A separation notice is an essential document that outlines the termination of an employment relationship, including the reasons for separation and the employee's eligibility for certain benefits or compensation. In the case of a 1099 employee, who is considered an independent contractor rather than a traditional employee, the separation notice serves as a crucial record of the end of their contract with a specific employer. In the state of Michigan, specifically in Wayne County, a Wayne Michigan Separation Notice for 1099 Employees would be specific to the region. This notice is important for both the employer and the 1099 employee, as it formalizes the end of their working relationship and protects the legal rights of each party involved. The Wayne Michigan Separation Notice for 1099 Employees typically includes information such as the employer's name, address, and contact details, as well as the contractor's name and contact information. Additionally, it includes the effective date of termination, the reason for separation (e.g., contract completion, project ending, breach of contract), and any relevant details relating to compensation or benefits. While there might not be different types of Wayne Michigan Separation Notices for 1099 Employees, variations may exist based on the specific industries or provisions relevant to independent contractors in Michigan. Some potential variations might include forms designed for contractors in construction, healthcare, technology, or other targeted sectors. Using relevant keywords, below is an example description: ------------------------------------------------------------------------------ A Wayne Michigan Separation Notice for 1099 Employees is a legal document that signifies the termination of an independent contractor's working relationship with an employer in Wayne County, Michigan. This crucial paperwork outlines the end of the 1099 employee's contract and contains important details regarding compensation, benefits, and cessation of employment. As an employer, it is crucial to use the Wayne Michigan Separation Notice for 1099 Employees to protect your company's interests while ensuring compliance with labor laws. By using this document, you can clearly communicate termination details, including reasons for separation, effective date of termination, and any outstanding financial obligations owed to the contractor. For 1099 employees, the Wayne Michigan Separation Notice provides vital information and a record of their contract's conclusion. It can serve as documentation for future employment opportunities and may be required when applying for unemployment benefits, should the contractor be eligible. This notice enables them to have a clear understanding of the termination terms, including any available benefits or potential legal ramifications. While there may not be different types of Wayne Michigan Separation Notices for 1099 Employees specifically, variations may occur based on the industry or any additional stipulations that apply to independent contractors in Michigan. For example, contractors in the construction industry may have specific forms tailored to their sector, whereas those in healthcare or technology may have different requirements. No matter the industry, utilizing a Wayne Michigan Separation Notice for 1099 Employees is essential to ensure a smooth and legally compliant separation process. This document protects both parties involved and serves as a valuable record of the termination of an independent contractor's working relationship with an employer in Wayne County, Michigan.

Wayne Michigan Separation Notice for 1099 Employee

Description

How to fill out Wayne Michigan Separation Notice For 1099 Employee?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any personal or business purpose utilized in your region, including the Wayne Separation Notice for 1099 Employee.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Wayne Separation Notice for 1099 Employee will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the Wayne Separation Notice for 1099 Employee:

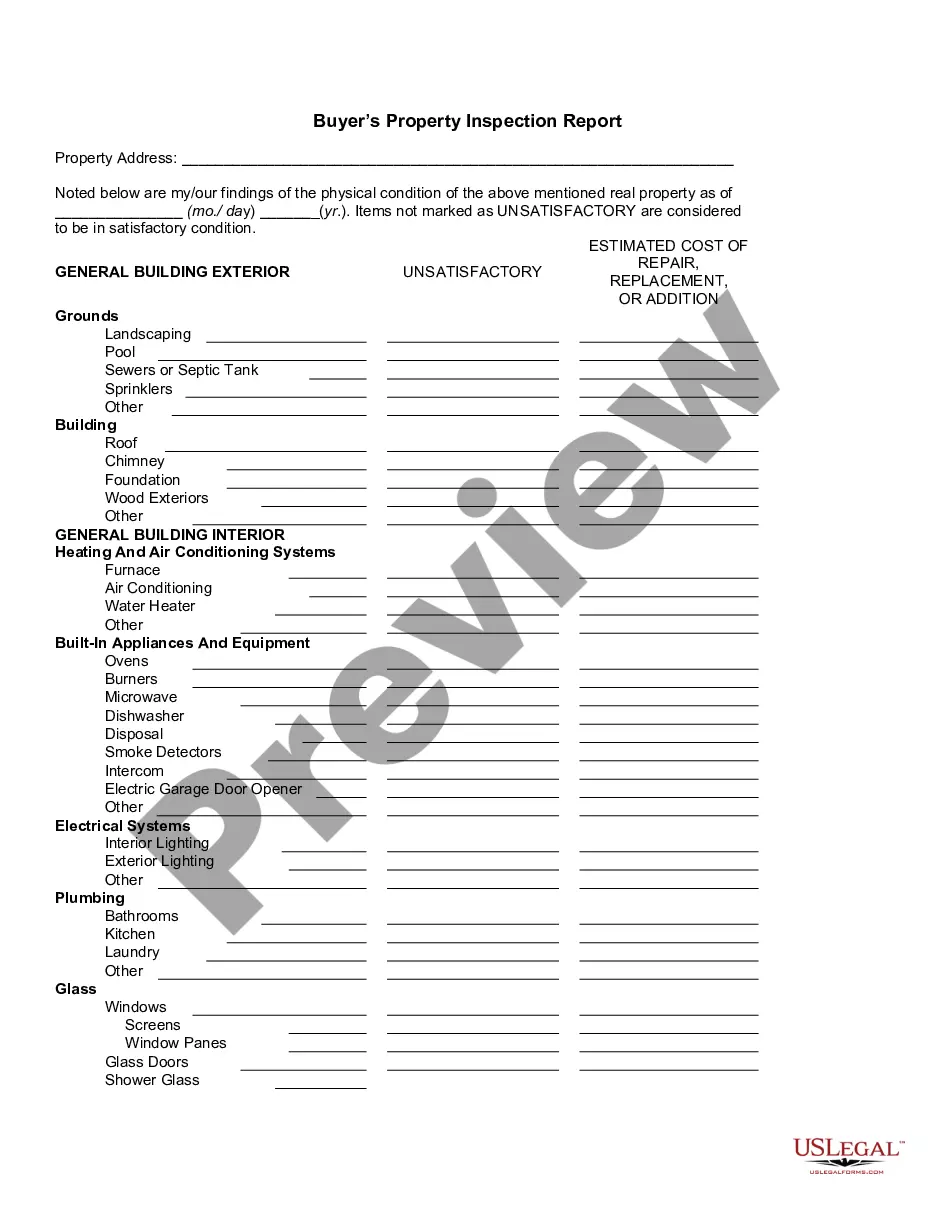

- Make sure you have opened the right page with your localised form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Wayne Separation Notice for 1099 Employee on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!