Santa Clara California Flood Insurance Authorization is a legal document that grants individuals or property owners in Santa Clara, California the coverage and protection against damages caused by flood-related incidents. Floods are natural disasters that can be devastating, leading to significant property damage, financial losses, and emotional distress. Obtaining flood insurance authorization is crucial for property owners as it ensures financial security and allows them to recover and rebuild in the aftermath of a flood event. There are different types of Santa Clara California Flood Insurance Authorization policies available to cater to the unique needs and requirements of individuals and businesses. These types include: 1. Residential Flood Insurance Authorization: This type of authorization is specifically designed for homeowners and residents in Santa Clara, California. It offers coverage for structural damages, personal property losses, and other related expenses caused by floods. Residential flood insurance is essential for safeguarding homes, belongings, and providing financial support for rebuilding or repairs. 2. Commercial Flood Insurance Authorization: This type of authorization is geared towards business owners and commercial property owners in Santa Clara, California. It provides protection against flood damages to commercial buildings, inventory, equipment, and furniture. Commercial flood insurance is vital for ensuring business continuity and minimizing financial losses due to flood-related disruptions. 3. National Flood Insurance Program (FIP): The FIP is a federal program that operates in Santa Clara, California and offers flood insurance authorization to property owners. It was established to provide affordable flood insurance options to individuals and communities at high risk of flooding. The FIP policies are available for both residential and commercial properties, providing essential coverage for flood damages. 4. Excess Flood Insurance: Excess flood insurance authorization provides additional coverage above and beyond the limits set by the FIP. It is suitable for property owners who require higher coverage limits due to the high value of their property, belongings, or business assets. 5. Preferred Risk Policy: The Preferred Risk Policy is another type of flood insurance authorization offered by the FIP. It is specifically designed for properties in low-to-moderate risk flood zones, offering affordable coverage to property owners who may face a lower risk of flooding. In conclusion, Santa Clara California Flood Insurance Authorization is a crucial document that grants property owners the necessary coverage and financial protection against flood-related damages. Different types of flood insurance policies are available, ranging from residential and commercial authorizations to programs like FIP and excess flood insurance. Having flood insurance authorization allows property owners to mitigate the financial impact of floods and aids in the recovery process after such disasters occur.

Santa Clara California Flood Insurance Authorization

Description

How to fill out Santa Clara California Flood Insurance Authorization?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare official paperwork that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any personal or business objective utilized in your county, including the Santa Clara Flood Insurance Authorization.

Locating samples on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Santa Clara Flood Insurance Authorization will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Santa Clara Flood Insurance Authorization:

- Make sure you have opened the right page with your local form.

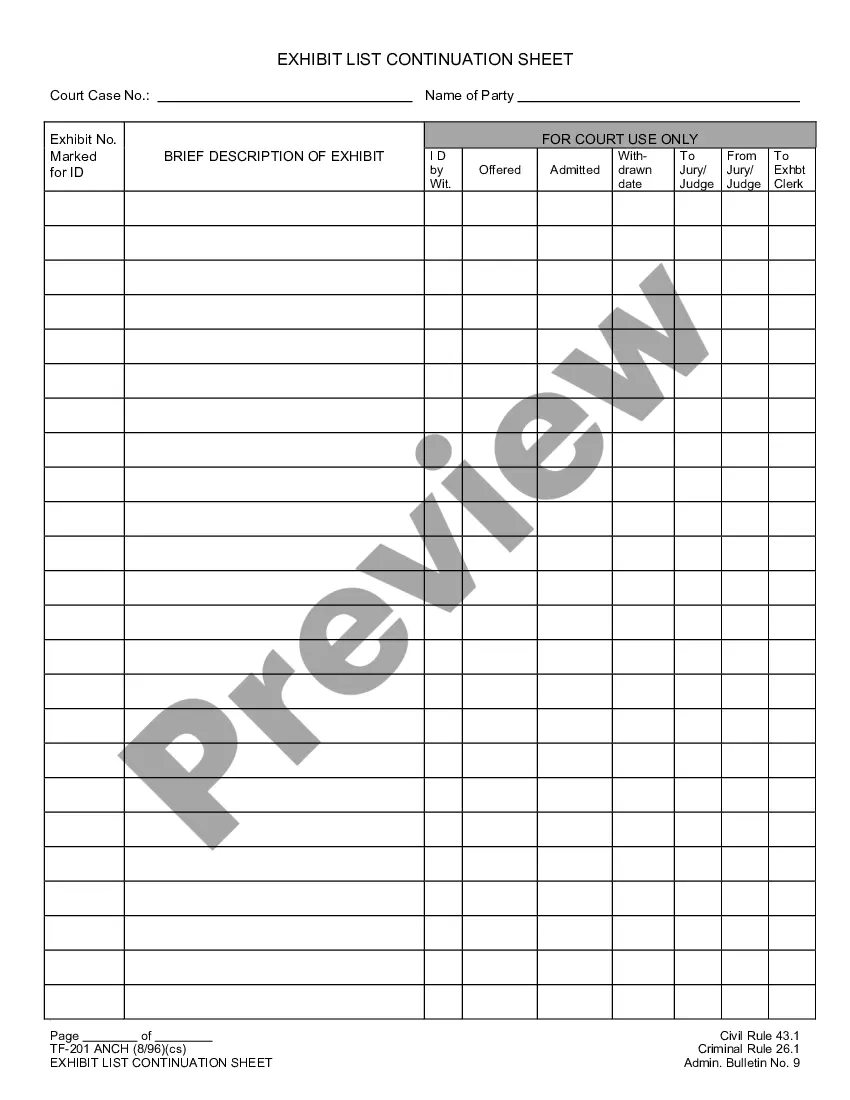

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Santa Clara Flood Insurance Authorization on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!