San Antonio Texas Appraisal System Evaluation Form

Description

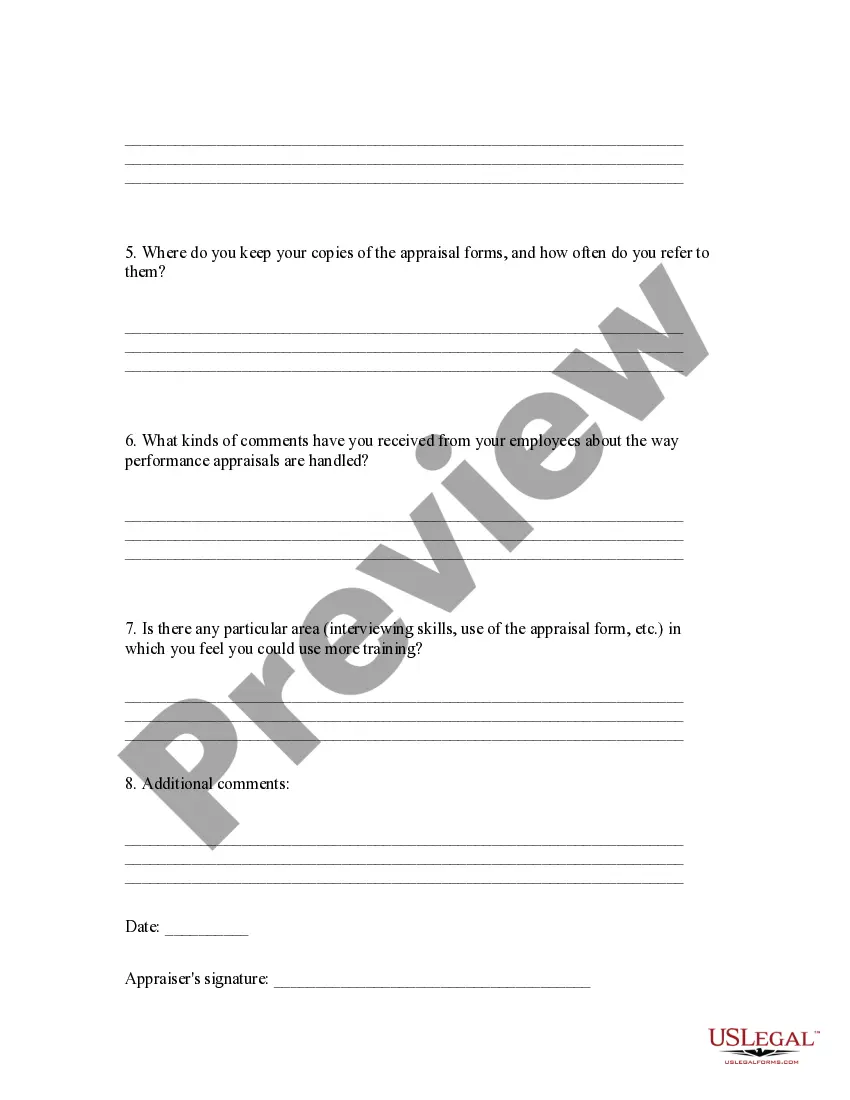

How to fill out Appraisal System Evaluation Form?

Drafting legal documents can be challenging. Moreover, if you opt to hire an attorney to create a business agreement, ownership transfer papers, pre-nuptial contract, divorce documents, or the San Antonio Appraisal System Evaluation Form, it could be quite expensive.

So what is the most sensible approach to conserve time and money while preparing legitimate forms in complete accordance with your state and local laws.

Review the form description and utilize the Preview option, if available, to ensure it’s the template you seek. Do not be concerned if the form does not meet your needs - search for the appropriate one in the header. Click Buy Now once you identify the necessary sample and select the most appropriate subscription. Log In or create an account to buy your subscription. Process a payment using a credit card or via PayPal. Choose the document format for your San Antonio Appraisal System Evaluation Form and save it. When completed, you can print it and fill it out on paper or upload the template to an online editor for a quicker and more convenient filling process. US Legal Forms allows you to utilize all the paperwork you've ever obtained multiple times - you can find your templates in the My documents tab in your profile. Give it a try today!

- US Legal Forms is an excellent answer, regardless of whether you're seeking templates for personal or business purposes.

- US Legal Forms boasts the largest online repository of state-specific legal documents, offering users the latest and professionally vetted forms for any situation all available in one location.

- Thus, if you require the latest version of the San Antonio Appraisal System Evaluation Form, you can effortlessly find it on our site.

- Acquiring the documents takes minimal time.

- Users with an existing account should verify their subscription is active, Log In, and select the form using the Download button.

- If you haven't yet registered, here's how to obtain the San Antonio Appraisal System Evaluation Form.

- Browse the site and confirm there is a template for your locality.

Form popularity

FAQ

The best way to win a property tax appeal is to present a well-structured case supported by relevant data. This means collecting information about comparable properties and market conditions that justify a lower appraisal. Completing the San Antonio Texas Appraisal System Evaluation Form can streamline the appeal process and ensure you include all necessary information. Consulting with experts or property tax consultants may also be beneficial.

Winning a property tax protest in Texas requires solid preparation and evidence. Gather documents, such as comparable sales and property tax assessments from similar properties, to support your case. Utilize the San Antonio Texas Appraisal System Evaluation Form to outline your arguments clearly. Successfully presenting your evidence during the hearing can significantly increase your chances of winning the protest.

Lowering your Texas property tax appraisal involves demonstrating that your property’s assessed value exceeds its market value. You can gather supporting documentation, such as recent sales data, to present your argument. The San Antonio Texas Appraisal System Evaluation Form can facilitate this process, allowing you to detail the reasons for your appeal efficiently. Contact your local appraisal office for additional strategies and support.

To fight an appraisal property tax in Texas, start by reviewing your property assessment details carefully. Identify discrepancies or reasons your appraisal seems inaccurate. You can leverage the San Antonio Texas Appraisal System Evaluation Form to articulate your concerns clearly when filing a protest. Be ready to present your case during the hearing phase for the best chance at a favorable resolution.

In Bexar County, Texas, the Assessor-Collector is responsible for property tax assessments. This official handles the valuation of properties and maintains tax records. If you need assistance with your San Antonio Texas Appraisal System Evaluation Form, consider reaching out to the Bexar County Appraisal District for guidance. They can provide valuable insights about the assessment process.

To dispute a property tax appraisal in Texas, you need to file a formal protest with your local appraisal district. Begin by gathering evidence to support your claim, such as comparable property values or errors in your appraisal. Utilize the San Antonio Texas Appraisal System Evaluation Form to guide you through this process, ensuring you include all pertinent details. Once your protest is filed, you may have a hearing where you can present your case.

When protesting property taxes in Texas, you can use various forms of evidence. This includes the San Antonio Texas Appraisal System Evaluation Form, recent sales data of comparable properties, photographs of your property, and any relevant appraisals. Collecting solid evidence strengthens your case and increases your chances of a successful protest.

To file for a homestead exemption in San Antonio, Texas, you must complete the San Antonio Texas Appraisal System Evaluation Form and submit it to the Appraisal District. You can often do this online or by mail. Keep an eye on deadlines and ensure you provide all necessary supporting documents, such as proof of identity and residency.

Winning a Texas property tax appeal requires presenting a well-structured case. Use the San Antonio Texas Appraisal System Evaluation Form to detail your arguments and support them with evidence. This could include recent sales of similar properties in your area or any discrepancies in the assessment. Preparation is key, so make sure you have all your data organized.

Yes, you can file your Texas homestead exemption online, making the process more convenient for you. Most counties, including Bexar County, allow you to submit the San Antonio Texas Appraisal System Evaluation Form through their official websites. Ensure you have all required information and documentation ready to upload efficiently.