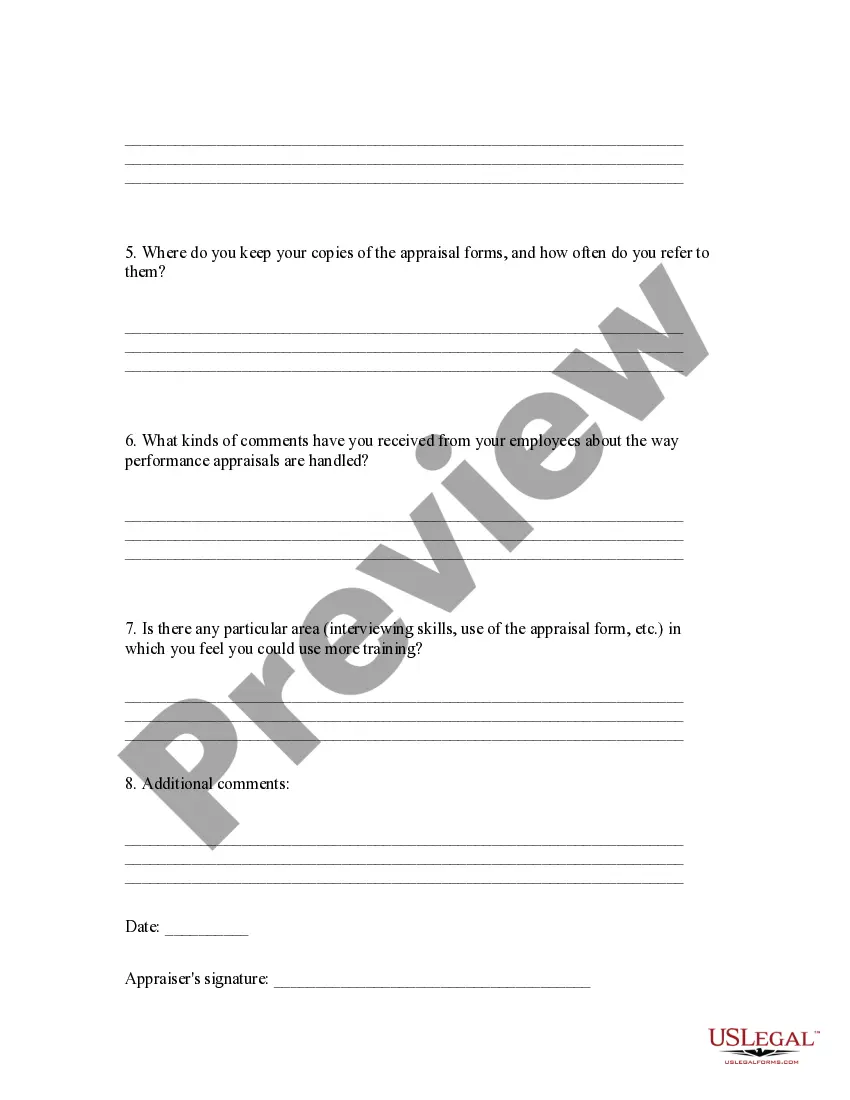

The Harris Texas Appraisal System Evaluation Form is a comprehensive assessment tool designed to evaluate the performance and effectiveness of the Harris Texas appraisal system. This evaluation form serves as a means to measure the accuracy, efficiency, and fairness of the appraisal processes utilized by the system. The form is specifically tailored to meet the appraisal requirements of Harris County in Texas, ensuring that it aligns with local regulations and guidelines. It is crucial for both appraisers and property owners as it helps gauge the quality of assessments and ensures the proper valuation of properties in the county. The Harris Texas Appraisal System Evaluation Form covers various crucial aspects of the appraisal system, including: 1. Assessment Accuracy: This section focuses on the accuracy of property valuations and the methods used to arrive at these values. It evaluates the consistency and correctness of the appraisal data collected by appraisers and examines the techniques employed to determine property worth. 2. Efficiency of Processes: This segment assesses the efficiency and timeliness of appraisal processes. It examines factors such as the use of advanced technology, data management systems, and the overall speed at which appraisals are conducted. Appraisers' ability to handle a high volume of properties within set timelines is also evaluated. 3. Fairness and Equity: This section evaluates the fairness and equity of the appraisal system. It scrutinizes whether appraisers treat similar properties equally, without any bias or discrimination. It also assesses the methods used to address property owners' concerns and disputes related to appraised values. 4. Communication and Customer Service: This part focuses on communication between appraisers and property owners. It evaluates the clarity, transparency, and accessibility of appraisers' communication channels. It also assesses how well appraisers address property owners' inquiries and provide helpful information regarding the appraisal process. Different types of Harris Texas Appraisal System Evaluation Forms may include: 1. Residential Property Evaluation Form: Specific to properties classified as residential, this form examines factors such as the accuracy of property measurements, proper classification of property types (single-family, multi-family, etc.), and the use of appropriate valuation methods specific to residential properties. 2. Commercial Property Evaluation Form: This form is tailored to evaluate the appraisal system's effectiveness for properties categorized as commercial, industrial, or mixed-use. It focuses on assessing the correct classification of properties, proper identification of potential income streams, and utilization of appropriate valuation techniques specific to commercial real estate. 3. Agricultural Property Evaluation Form: Designed for properties classified as agricultural, this form assesses the accuracy of land assessments, identification of agricultural exemptions, and the fairness of valuations for farmland, and ranches. Overall, the Harris Texas Appraisal System Evaluation Form is a vital tool that ensures the appraisal system operates efficiently, accurately, and fairly. It enables continuous improvement in the valuation of properties in Harris County, Texas, benefiting both property owners and the local community.

Harris Texas Appraisal System Evaluation Form

Description

How to fill out Harris Texas Appraisal System Evaluation Form?

Creating forms, like Harris Appraisal System Evaluation Form, to take care of your legal affairs is a difficult and time-consumming process. Many cases require an attorney’s involvement, which also makes this task not really affordable. However, you can acquire your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms intended for a variety of scenarios and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Harris Appraisal System Evaluation Form form. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before getting Harris Appraisal System Evaluation Form:

- Ensure that your document is specific to your state/county since the rules for creating legal documents may vary from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the Harris Appraisal System Evaluation Form isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start using our website and get the document.

- Everything looks good on your side? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment details.

- Your form is all set. You can go ahead and download it.

It’s an easy task to locate and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!