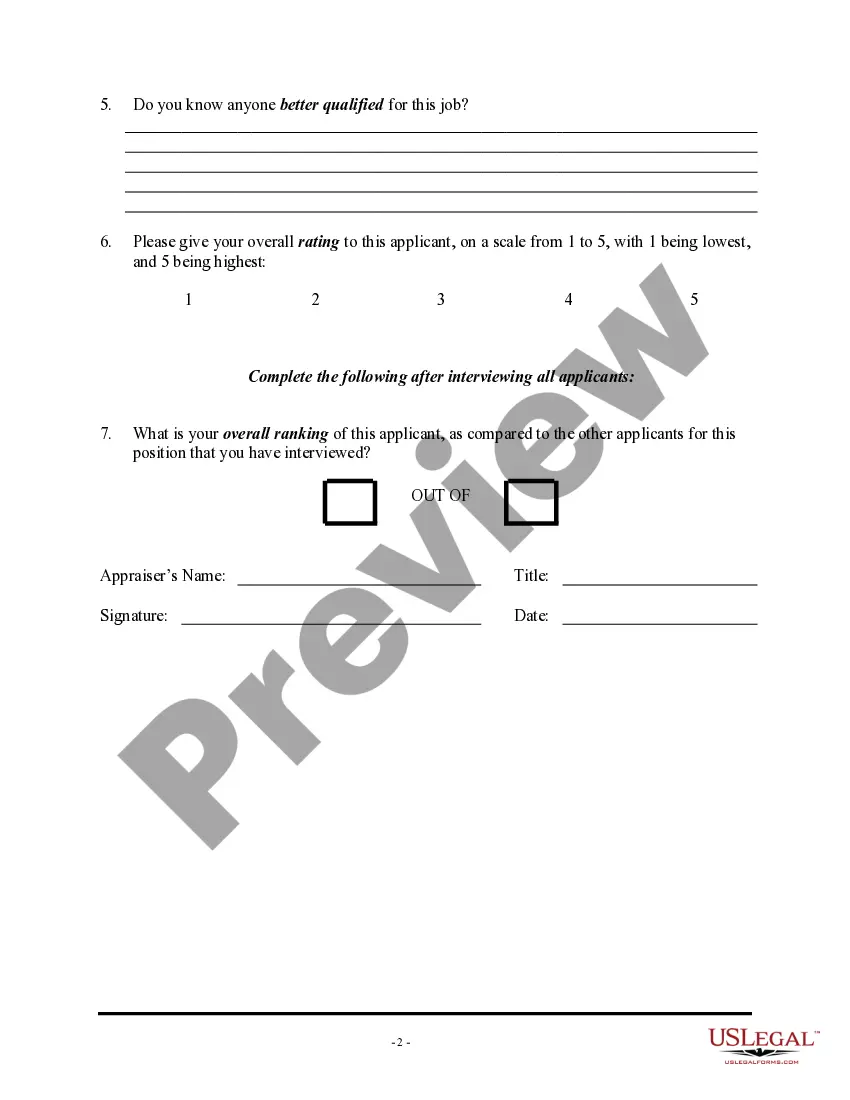

Dallas Texas Co-Employee Applicant Appraisal Form

Description

How to fill out Co-Employee Applicant Appraisal Form?

Do you require to swiftly generate a legally-binding Dallas Co-Employee Applicant Assessment Form or perhaps any other document to manage your personal or business affairs.

You have two choices: employ a specialist to draft a legitimate document for you or compose it entirely on your own. Luckily, there is an alternative option - US Legal Forms. It will assist you in obtaining professionally crafted legal documents without needing to incur exorbitant charges for legal services.

Select the subscription that best meets your requirements and proceed with the payment.

Choose the format in which you wish to receive your document and download it. Print it, fill it out, and sign where indicated. If you’ve previously set up an account, you can effortlessly Log In to it, locate the Dallas Co-Employee Applicant Assessment Form template, and download it. To re-download the form, simply navigate to the My documents tab.

- US Legal Forms offers an extensive array of over 85,000 state-compliant document templates, including the Dallas Co-Employee Applicant Assessment Form and related form packages.

- We provide templates for a variety of life situations: from divorce documentation to real estate document templates.

- We have been in the industry for more than 25 years and have built a solid reputation among our clients.

- To become one of them and acquire the necessary template without additional hassles, start by confirming whether the Dallas Co-Employee Applicant Assessment Form complies with your state's or county's regulations.

- If the document contains a description, ensure to check its intended purpose.

- If the document isn’t what you were searching for, initiate a new search using the search box at the top.

Form popularity

FAQ

Federal, state and private employees are all subject to drug testing.

You may file an Application for Residential Homestead Exemption (PDF) with your appraisal district for the $25,000 homestead exemption up to two years after the taxes on the homestead are due.

Average Dallas County hourly pay ranges from approximately $14.42 per hour for Outreach Worker to $28.16 per hour for Senior Executive Assistant. The average Dallas County monthly salary ranges from approximately $3,494 per month for Process Manager to $8,449 per month for Security Supervisor.

You may send your written request by email at mailingaddresschg@dcad.org, by fax at 214-630-6634 or mail to Dallas Central Appraisal District 2949 N Stemmons Fwy. Dallas, TX 75247.

Can a city or municipal government require drug testing of all its employees? Generally speaking, the answer is ?no,? although there are certain circumstances where a drug test may be appropriate.

If you are a single or married homeowner filing together, you may be eligible to apply online. Each individual owner, excluding married couples, residing on the property must complete a separate application to qualify for an exemption for his or her interest in the property.

With more than 6500 employees ~ 350 different job titles across 150 departments ~ we hire over 1500 men and women each year and we are continuously recruiting.

APPLICATION DEADLINES: For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in Tax Code §11.13(c) and (d), you must file the completed application with all required documentation between January 1 and no later than April 30 of the year for which you are requesting an

The Tarrant Appraisal District has launched their new online website feature that will allow homeowners to apply for the Residence Homestead exemption online. There is no fee for filing a Residence Homestead exemption application.

If you meet the minimum qualifications, your information will be forwarded to the appropriate hiring authority/department. How long does it take to process my application? It takes approximately 7 to 10 business days for processing.