Houston Texas Standard Conditions of Acceptance of Escrow refer to the set of regulations and guidelines that govern the process of accepting escrow in Houston, Texas. Escrow is a financial arrangement where a neutral third party holds and regulates funds or assets during a transaction between two parties. In the case of a real estate transaction, escrow ensures that the buyer's funds are protected until the seller delivers the property as agreed. The Houston Texas Standard Conditions of Acceptance of Escrow outline the specific terms and conditions that must be met for an escrow to be accepted in Houston. These conditions typically include: 1. Valid Contract: A valid purchase and sale agreement between the buyer and seller must be in place before an escrow is accepted. This contract should include all necessary details of the transaction, such as purchase price, property description, and closing date. 2. Escrow Agent: The escrow must be handled by a qualified escrow agent who is licensed and regulated by the appropriate authorities. The agent acts as a neutral party and follows the instructions provided by the contract and the parties involved. 3. Good Faith Deposit: The buyer is typically required to provide a good faith deposit, also known as an earnest money deposit, as a show of commitment to the transaction. The conditions of acceptance will specify the minimum amount and the deadline for depositing the funds. 4. Title Search and Insurance: The buyer may be required to conduct a title search to ensure that the property being purchased has clear and marketable title. Additionally, the conditions may state that the buyer needs to obtain title insurance to protect against any future claims on the property. 5. Contingencies and Disclosures: The contract may include various contingencies, such as the satisfaction of a home inspection, appraisal, or mortgage approval. The conditions of acceptance will determine the timeline and procedures for resolving these contingencies. The seller must also disclose any known defects or issues with the property. 6. Closing Procedures: The accepted conditions will specify the closing procedures, including the responsibilities of each party, the payment of closing costs, and the documents required for the transfer of ownership. The conditions may also stipulate a specific location for the closing to take place. It is important to note that the exact details of the Houston Texas Standard Conditions of Acceptance of Escrow may vary depending on the specific escrow agent, the nature of the transaction, and the preferences of the parties involved. However, these general conditions provide a framework for the acceptance of escrow in real estate transactions in Houston, Texas. Different types of Houston Texas Standard Conditions of Acceptance of Escrow may be categorized based on the type of transaction, such as residential real estate escrow, commercial real estate escrow, or new construction escrow. Each type may have slightly different requirements and considerations depending on the nature of the transaction. However, the fundamental principles of protecting the parties' interests and ensuring a smooth closing process typically remain consistent across these different types.

Houston Texas Standard Conditions of Acceptance of Escrow

Description

How to fill out Houston Texas Standard Conditions Of Acceptance Of Escrow?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Houston Standard Conditions of Acceptance of Escrow, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Houston Standard Conditions of Acceptance of Escrow from the My Forms tab.

For new users, it's necessary to make some more steps to get the Houston Standard Conditions of Acceptance of Escrow:

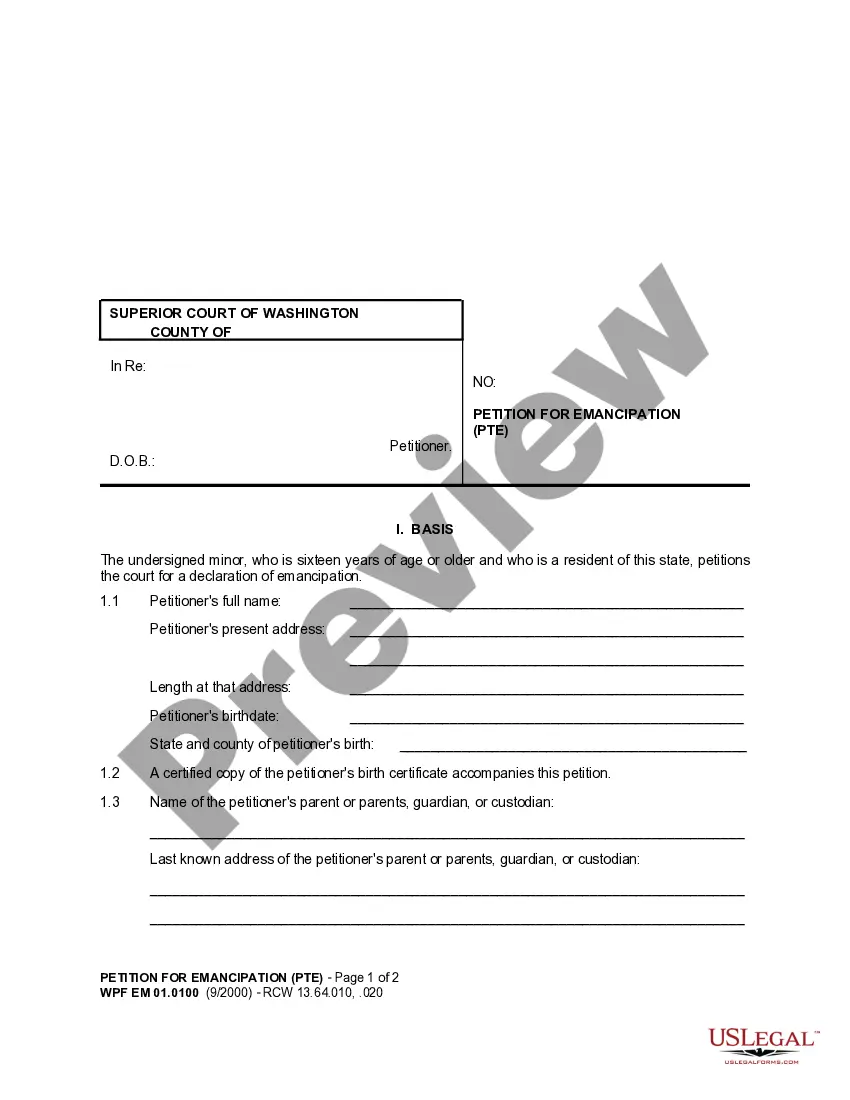

- Analyze the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!