Los Angeles, California Employee Payroll Record is a comprehensive and detailed document that provides information on the payment history and financial details of employees working in Los Angeles, California. This record serves as a crucial resource for both employers and employees for managing wages, taxes, and various other aspects of payroll management. Keywords: — Los Angeles, California: This refers to the specific location where the employee payroll record is maintained, which is Los Angeles, California. It indicates the jurisdiction and legal requirements specific to this area. — Employee: The payroll record pertains to the employees of various organizations based in Los Angeles, California. It contains information related to their compensation and employment details. — Payroll Record: This record contains a wide range of information regarding employee compensation, such as salary, wages, bonuses, commissions, and overtime. It serves as a consolidated account of an employee's earning history. Types of Los Angeles, California Employee Payroll Record: 1. Comprehensive Payroll Record: This type of record includes detailed information about an employee's salary, overtime, allowances, deductions, taxes, benefits, and other financial transactions related to payroll. It provides a comprehensive overview of an employee's earnings and deductions. 2. Tax Report Payroll Record: This type of record focuses primarily on tax-related information, such as the taxes withheld from an employee's wages, Social Security contributions, and Medicare taxes. It ensures that taxes are accurately calculated and paid to the appropriate tax authorities. 3. Benefits and Deductions Payroll Record: This record captures the various benefits provided to employees, such as health insurance, retirement plans, and other deductions like union dues or loan repayments. It helps in tracking the employee's enrollment in benefit programs and their corresponding deductions. 4. Time and Attendance Payroll Record: This record encompasses data related to an employee's attendance, hours worked, leaves taken, and breaks. It is used to calculate wages accurately and ensure compliance with labor laws and company policies. 5. Commission-Based Payroll Record: This type of record is applicable to employees whose compensation primarily relies on commissions earned from sales or service targets achieved. It tracks their commission amounts, rates, and performance-based incentives. These different types of Los Angeles, California Employee Payroll Records serve specific purposes and assist employers, employees, and payroll administrators in managing various aspects of employee compensation, taxation, and benefits effectively.

Los Angeles California Employee Payroll Record

Description

How to fill out Los Angeles California Employee Payroll Record?

Whether you plan to start your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Los Angeles Employee Payroll Record is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to get the Los Angeles Employee Payroll Record. Follow the guidelines below:

- Make sure the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the right one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Los Angeles Employee Payroll Record in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

311 Call Center Some of the most popular City services can be requested by calling 311 or (213) 473-3231, emailing us at 311@lacity.org, via social media, or by using the MyLA311 mobile app and website.

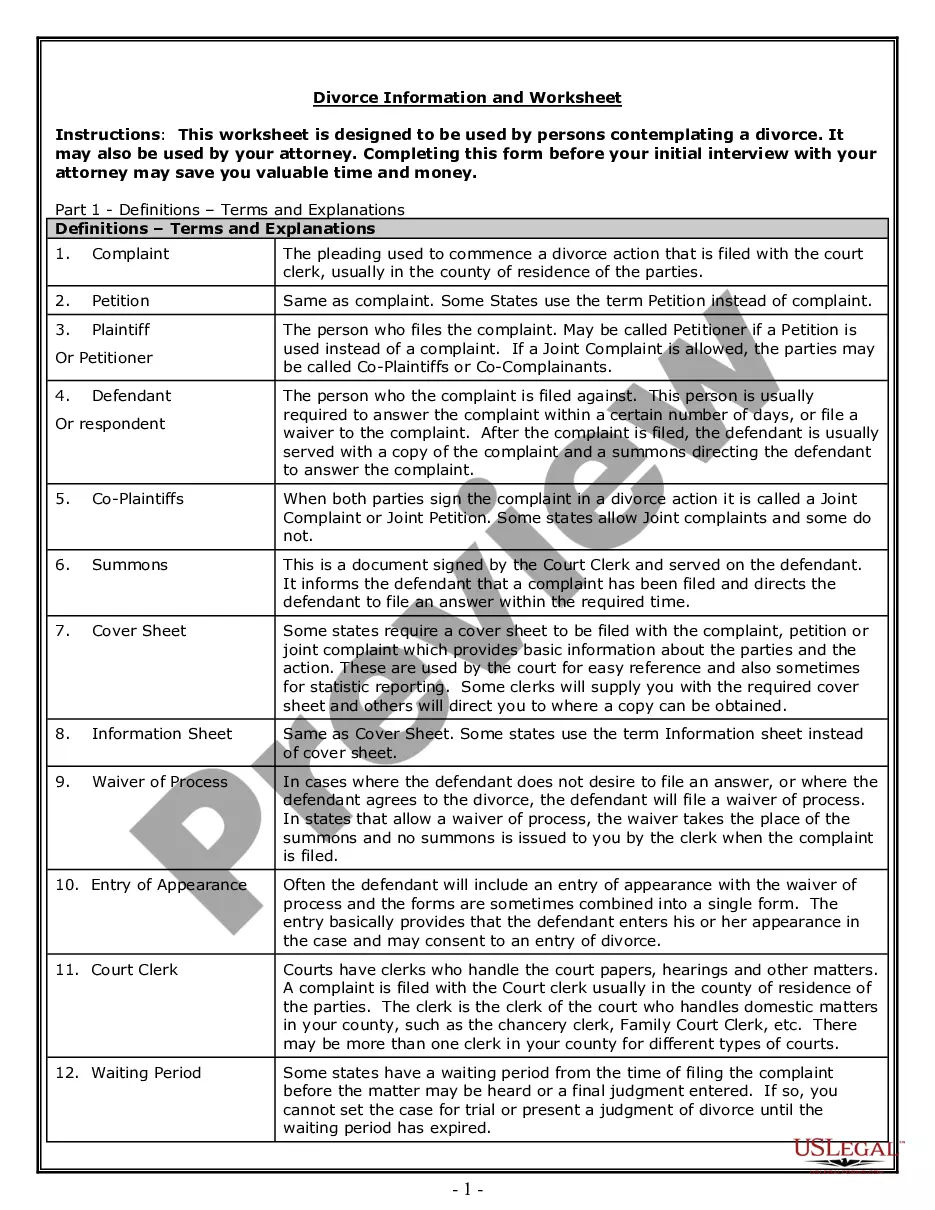

What do employee payroll records include? General information. Employee name. Address.Tax withholding forms. Form W-4. State W-4 form.Time and attendance records. Time cards. Total hours worked each day and week.Payroll records. Pay rate.Termination/separation documents, if applicable. Final paycheck information.

California requires employers to provide an accurate and written itemized statement showing: (1) the gross wages earned (ithe amount before deductions) (2) the total hours worked by the employee, (3) the number of piece-rate units earned and any applicable piece rate if the employee is paid on a piece-rate basis (the

Los Angeles Convention Center Employee Verification For City Employees:Please contact the City of Los Angeles, Personnel Department at (213) 922-8565, Monday through Friday, between AM to PM. Please fax written verification to: (213) 922-8514.

Those requesting employment or salary verification may access THE WORK NUMBER® online at using DOL's code: 10915. You may also contact the service directly via phone at: 1-800-367-5690.

To complete your payroll setup checklist, you just need to enter these pieces of key info: Withholding account number. Unemployment Insurance Account Number (and rate) Worker's Compensation Insurance Account Number (and rate)

Dear Recipient name, This letter is to verify the employment of Employee name as Job Title/Role within our organization. He/she started work on Employee start date and is current state of employment. Employee's name current title is Job title.

However, for these types of projects, you are required to report certified payroll for yourself. Be careful you do not go into autopilot when you complete payroll each month. Employees on the job may change from month-to-month, prevailing wage rates may change from year-to-year, and more.

Personnel files usually contain documents that the employee has already reviewed and so he or she is familiar with their content. This includes documents such as job applications, performance evaluations, letters of recognition, training records, and forms that relate to transfers and promotion.

Employment Verification Request written verification be faxed to (916) 376-5393 or sent to DGS - HR, 7th Floor, P.O. Box 989052, MS 402, West Sacramento, CA 95798-9052. Information that can be provided includes: Dates of employment, Title (job classification),Written verification has a five-day turn-around.