Collin Texas Self-Employed Independent Contractor Questionnaire

Description

How to fill out Self-Employed Independent Contractor Questionnaire?

Are you seeking to swiftly generate a legally-binding Collin Self-Employed Independent Contractor Questionnaire or perhaps any other document to manage your personal or business matters.

You can opt for one of the two alternatives: reach out to a legal consultant to draft a legitimate document for you or produce it entirely by yourself. The encouraging news is, there exists another option - US Legal Forms. It will assist you in obtaining professionally crafted legal documents without incurring exorbitant costs for legal services.

If the document is not what you anticipated to find, restart the searching process by utilizing the search bar in the header.

Choose the subscription that best fits your requirements and proceed to payment. Select the format in which you would like to receive your form and download it. Print it, complete it, and sign where indicated. If you have previously created an account, you can easily Log In, locate the Collin Self-Employed Independent Contractor Questionnaire template, and download it. To retrieve the form again, simply navigate to the My documents tab. It is straightforward to locate and download legal forms using our catalog. Furthermore, the documents we provide are updated by industry professionals, ensuring you greater peace of mind when addressing legal matters. Experience US Legal Forms now and see for yourself!

- US Legal Forms provides an extensive collection of over 85,000 state-compliant document templates, including Collin Self-Employed Independent Contractor Questionnaire and form packages.

- We supply documents for various use cases: from divorce paperwork to real estate document templates.

- We have been operating in the market for more than 25 years and have established a robust reputation among our clients.

- Here’s how you can join them and obtain the required document without unnecessary complications.

- First, carefully confirm if the Collin Self-Employed Independent Contractor Questionnaire is aligned with your state's or county's regulations.

- If the form includes a description, ensure to verify its suitability.

Form popularity

FAQ

The purpose of the Contractor's Questionnaire is to develop sufficient information to assist the underwriter in evaluating the contractor's qualifications, in order that the underwriter will be in a position to provide the maximum bonding capacity. All information must be complete.

Bachman suggests independent contract workers ask the following questions. If the firm decides to end my contract early, what is the minimum notice will you commit to provide? What are the payment terms? Will I be required to work a set schedule? Or can I work on my own schedule as long as my work is done on time?

A worker does not have to meet all 20 criteria to qualify as an employee or independent contractor, and no single factor is decisive in determining a worker's status. The individual circumstances of each case determine the weight IRS assigns different factors.

The 5 personality traits that make a successful contractor Confidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.

What is the IRS 20-Factor Test? The IRS 20-Factor Test, commonly referred to as the Right-to-Control Test, is designed to evaluate who controls how the work is performed. According to the IRS's Common-Law Rules, a worker's status corresponds to the level of control and independence they have over their work.

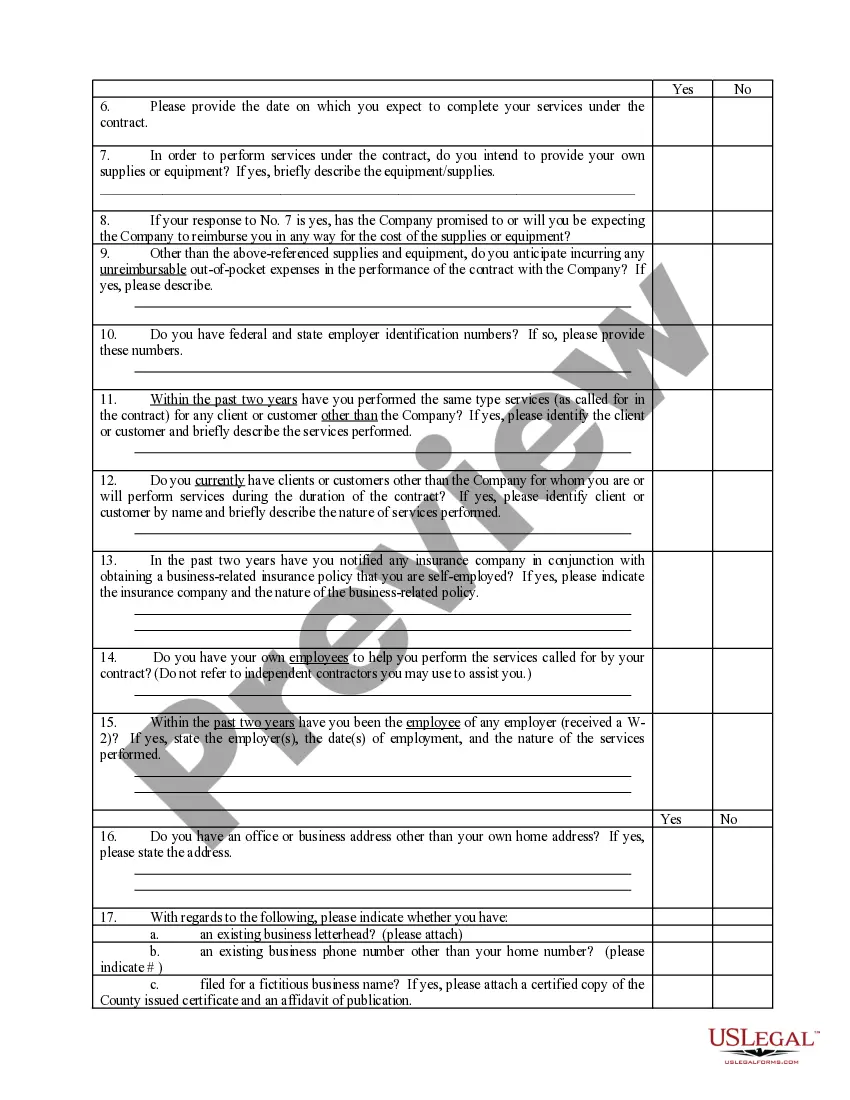

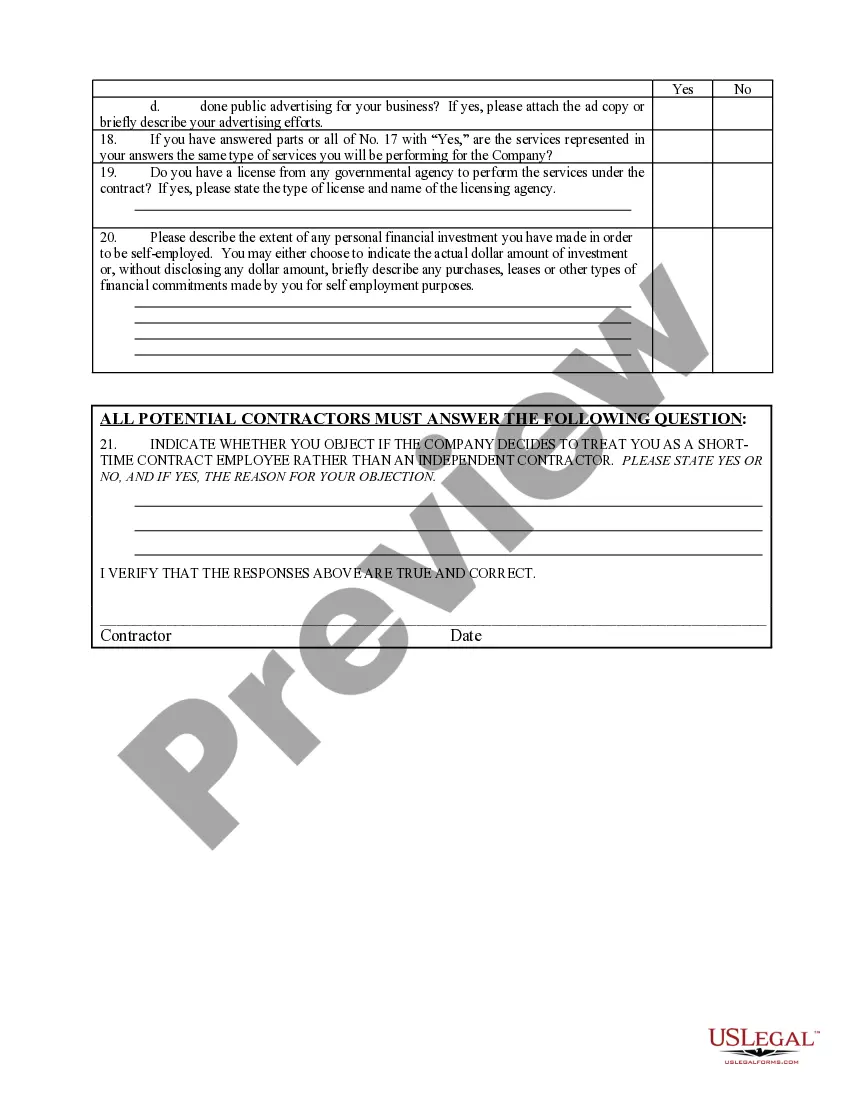

Independent Contractor Questionnaire. The Independent Contractor Questionnaire (ICQ) is completed by the buyer in cooperation with the vendor to assist in Independent Contractor (IC) or employee determinations. Proper classification of individuals is critical to appropriately process and make payments for services.

What Is the ABC Test? The ABC test is a test employers must pass to classify a worker as an independent contractor in many states and according to the U.S. Department of Labor. Employers are responsible for the correct categorization of workers or could face costly fines.

When deciding whether you can safely treat a worker as an independent contractor, there are two separate tests you should consider: The common law test; and The reasonable basis test. The common law test: IRS examiners use the 20-factor common law test to measure how much control you have over the worker.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used