Kings New York Exemption Statement — Texas is a legal document that applies specifically to residents of Texas. This statement is designed to inform individuals about the exemptions they may be eligible for under the state's laws. Here are some key points and types of exemptions covered in the Kings New York Exemption Statement — Texas: 1. Homestead Exemption: This exemption allows Texas homeowners to reduce the assessed value of their primary residence for property tax purposes. It provides financial relief by lowering the overall tax burden. 2. Personal Property Exemptions: Texans may be eligible for exemptions on personal property such as furniture, vehicles, and appliances. These exemptions vary depending on the value and type of personal property owned. 3. Agricultural Exemptions: Individuals engaged in agricultural activities, such as farming or ranching, may be eligible for special tax exemptions on their land, equipment, and livestock. These exemptions aim to support the state's agriculture industry. 4. Disabled Veteran Exemption: Disabled veterans who meet certain criteria can apply for property tax exemptions on their primary residence. This exemption recognizes the sacrifices made by veterans and provides additional support to those in need. 5. Religious and Charitable Organization Exemptions: Churches, religious organizations, and charitable entities may be eligible for property and sales tax exemptions in Texas. These exemptions encourage the promotion of religious and charitable activities across the state. 6. Special Exemptions: The Kings New York Exemption Statement — Texas may also cover other types of exemptions, such as exemptions for disabled individuals, senior citizens, and military personnel. These exemptions are aimed at providing financial relief and support to those in specific circumstances. It is important to note that the Kings New York Exemption Statement — Texas should be reviewed thoroughly, as eligibility criteria, application procedures, and exemptions offered may vary. It is advisable to consult with legal professionals or the appropriate Texas governmental authorities to ensure accurate and up-to-date information when applying for any exemption mentioned in the statement.

Kings New York Exemption Statement

Description

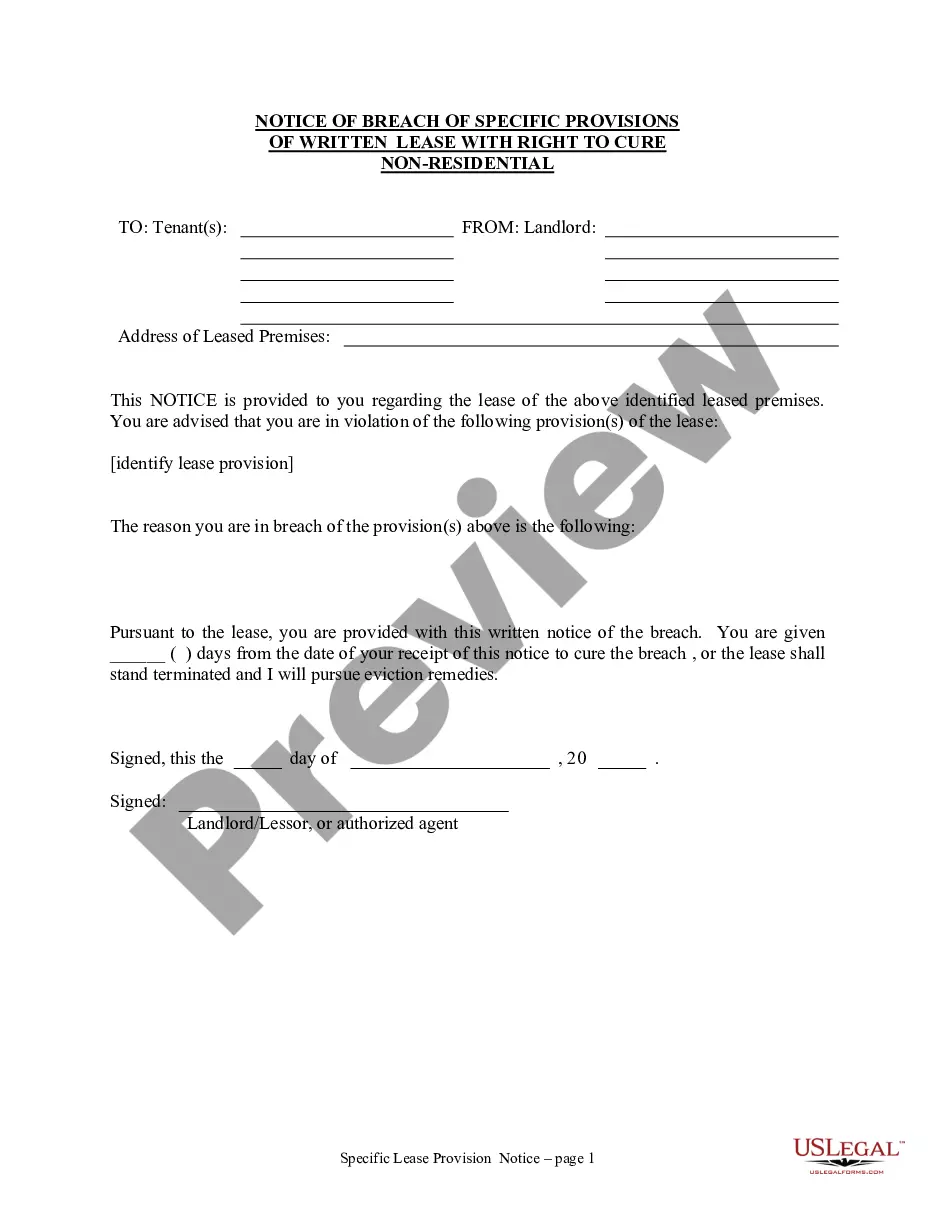

How to fill out Kings New York Exemption Statement?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Kings Exemption Statement - Texas, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Kings Exemption Statement - Texas from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Kings Exemption Statement - Texas:

- Examine the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document when you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You must include the Ag/Timber Number on the agricultural exemption certificate (PDF) or the timber exemption certificate (PDF) when buying qualifying items.

How Do I Apply for It? Visit the tax appraisal website for your county to find any specific instructions. Obtain a copy of the Application of Residential Homestead Exemption (a.k.a., Property Tax Form 50-114) from your local appraisal district.

You may file a late application for a residential homestead exemption up to two years after the date the taxes become delinquent. You will get a new tax bill with a lower amount or refund if you already paid. 3.

How do I apply for a homestead exemption? To apply for a homestead exemption, you need to submit an application with your county appraisal district. Filing an application is free and only needs to be filed once. The application can be found on your appraisal district website or using Texas Comptroller Form 50-114.

In Texas, the residential homestead exemption entitles the homeowner to a $25,000 reduction in value for school tax purposes. Counties, cities, and special taxing districts may offer homestead exemptions up to 20% of the total value. Most counties in North Texas do offer this 20% reduction.

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

There is no need to reapply annually unless that chief appraiser sends you a new application. The general qualifications for the Residence Homestead exemption include the following: You must complete the application and provide any additional supporting documents as required by the Texas Property Tax Code.

Texas Homestead Exemption Explained - How to Fill- YouTube YouTube Start of suggested clip End of suggested clip Residence. So in order to be approved for this residence residential exemption you do need to occupyMoreResidence. So in order to be approved for this residence residential exemption you do need to occupy the property on the first day of january of the year that you're seeking.

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.

How do I apply for a homestead exemption? To apply for a homestead exemption, you need to submit an application with your county appraisal district. Filing an application is free and only needs to be filed once. The application can be found on your appraisal district website or using Texas Comptroller Form 50-114.