San Diego California Flood Insurance Authorization is a crucial document that provides financial protection against flood-related damages in the city of San Diego, California. This insurance policy is specifically designed to cover losses and damages caused by flooding, ensuring homeowners, businesses, and property owners are financially safeguarded. Flood Insurance Authorization in San Diego, California, offers comprehensive coverage for both residential and commercial properties located in flood-prone areas. It is highly recommended for all property owners, as standard homeowners' insurance policies typically do not include protection from flood damages. The two main types of San Diego California Flood Insurance Authorization are: 1. National Flood Insurance Program (FIP) Policies: These policies are provided by the Federal Emergency Management Agency (FEMA), which runs the FIP. These policies are available to homeowners, renters, and business owners in San Diego, California, regardless of whether their property is located in a floodplain. FIP policies cover both the building structure and its contents. 2. Private Flood Insurance Policies: In addition to FIP policies, private insurance companies also offer flood insurance coverage in San Diego, California. These policies may provide additional coverage options and higher policy limits compared to FIP policies. Private flood insurance policies can be tailored to specific needs and may offer enhanced protection for high-value properties or buildings with unique features. Obtaining San Diego California Flood Insurance Authorization is essential for homeowners and businesses, as floods can cause substantial and costly damages to properties, including structural damage, destruction of personal belongings, and the need for extensive cleanup and restoration. Without flood insurance, individuals may be left with significant financial burdens that are challenging to recover from. In conclusion, San Diego California Flood Insurance Authorization is a vital protective measure against flood-related losses and damages. Whether through FIP policies or private insurance options, it is crucial for property owners to secure proper coverage to ensure financial stability in the event of a flood.

San Diego California Flood Insurance Authorization

Description

How to fill out San Diego California Flood Insurance Authorization?

Whether you intend to start your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like San Diego Flood Insurance Authorization is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to get the San Diego Flood Insurance Authorization. Adhere to the guidelines below:

- Make sure the sample meets your personal needs and state law regulations.

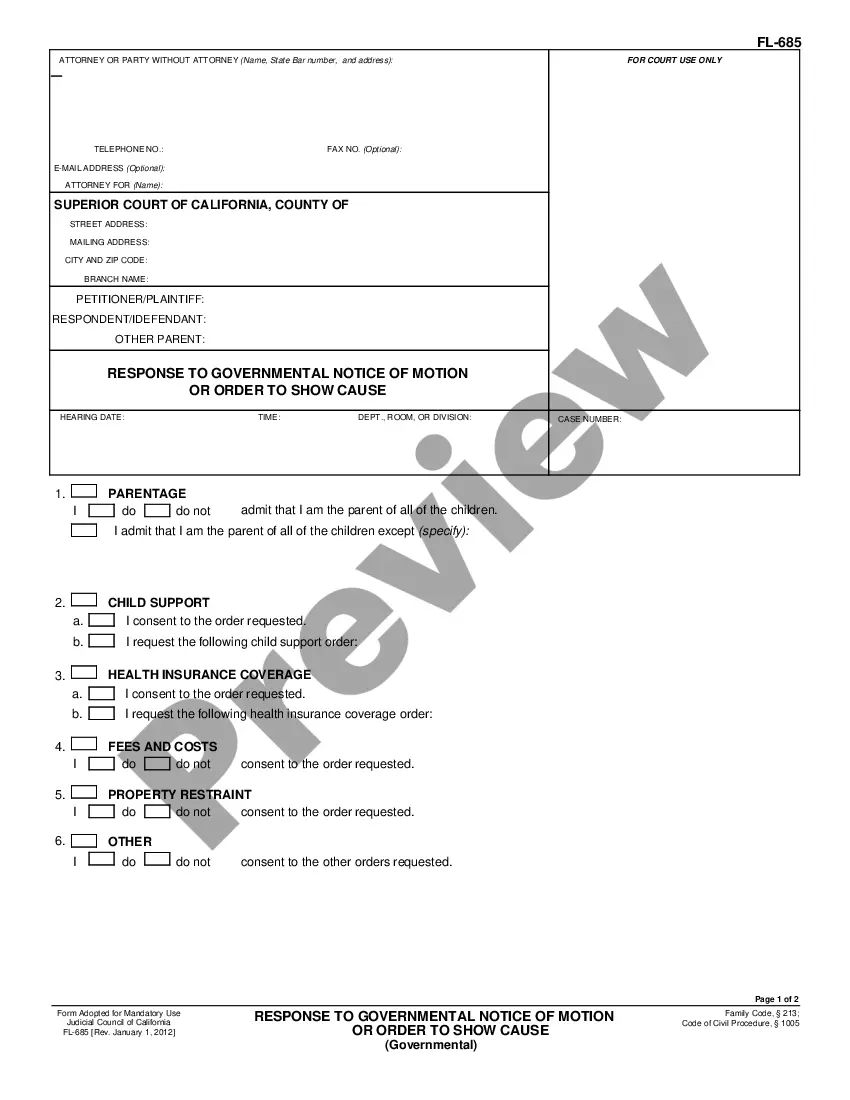

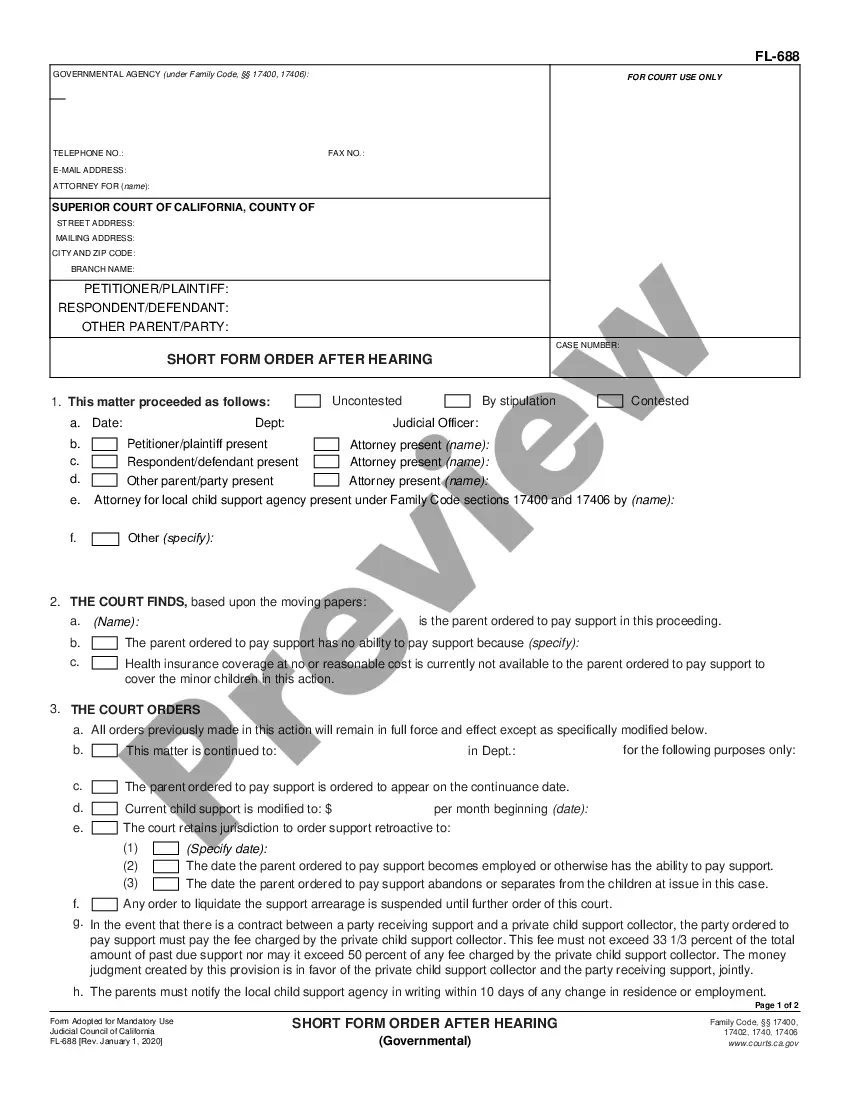

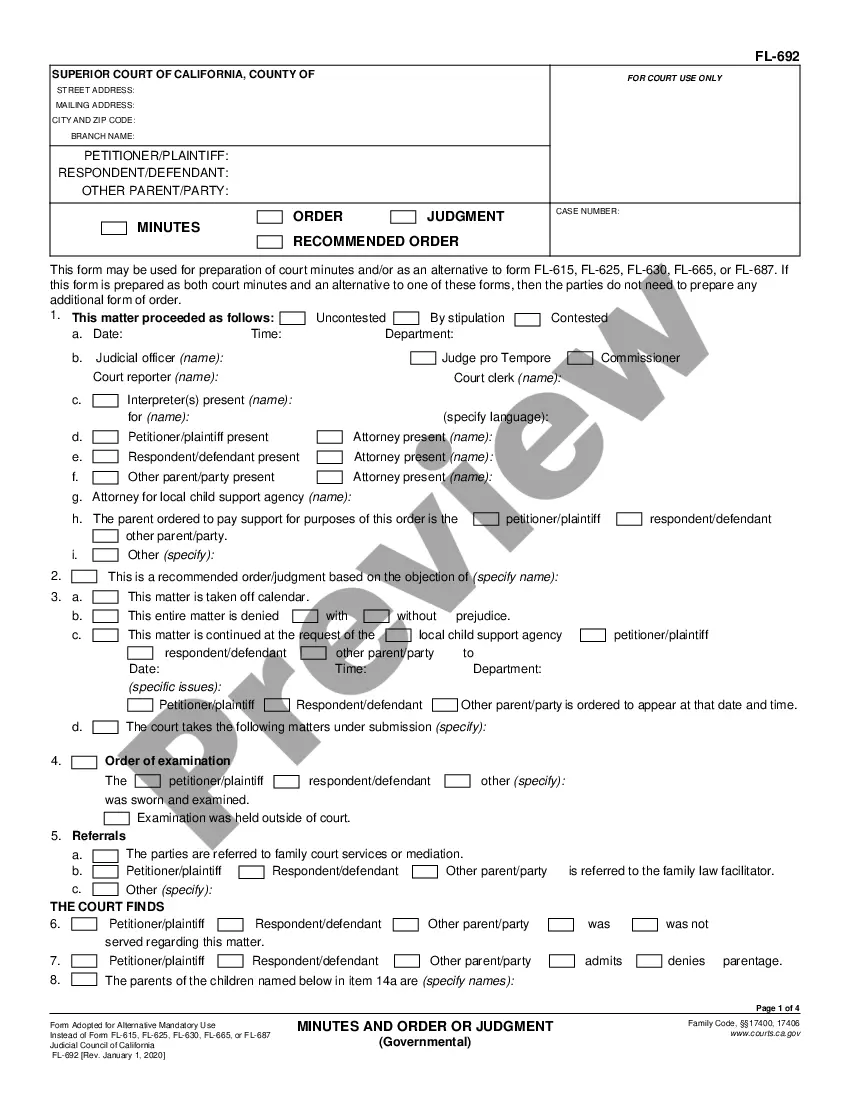

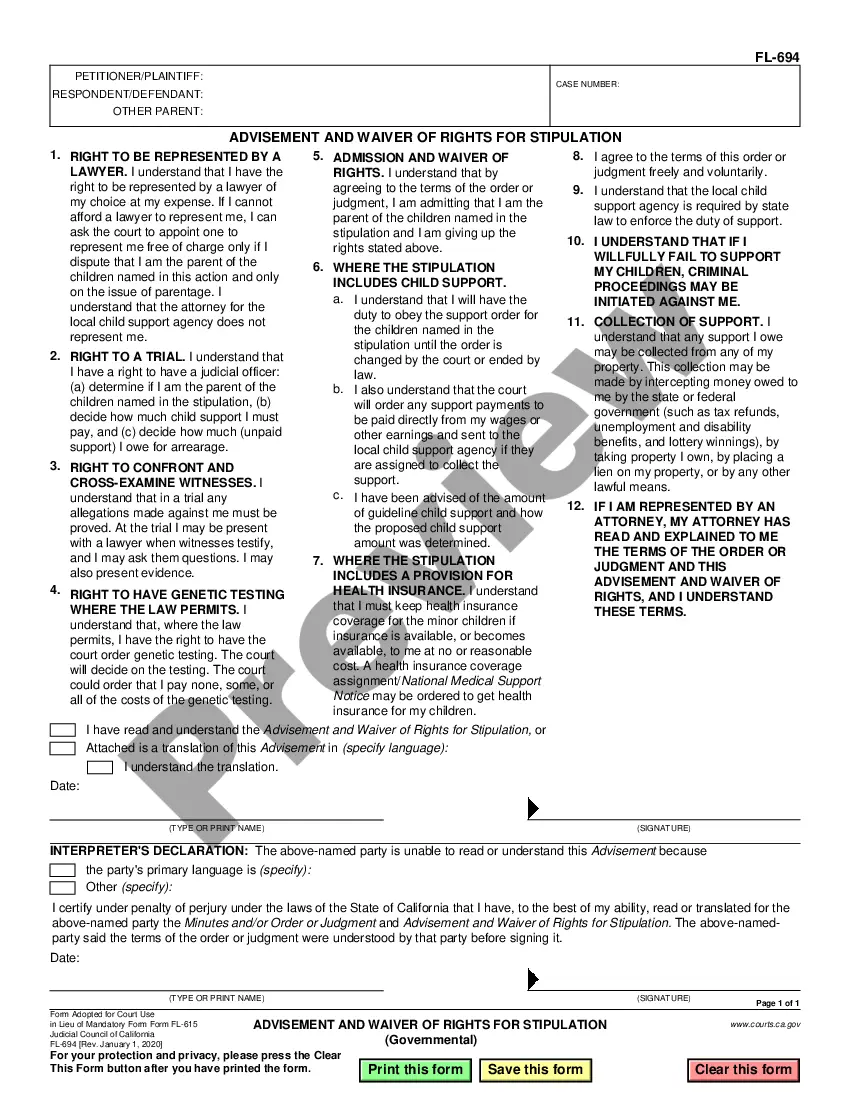

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Flood Insurance Authorization in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!