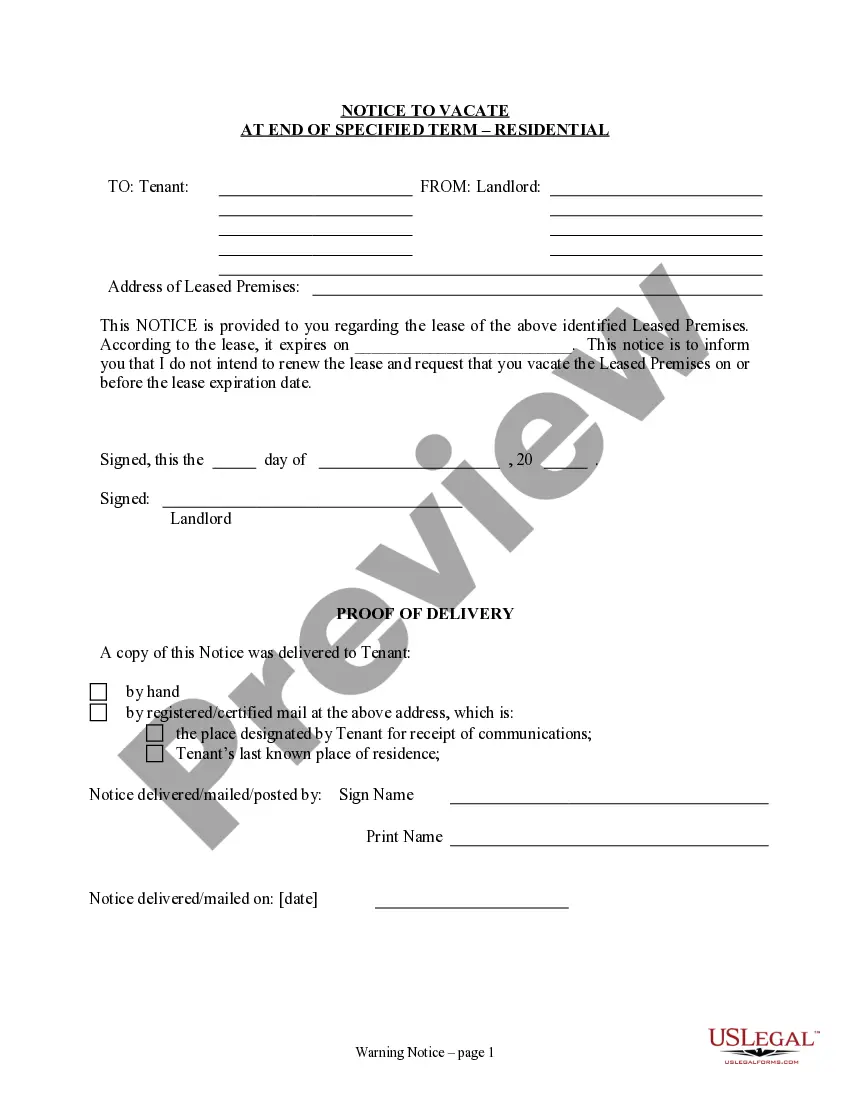

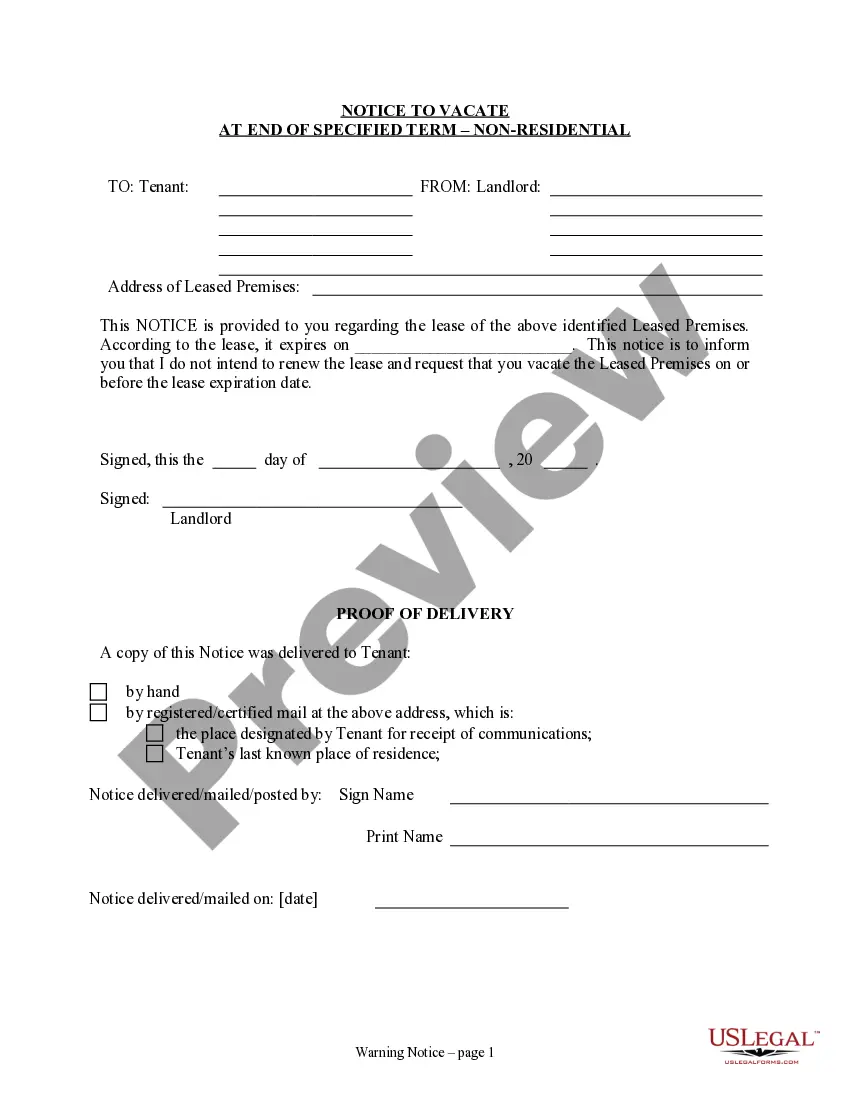

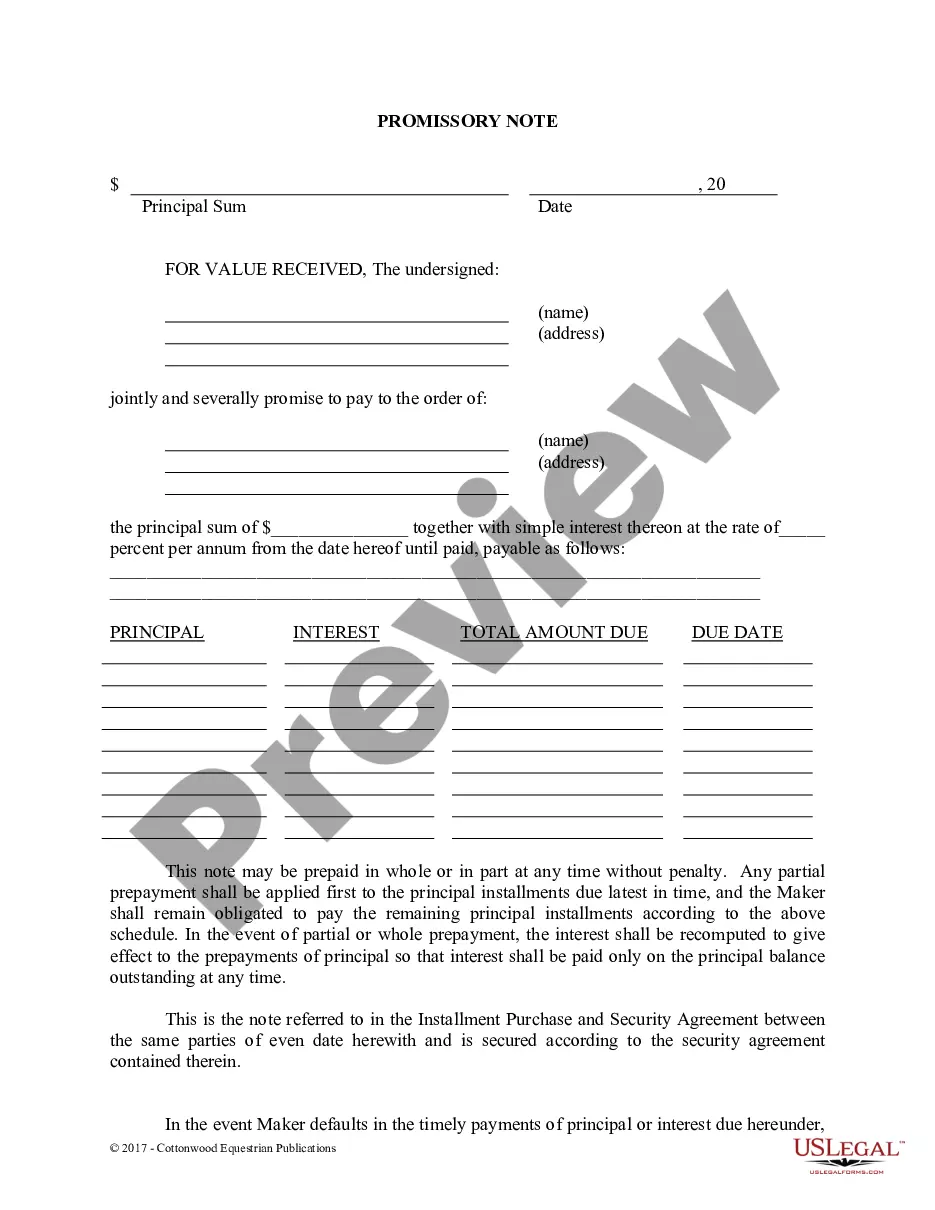

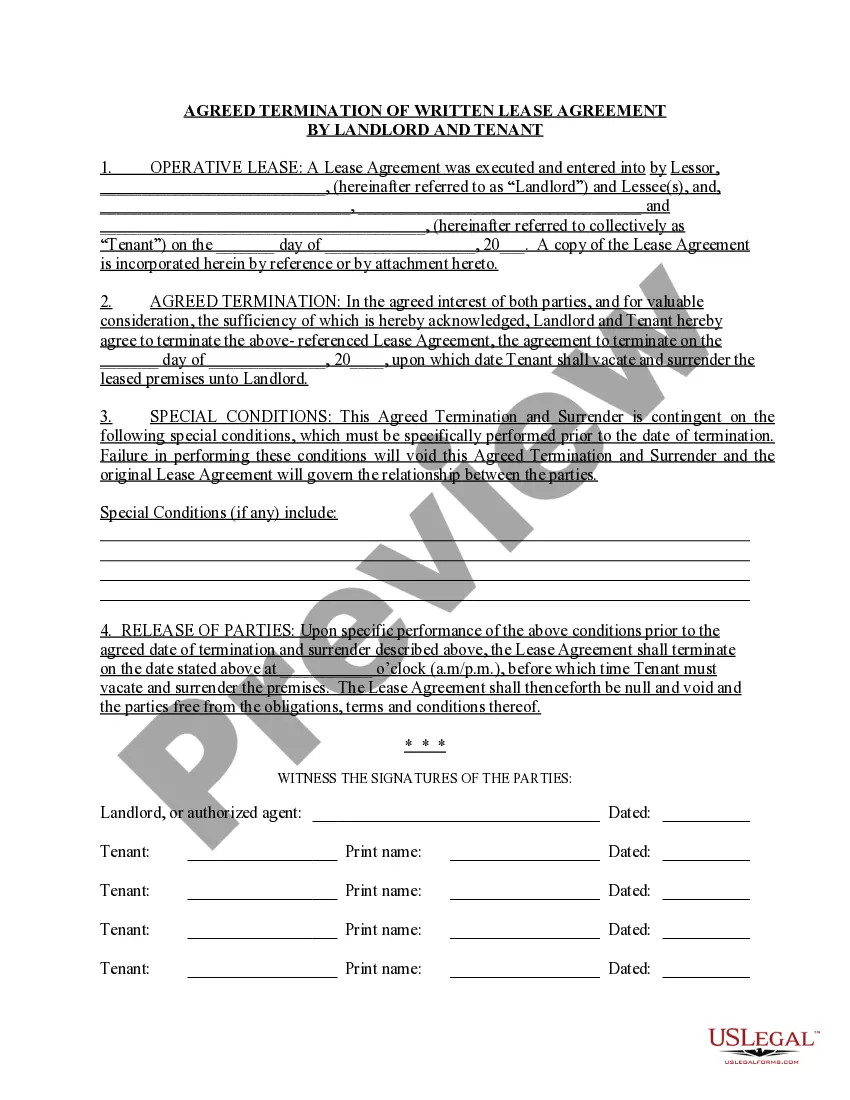

Maricopa, Arizona Occupancy Affidavit and Financial Status: A Detailed Description In Maricopa, Arizona, an Occupancy Affidavit and Financial Status form is a legal document required in various circumstances to verify a person's occupancy and financial situation. This document is used by landlords, property managers, banks, and other relevant entities to obtain crucial information about an individual's financial standing and the status of their occupancy in a property or dwelling. The Maricopa Occupancy Affidavit and Financial Status form typically consists of multiple sections that collect specific details about the person's financial situation and housing occupancy. Some key sections and relevant keywords that may be included in this document are: 1. Personal Information: This section gathers personal details such as full name, address, contact information, and social security number. These pieces of information are essential for identification and verification purposes. 2. Housing Occupancy Details: In this section, the individual must provide comprehensive information about their current housing situation. This includes the address of the property, duration of occupancy, names of other occupants, and any lease or rental agreements associated with the property. 3. Financial Status: The financial section of the Occupancy Affidavit requires individuals to divulge their income, employment status, and details of any other financial resources they may have, such as investments, retirement funds, or savings accounts. This section aims to assess the person's financial stability and ability to meet their financial obligations. 4. Credit History: In some cases, the document may require individuals to disclose their credit history, including outstanding debts, credit scores, and any bankruptcy or foreclosure records. This information is relevant for landlords and financial institutions when assessing the individual's creditworthiness. 5. Declarations and Signatures: At the conclusion of the form, individuals are required to sign the affidavit, declaring that all the information provided is accurate to the best of their knowledge. The signature holds them legally responsible for the contents of the document. It is important to note that variations of the Maricopa Occupancy Affidavit and Financial Status form may exist depending on the specific purpose it serves. For instance, there might be different versions for rental applications, mortgage applications, or loan agreements. These variants cater to the unique requirements of each scenario, ensuring the gathering of relevant information tailored to the particular situation. To summarize, the Maricopa, Arizona Occupancy Affidavit and Financial Status form is a critical document used in legal and financial matters to ascertain a person's housing occupancy and financial situation. Its purpose is to validate the individual's claims and provide vital information to relevant parties involved in rental agreements, property purchases, or loan applications. By collecting precise details about the person's financial stability and housing arrangements, it assists landlords, banks, and other institutions in making informed decisions regarding tenancy, lending, or credit approvals.

Maricopa Arizona Occupancy Affidavit and Financial Status

Description

How to fill out Maricopa Arizona Occupancy Affidavit And Financial Status?

Do you need to quickly draft a legally-binding Maricopa Occupancy Affidavit and Financial Status or probably any other form to take control of your own or corporate affairs? You can select one of the two options: contact a professional to draft a legal document for you or create it entirely on your own. Thankfully, there's a third option - US Legal Forms. It will help you get professionally written legal paperwork without having to pay unreasonable fees for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-specific form templates, including Maricopa Occupancy Affidavit and Financial Status and form packages. We provide templates for a myriad of use cases: from divorce papers to real estate document templates. We've been on the market for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra troubles.

- First and foremost, double-check if the Maricopa Occupancy Affidavit and Financial Status is tailored to your state's or county's laws.

- In case the form comes with a desciption, make sure to check what it's intended for.

- Start the searching process over if the form isn’t what you were seeking by using the search box in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Maricopa Occupancy Affidavit and Financial Status template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. In addition, the templates we provide are reviewed by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!