San Antonio Texas Flood Insurance Authorization is a crucial provision that allows homeowners and property owners in San Antonio, Texas, to gain financial protection against flooding and its devastating aftermath. Flood insurance is a specialized form of coverage that specifically safeguards against damages caused by floods, which are not typically covered under standard homeowners' insurance policies. To provide a comprehensive description, it is important to cover different types of flood insurance authorizations available in San Antonio, Texas. These include: 1. National Flood Insurance Program (FIP) Authorization: The FIP is administered by the Federal Emergency Management Agency (FEMA) and offers flood insurance coverage to property owners in communities that participate in the program. San Antonio, Texas, is one such community, enabling residents to apply for FIP flood insurance authorization. 2. Private Flood Insurance Authorization: In addition to the FIP, private insurance companies also offer flood insurance policies. These policies provide an alternative to the FIP and can often offer more tailored coverage options or higher coverage limits. Homeowners in San Antonio, Texas, have the option to choose private flood insurance authorization if it better meets their needs. With flood insurance authorization, property owners in San Antonio, Texas, can enjoy several benefits. Firstly, their property and belongings are protected against the potential financial devastation caused by flooding. Floods can occur due to heavy rains, hurricanes, storm surges, or even flash floods, and the resulting damage can be extremely costly to repair or replace. Secondly, having flood insurance authorization allows property owners to access financial resources to recover from flood-related damages. Flood insurance provides compensation for repair and replacement costs, including structural damage, damaged electrical systems, water damage to personal belongings, and even the cost of temporary accommodation during repairs. Flood insurance authorization in San Antonio, Texas, ensures that property owners are well-prepared and equipped to face the unpredictable nature of flooding in the region. It is important to note that flood insurance may have certain restrictions and coverage limits, so homeowners should carefully review their policy to understand the specifics. In conclusion, San Antonio Texas Flood Insurance Authorization provides homeowners and property owners with financial protection against the damaging effects of floods. Whether through the National Flood Insurance Program or private insurance companies, property owners can secure coverage that prepares them for the potential risks associated with flooding. By obtaining flood insurance, individuals are taking a proactive step towards safeguarding their property, belongings, and financial stability in the face of unexpected flooding events.

San Antonio Texas Flood Insurance Authorization

Description

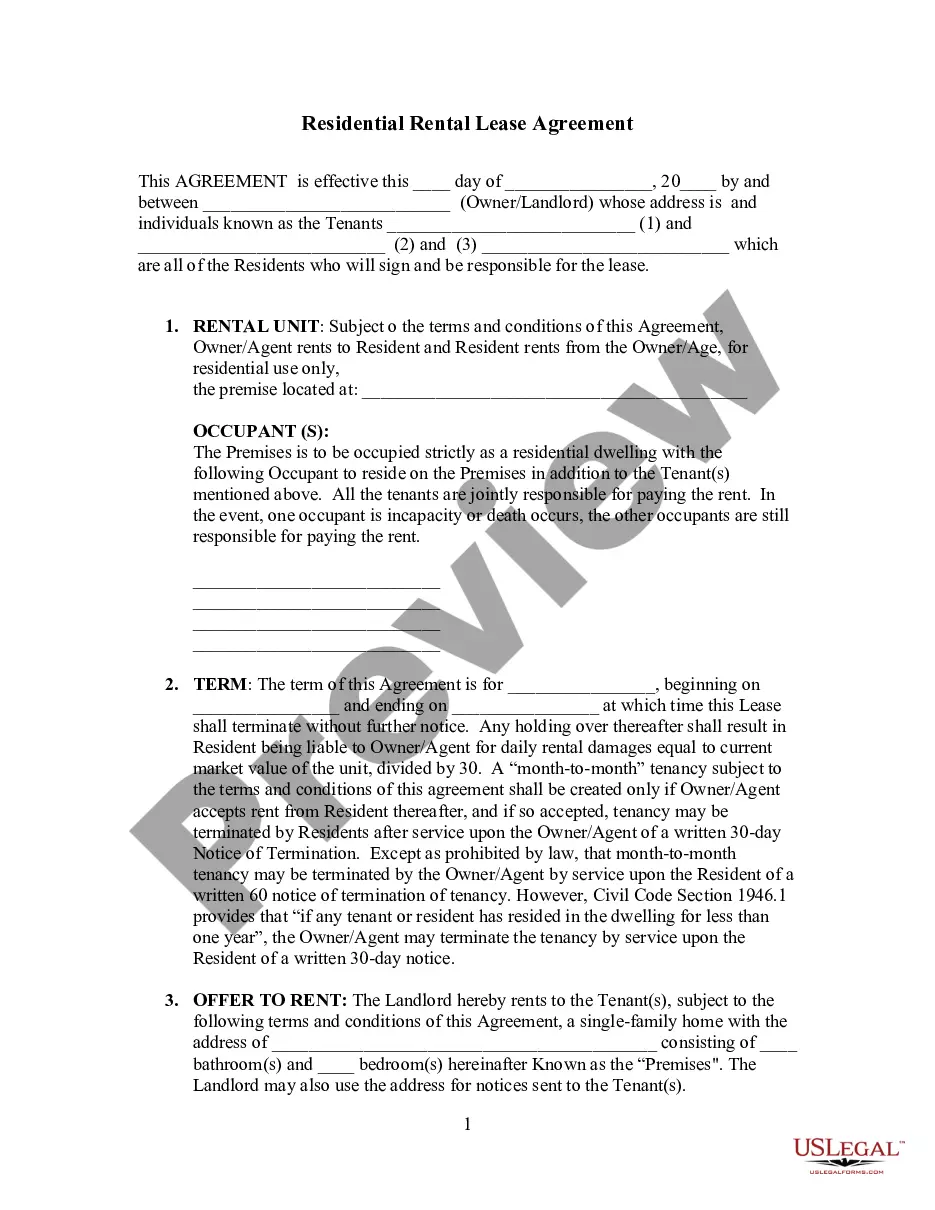

How to fill out San Antonio Texas Flood Insurance Authorization?

Do you need to quickly create a legally-binding San Antonio Flood Insurance Authorization or probably any other document to handle your personal or corporate matters? You can select one of the two options: hire a professional to draft a legal document for you or create it entirely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you get neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-specific document templates, including San Antonio Flood Insurance Authorization and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the needed template without extra troubles.

- To start with, double-check if the San Antonio Flood Insurance Authorization is adapted to your state's or county's laws.

- In case the document comes with a desciption, make sure to check what it's suitable for.

- Start the search again if the document isn’t what you were seeking by utilizing the search bar in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the San Antonio Flood Insurance Authorization template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. Additionally, the templates we offer are updated by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!