Cuyahoga Ohio Exemption Statement — Texas is a legal document that pertains to individuals or businesses residing in Cuyahoga County, Ohio, but claiming an exemption from certain taxes or regulations in the state of Texas. This statement serves as a proof or declaration of the exemption status for tax or regulatory purposes. There are different types of Cuyahoga Ohio Exemption Statement — Texas based on the specific exemption being sought. Some common types include: 1. Property Tax Exemption Statement: This documentation is utilized by property owners in Cuyahoga County, Ohio, who own properties in Texas and wish to claim an exemption on property taxes based on applicable laws and regulations in Texas. 2. Sales Tax Exemption Statement: This type of statement is relevant for businesses or individuals based in Cuyahoga County but involved in sales or transactions in Texas. They can claim an exemption from certain sales taxes by submitting the Cuyahoga Ohio Exemption Statement — Texas as evidence. 3. Business Licensing Exemption Statement: This statement applies to businesses headquartered in Cuyahoga County that wish to operate in Texas without obtaining certain state-specific licenses or permits. By submitting the exemption statement, they can establish their eligibility for exemption from particular licensing requirements. 4. Employment Tax Exemption Statement: This type of statement may be used by Cuyahoga County employers who have employees in Texas and wish to claim an exemption from specific employment-related taxes or contributions in Texas government programs. 5. Special Exemption Statement: This category includes any unique or specific exemptions that may not fall into the mentioned types. This could apply to individuals or businesses who seek an exemption in Texas based on a non-standard circumstance or regulation. Overall, a Cuyahoga Ohio Exemption Statement — Texas is an essential document for individuals or businesses operating in Cuyahoga County, Ohio, seeking exemptions from taxes or regulations in the state of Texas. By submitting the appropriate type of exemption statement, they can establish their eligibility and comply with legal requirements in both jurisdictions.

Cuyahoga Ohio Exemption Statement

Description

How to fill out Cuyahoga Ohio Exemption Statement?

Whether you plan to open your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Cuyahoga Exemption Statement - Texas is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Cuyahoga Exemption Statement - Texas. Follow the guide below:

- Make certain the sample meets your personal needs and state law requirements.

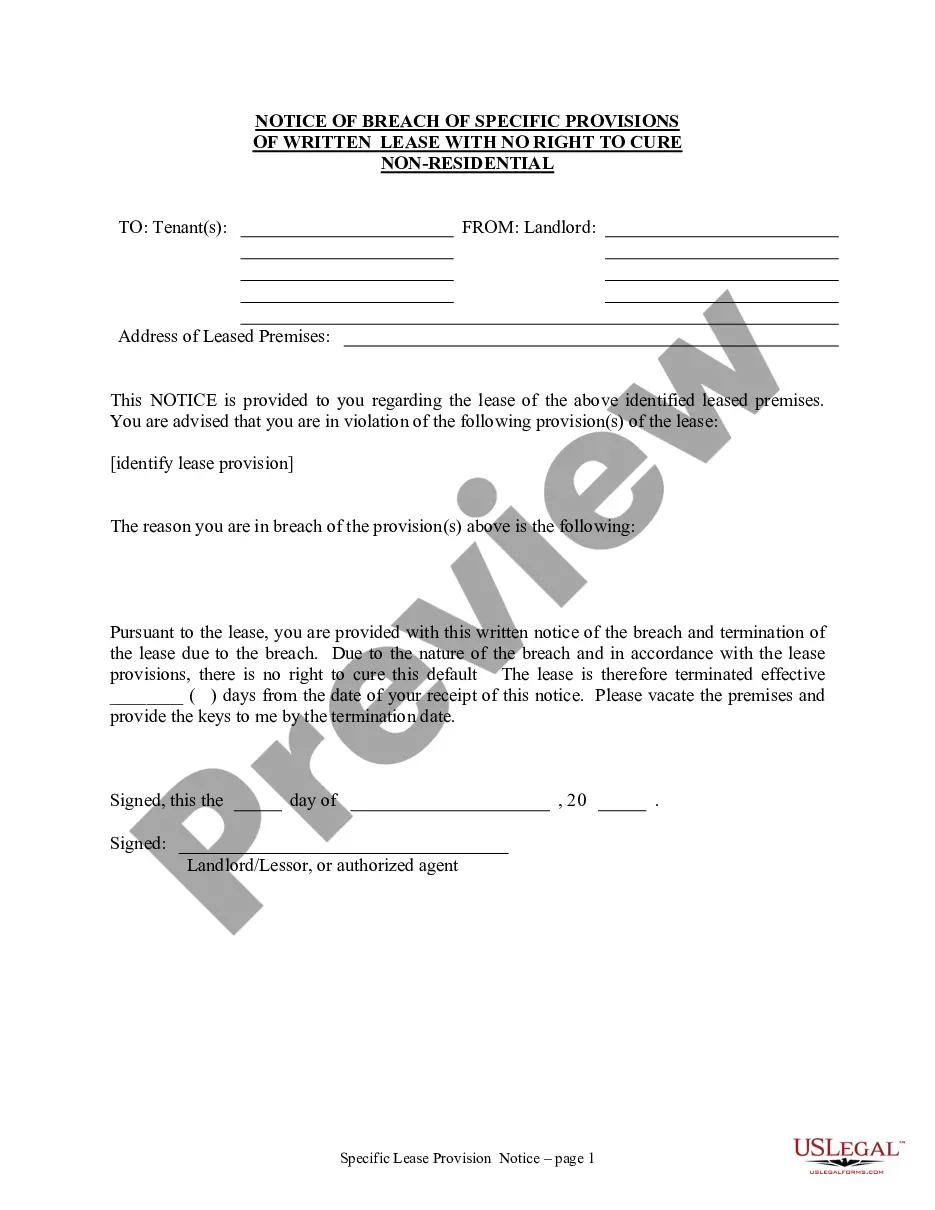

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Cuyahoga Exemption Statement - Texas in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!