Oakland Michigan Exemption Statement — Texas is a legal document that serves as an exemption claim issued by Oakland County, Michigan, for properties owned by individuals or organizations residing or conducting businesses in Texas. This statement is significant for identifying properties that are exempt from certain taxes or have special tax classifications. The Oakland Michigan Exemption Statement — Texas assures that the property owner meets specific criteria as defined by Oakland County to qualify for tax exemptions or special classifications within the state of Texas. It serves as evidence of entitlement to exemption benefits for various purposes, such as reducing property taxes or qualifying for specific tax incentives. There are several types of Oakland Michigan Exemption Statements — Texas that are relevant to different categories of property owners or organizations: 1. Residential Exemption: This exemption is applicable to individuals who own residential properties in Texas. It allows them to claim exemptions on their primary residences, reducing their annual property tax obligations. 2. Agricultural Exemption: This exemption applies to properties used for agricultural purposes, such as farming, ranching, or timber production. Qualifying property owners can benefit from reduced taxes and other special tax treatments related to their agricultural operations. 3. Nonprofit Organization Exemption: This exemption is specifically for nonprofit organizations operating in Texas. It allows them to claim exemptions on their properties, provided they meet certain criteria as defined by the Oakland County guidelines. 4. Economic Development Exemption: This exemption is aimed at encouraging economic growth and attracting new businesses to Texas. It offers tax incentives to qualifying businesses, such as reduced property taxes, in order to stimulate investment and job creation. 5. Historic Preservation Exemption: This exemption targets historically significant properties. Property owners who own and maintain buildings or structures with historical significance can apply for this exemption, which helps preserve and protect the state's historical heritage. These are just a few examples of the Oakland Michigan Exemption Statement — Texas types that property owners or organizations may encounter. It's important to consult with legal and tax professionals, as well as refer to the specific guidelines provided by Oakland County, to determine which exemptions might be applicable and how to properly apply for them.

Oakland Michigan Exemption Statement

Description

How to fill out Oakland Michigan Exemption Statement?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare official documentation that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any personal or business purpose utilized in your region, including the Oakland Exemption Statement - Texas.

Locating forms on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Oakland Exemption Statement - Texas will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to obtain the Oakland Exemption Statement - Texas:

- Make sure you have opened the proper page with your regional form.

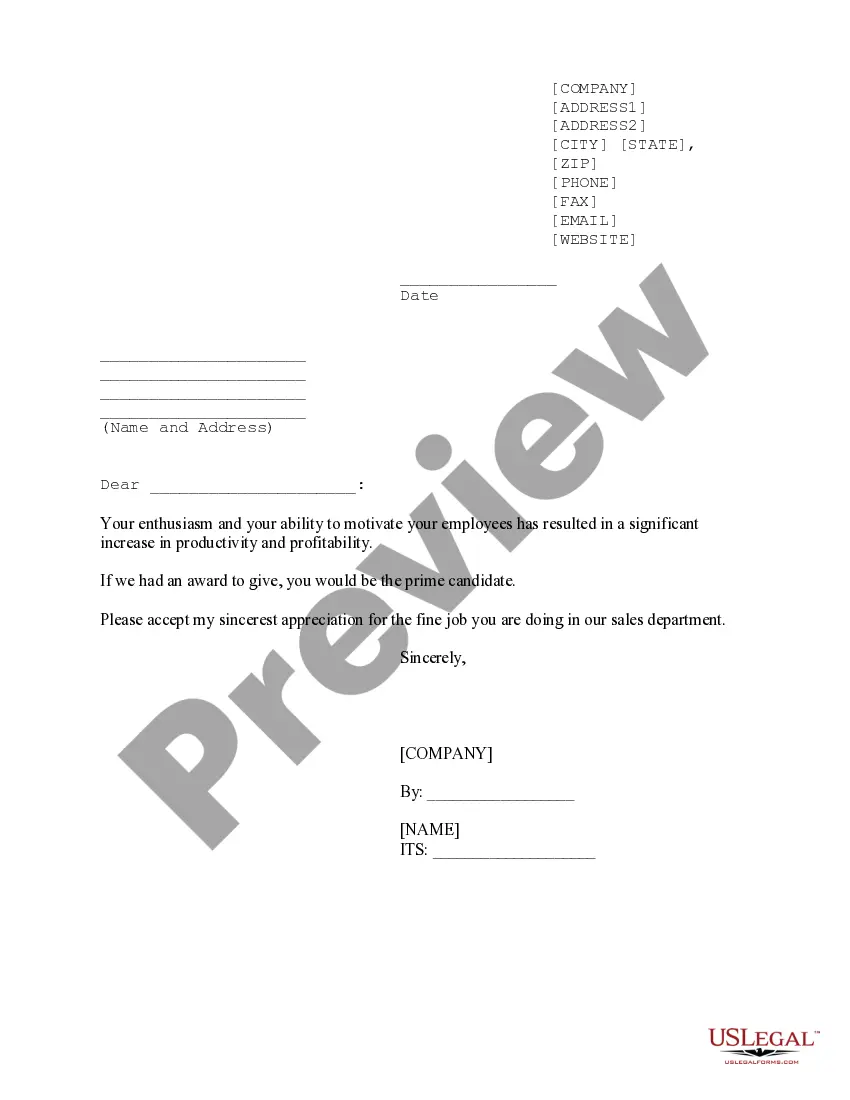

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Oakland Exemption Statement - Texas on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!